WS Guinness Sustainable Energy Fund

The WS Guinness Sustainable Energy strategy is managed for capital growth and invests in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, biofuels and biomass).

Overview

The Guinness Sustainable Energy strategy is managed for capital growth and invests in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, biofuels and biomass).

We believe that over the next twenty years the sustainable energy sector will benefit from the combined effects of:

- Demand growth - The electrification of transportation and improved energy storage economics brings attractive long-term sustainable energy demand growth

- Improving Economics - Sustainable energy sources have become cost competitive with power from fossil fuels; we expect the cost of supply to continue to fall

- Public & Private Support - Both governments and companies are pursuing sustainable energy in order to achieve mandated carbon targets or to improve public perception

- Low current exposure - Poor profitability and need for subsidies has kept the weight of sustainable energy in global indices and broad global equity funds at a low level

Sustainability Theme - The sustainable energy sector offers ‘green’ credentials that some investors are targeting to help facilitate global de-carbonisation and to reduce carbon intensity of their portfolios

Investment Team

High quality funds are run by high quality people.

We are proud of our collegial culture, with teams across the business benefiting from each other’s expertise as they target long-term returns for investors.

Awards & Ratings

We have a firm commitment to delivering the very best. That commitment is reflected in the awards we have received, some of which are shown below.

WS Guinness Sustainable Energy Fund

Responsible A

Square Mile Investment Consulting & Research Limited

WS Guinness Sustainable Energy Fund

Best Fund over 10 Years - Equity Theme - Alternative Energy

Refinitiv Europe Lipper Fund Awards 2022

WS Guinness Sustainable Energy Fund

FCA Sustainability Focus

2026 Investor Conferences

For professional investors only.

Join our fund managers for a series of professional investor conferences as we cover critical topics to investors today.

Book your place below for a rewarding morning of investment ideas, roundtable discussions and expert analysis at our CPD-accreditied conferences around the UK.

How to Invest

We aim to make it simple to invest in our funds. All our funds are open to direct investment via an application form. They are widely available on investment platforms and are eligible for UK investors’ ISAs and SIPPs.

Investment Case

The Guinness Sustainable Energy strategy is positioned to benefit from the many opportunities associated with the sustainable energy transition. We identify four sub-sectors and have assembled a proprietary investment universe of around 250 companies with critical mass that are most directly exposed to them:

- Displacement: displacement or more efficient usage of hydrocarbon-based energy

- Electrification: the switching of hydrocarbon-based fuel demand towards electricity, especially for electric vehicles

- Installation: the manufacture of equipment for the generation and consumption of sustainable energy

- Generation: the production of sustainable energy, either pureplay companies or those transitioning from hydrocarbon-based fuels

We do not limit ourselves to ‘pure plays’, opening our universe up to some companies with existing hydrocarbon-based fuel exposure, but this must be allied with a commitment to transitioning their business models towards sustainable energy sources.

We conduct rigorous independent analysis of the fundamental drivers of sustainable energy markets: energy commodity prices; sustainable energy technology research and development; installation and equipment prices; political and economic support for the sector; government and private sector demand. This allows us to form a top-down view, which in turn informs our industry energy sub-sector allocation.

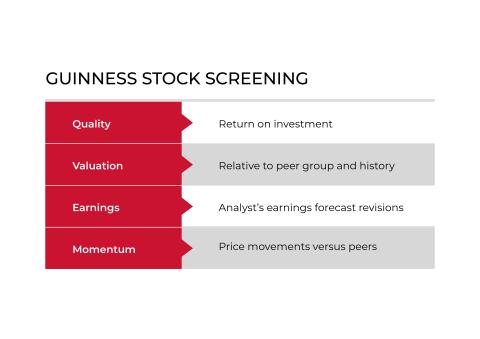

The team operates a disciplined stock screening process. We review our investment universe each week to identify companies which look attractive on return on investment, valuation, earnings sentiment and price momentum. We also use sub-sector specific screens. Ideas generated by screening are then subjected to due diligence centred around detailed financial modelling.

The portfolio comprises around 30 broadly equally weighted positions. This portfolio construction is designed to create a balance between maintaining fund concentration and managing stock-specific risk, and there is no reference to the benchmark. The portfolio is liquid, with 90% of the Fund normally invested in companies with a market capitalisation over US $500 million.

Why invest in the WS Guinness Sustainable Energy Fund?

Concentrated Exposure

The Guinness Sustainable Energy Fund aims to deliver investment returns via concentrated exposure to 33 sustainable energy companies with an equal-weight approach; available in a daily traded UCITS structure.

Specialist Team

The Guinness Energy Team has 20 years of experience of running energy investment strategies in a consistent manner and providing insight for investors into the energy markets.

Investment Process

The Fund is run using a Top Down and Bottom Up investment process based on an internally created Universe of 250 Sustainable Energy companies with detailed valuation models.

Valuation Opportunity

The fund selects the most attractive equities in the investment universe. The portfolio displays growth characteristics together with higher return on capital, lower valuation multiple and stronger balance sheets than the MSCI World Index.

Sustainability Theme

The strategy invests in companies playing a key role in global decarbonisation, providing a vehicle for investors to align their capital with this positive impact.

Investment process

We conduct rigorous independent analysis of the fundamental drivers of sustainable energy markets: energy commodity prices; sustainable energy technology research and development; installation and equipment prices; political and economic support for the sector; government and private sector demand. This allows us to analyse likely demand for sustainable energy equipment and services and creates our top-down view, which in turn informs our industry energy sub-sector allocation. Analysis of the key drivers of growth, scarcity, barriers to entry and economics informs our weighting to our internally generated Sustainable Energy subsectors.

Bottom-up stock screening

The team operates a disciplined stock screening process. We review a universe of around 179 sustainable energy stocks each week to identify companies which look attractive on their return on investment, valuation, earnings sentiment and price momentum. Other sub-sector specific screens are also employed to generate ideas.

Stock due diligence

Stock ideas are taken from our screens. We then conduct due diligence to establish whether we have conviction to include the stock in our portfolio. The due diligence centres around detailed financial modelling.

Portfolio construction

Equal-weight approach

The portfolio comprises around 30 broadly equally weighted positions. Our equal-weight portfolio construction approach is designed to create a balance between maintaining fund concentration and managing stock-specific risk. It also imposes a structural sell discipline: an existing position must be sold to purchase a new holding.

Sector weights

There is no benchmark adherence in the Fund’s sub-sector weights.

Portfolio Risk Controls

Stock specific risk

Stock specific risk in the sustainable energy sector tends to be higher than the broader market. By constructing the fund of 30 broadly equally weighted positions, we avoid significant exposure to any one individual stock.

Liquidity

The portfolio is liquid, with 90% of the Fund normally invested in companies with a market capitalisation over US $500 million.

Currency

The Fund is not hedged from a currency perspective.

Factsheets

| Fund | English | French | German | Spanish | Italian |

|---|---|---|---|---|---|

| WS Guinness Sustainable Energy Fund | Download |

Updates

Documents

Fund Facts

For information on the Fund’s current investments, please see the latest factsheet available on the literature tab above.

Will Riley

Share Classes

For full information on the share classes available for investment please refer to the Key Investor Information document.

Share Prices

The Fund is priced every working day at 12:00 UK time and updated here shortly after.

| Fund Name | ISIN | Fund Price | (+/-) | Date |

|---|---|---|---|---|

| WS Guinness Sustainable Energy Fund Y Accumulation | GB00BP5J6198 | 109.8300 | -0.3800 | |

| WS Guinness Sustainable Energy Fund Z Large Investor Accumulation GBP Shares | GB00BP5J6206 | 110.4300 | -0.3800 |

Date: April 14, 2026 11:00 AM [BST]

Jonathan Waghorn & Will Riley

Date: January 13, 2026 11:00 AM [GMT]

Jonathan Waghorn & Will Riley

Date: October 14, 2025 11:00 AM [BST]

Jonathan Waghorn & Will Riley

Date: July 10, 2025 11:00 AM [BST]

Jonathan Waghorn & Will Riley

Date: April 8, 2025 11:00 AM [BST]

Jonathan Waghorn & Will Riley

PROPELLED BY DEMAND

FUN FACT

Q: Who has a bigger brain, Dolphins or Humans?

A: Dolphins.

PROPELLED BY DEMAND

FUN FACT

Q: How fast can a dolphin swim without a propellor?

A: Short-beaked common dolphins can swim up to 60km/h.

How to Invest

We’ve tried to make investing in our Funds as simple as possible. All of our funds are available to invest directly via an application form, we also have good availability across a number of investment supermarkets whilst being eligible for ISAs & SIPPs.

WS Guinness Sustainable Energy Fund is an equity fund. Investors should be willing and able to assume the risks of equity investing. The Fund invests at least 80% in companies involved in sustainable energy or energy technology sectors; it is therefore susceptible to the performance of those sectors, and can be volatile. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement, you may not get back the amount originally invested. Details on the risk factors are included in the Fund’s documentation, available on the website www.waystone.com. If you are in any doubt about the suitability of investing in this Fund, please consult your investment or other professional adviser.

Source: FE fundinfo. Net of fees. Investors should note that fees and expenses are charged to the capital of the Fund. This reduces the return on your investment by an amount equivalent to the Ongoing Charges Figure (OCF). The OCF for the Y share class is 0.67%. Returns for share classes with a different OCF will vary accordingly. Transaction costs also apply and are incurred when a fund buys or sells holdings. The performance returns do not reflect any initial charge; any such charge will also reduce the return.