WS Guinness Global Innovators Fund

The Guinness Global Innovators strategy seeks capital appreciation and invests in high-quality growth companies.

Overview

The Guinness Global Innovators strategy seeks capital appreciation and invests in high-quality growth companies.

Quality companies with the ability to sustain peer-leading growth over time can offer outperformance for investors over a market cycle.

Rather than relying on past growth to identify such companies, we look for those harnessing the power of innovation via exposure to secular growth themes.

Through a focus on companies with quality characteristics such as high returns on capital, strong balance sheets and sustainable competitive advantages, we aim to select only those with the strength to weather different market environments.

By applying a valuation discipline to stock selection, we seek to avoid overpaying for future growth and the hype that can surround growth companies.

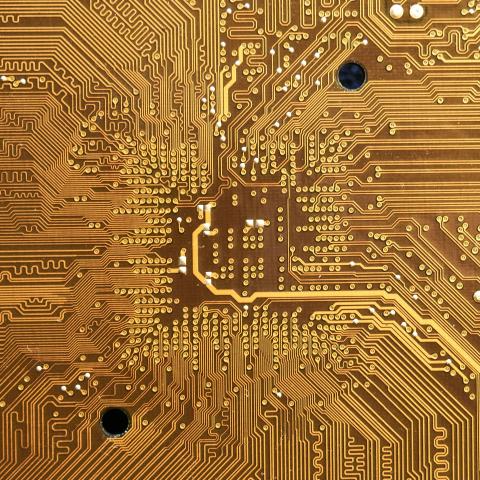

Opportunities in Semiconductors

The semiconductor industry is at an innovation frontier which stretches into a wide range of growth areas. The Guinness Global Innovators team looks at the industry from an investment perspective, examining the market's drivers and opportunities, and explaining how the strategy's emphasis on growth, quality and valuation leads to an overweight in semiconductor stocks.

Investment Team

High quality funds are run by high quality people.

We are proud of our collegial culture, with teams across the business benefiting from each other’s expertise as they target long-term returns for investors.

Awards & Ratings

We have a firm commitment to delivering the very best. That commitment is reflected in the awards we have received, some of which are shown below.

Guinness Global Innovators Fund

Elite Rated Fund

FundCalibre

How to Invest

We aim to make it simple to invest in our funds. All our funds are open to direct investment via an application form. They are widely available on investment platforms and are eligible for UK investors’ ISAs and SIPPs.

FINDING COMPANIES WITH AN INNOVATIVE ADVANTAGE

FUN FACT

Q: How many species of woodpecker are there globally?

A: There are around 200 species of Woodpeckers in the world.

Investment Case

The Guinness Global Innovators strategy invests in high-quality companies exposed to secular growth themes.

Companies that can sustain faster growth than the market can outperform over a cycle. Investing for growth, however, is beset by pitfalls which the Guinness Global Innovators strategy is designed to avoid.

In the search for growth, the past is often a poor predictor of the future. We therefore start by looking for profitable companies that are exposed to long-lasting, secular growth themes.

To identify companies which can harness these themes in the long term, we look for those businesses with quality characteristics such as high returns on capital, strong balance sheets and understandable and measurable business models.

A key risk of growth investing is overpaying for future growth. By applying a valuation discipline to stock selection, we aim to ensure we are not chasing fads.

To limit stock-specific risk while investing with conviction in every position, we structure the portfolio with an equal-weight approach, bringing discipline and repeatability.

Why Invest in the WS Guinness Global Innovators Fund?

The Guinness Global Innovators strategy seeks capital appreciation and invests in high-quality growth companies.

Exposure to secular growth themes

High historic growth is often quickly mean-reverting. We focus on differentiated global businesses exposed to secular growth themes that may offer predictable, sustainable growth.

Quality approach to help protect against downside risks

High returns on capital, strong balance sheets and sustainable competitive advantages help us avoid the pitfalls of growth investing such as chasing fads.

Value discipline

With bottom-up, valuation-driven stock selection and ESG integration we aim to avoid overpaying for future growth.

High conviction

The Fund typically invests in just 30 companies, with each company having a broadly equal weighting. This provides a good balance between the benefits of diversification while also allowing each company to add meaningfully to performance. We don’t have a long tail of small positions and by definition we can never just ‘hug’ the benchmark index.

Low turnover

We prefer to invest over the long term. We also recognise the increased costs of trading in and out of companies unnecessarily. Typically we will hold a company in the portfolio for between 3 and 4 years.

Repeatable and independent

Ian Mortimer and Matthew Page have managed funds in accordance with this investment process since 2010, and the strategy has been applied since 2003. The process is clear, robust, transparent and scalable. It filters out much of the noise and hype that surrounds companies to focus on the true signals that drive company valuations. By performing their own company research and analysis, using their own proprietary modelling systems, the managers try to avoid some of the behavioural biases associated with being unduly influenced by market sentiment.

How do we run the Fund?

Identifying innovative companies

The investment process begins by identifying innovation themes – secular growth themes in the market that are driving growth, disrupting incumbent business models or technology, or significantly improving current products or services. We utilise third party research and analysis to broaden our understanding of growth trends in the market. We identify around 10 themes and update them annually. We then identify companies with exposure to these secular growth themes which have a market capitalisation greater than $1bn.

Quality Screen

With the initial Global Innovators universe created, we then employ screening to identify high-quality companies. We only want to invest in profitable companies with strong balance sheets and good growth prospects, as these quality characteristics help to protect against the downside risks in growth investing. The simple quality criteria screened for are (i) return on capital greater than cost of capital last year (ii) debt/equity < 150%, and (iii) positive earnings growth expected next year. The companies left after the quality screen make up the investible investment universe for the fund and typically have better than average financial metrics showing faster profit growth, larger profit margins, and less susceptibility to cyclical pressures.

Further research and stock selection

Within the investible Global Innovators universe, we prioritise candidates for further due diligence on growth, quality and valuation characteristics. We then subject all potential investments to detailed fundamental analysis, with proprietary modelling, an assessment of a stock’s return potential, risk analysis and ESG integration. Above all, we want to understand what competitive advantages or barriers to entry are sustaining a company’s return on investment to determine whether its returns will persist. We also recognise that sentiment and hype can sometimes drive up the valuations of growth companies and so we try to maintain a strict value discipline. We want to avoid paying up for high levels of expected growth in the future as we know, on average, very high growth expectations are often not met, and this can have a detrimental effect on a company’s valuation. We therefore look for companies offering good value relative to their sector, to their historic valuations, or in absolute terms. Our portfolio is fixed at 30 positions, so a new holding must present a better risk/return profile than an existing holding.

Sell discipline

It is often easier to find companies to buy that look cheap than it is to identify those companies you own which should be sold. We consider sell discipline as important as selecting companies for purchase and continuously monitor the companies we hold in the Fund. The six core reasons we may sell a company are outlined below.

- The company's exposure to a secular growth theme has diminished

- Their balance sheet becomes stretched

- The valuation becomes too rich, or no longer offers compelling upside

- There is a change in a company’s capital budgeting approach

- Our original investment thesis no longer holds

- We find a more compelling investment idea

How do we construct the portfolio?

The WS Guinness Global Innovators Fund is a concentrated portfolio of around 30 broadly equally weighted stocks. This provides a number of useful attributes:

- It reduces stock-specific risk, as we will not be overweight in a small number of favourite companies.

- We will not have a long tail of small holdings in the portfolio, which can be a distraction and a potential drag on performance.

- It instils a strong sell discipline as we will sell a position in order to make way for a new one; and we must constantly assess the companies we own in the portfolio in comparison to the rest of the universe available to us.

- We are truly index independent. All companies held are given equal target weights without regard to their weighting in the benchmark index, so our portfolio has a high active share.

Factsheets

| Fund | English | French | German | Spanish | Italian |

|---|---|---|---|---|---|

| WS Guinness Global Innovators Fund | Download |

Updates

Documents

Fund Facts

For information on the Fund’s current investments, please see the latest factsheet available on the literature tab above.

Matthew Page

Share Classes

For full information on the share classes available for investment please refer to the Key Investor Information document.

Share Prices

The Fund is priced every working day at 12:00 UK time and updated here shortly after.

Date: January 13, 2025 02:00 PM [GMT]

Dr. Ian Mortimer & Matthew Page

Date: October 14, 2024 02:00 PM [BST]

Dr. Ian Mortimer & Matthew Page

Date: July 15, 2024 02:00 PM [BST]

Dr. Ian Mortimer & Matthew Page

THE INNOVATION BOUNCE

FUN FACT

Q: What is the height of the tallest kangaroo recorded?

A: 8ft

THE INNOVATION BOUNCE

FUN FACT

Q: How high can a Kangaroo bounce?

A: Up to 10 feet

DRILLING FOR INFLATION

FUN FACT

Q: Why is a Woodpecker a good weather forecaster?

A: They call a lot when it's about to rain

DRILLING FOR INFLATION

FUN FACT

Q: What speed does a woodpecker’s beak strike wood?

A: 25 mph/40kph

How to Invest

We’ve tried to make investing in our Funds as simple as possible. All of our funds are available to invest directly via an application form, we also have good availability across a number of investment supermarkets whilst being eligible for ISAs & SIPPs.

WS Guinness Global Innovators Fund is an equity fund. Investors should be willing and able to assume the risks of equity investing. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement; you may not get back the amount originally invested. Details on the risk factors are included in the Fund’s documentation, available on the website www.waystone.com. If you are in any doubt about the suitability of investing in this Fund, please consult your investment or other professional adviser.

Source: FE fundinfo. Net of fees. Investors should note that fees and expenses are charged to the capital of the Fund. This reduces the return on your investment by an amount equivalent to the Ongoing Charges Figure (OCF). The OCF for the Y share class is 0.79%. Returns for share classes with a different OCF will vary accordingly. Transaction costs also apply and are incurred when a fund buys or sells holdings. The performance returns do not reflect any initial charge; any such charge will also reduce the return.