Our Approach to Responsible Investing and ESG

INTRODUCTION TO RESPONSIBLE INVESTING & ESG

DEFINING ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

Fundamental data and rigorous research have always been the cornerstones of our investment processes at Guinness Global Investors. Whilst Environmental, Social and Governance (ESG) factors have inherently been integral in our company analyses, the emergence and evolution of new data sources has allowed us to establish a more thorough framework, harness additional investment insights, and launch the Guinness Global Quality Mid Cap strategy.

ESG refers to measuring and assessing the potential risk and opportunities from environmental, social and governance factors. Environmental criteria consider how a company performs as a steward of nature; Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates; and Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

As proud signatories of the United Nations Principles for Responsible Investments (PRI), we are committed to adopting and implementing responsible investment principles in a manner that is consistent with our fiduciary responsibilities to clients. We do this by incorporating ESG analysis into our investment process and engaging with investee companies on ESG issues.

DEFINING RESPONSIBLE INVESTMENT

The jargon used to describe responsible or ESG investing has become increasingly nuanced, confusing, and overlapping as investors have sought their own differentiated approach. Whilst the same labelling can represent different things to different people, we generally find that “responsible investment” describes the entire spectrum of ESG-related investment methodologies.

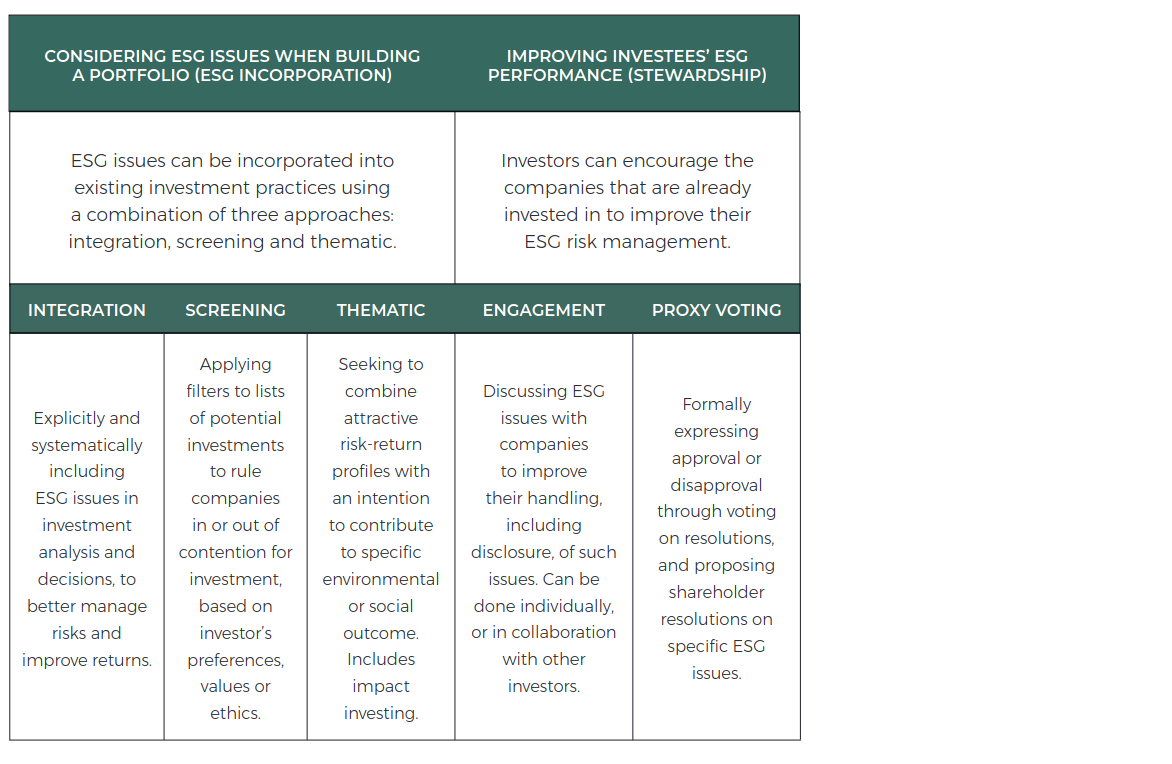

The UN PRI defines responsible investment (RI) as “a strategy and practice to incorporate environmental, social and governance (ESG) factors in investment decisions and active ownership”. There are several components to responsible investing, which the PRI summarises as follows:

OUR INVESTMENT PHILOSOPHY

ESG factors play an important role in both the quality and valuation of a company. For example, material ESG risks could well lead to an impairment of capital and lower future return on capital. There may also be an upside to the valuation of a company if management are taking steps to mitigate ESG risks or proactively improving their company’s ESG practices. We believe that ESG factors – though important by themselves – add value to our investment analysis when combined with traditional financial metrics.

Simply speaking, we believe that considering ESG issues is a pragmatic part of our day-to-day activities as investors, helping to form our understanding of the business model of a company, its long-term return on capital potential and its mitigation of risk.

ESG INCORPORATION

The first approach to ESG incorporation, according to the UN PRI, is the integration of ESG factors. The PRI defines this as “the explicit and systematic inclusion of financially material ESG information in investment analysis and investment decisions”. As long-term investors seeking to identify good quality companies across our portfolios, we believe that ESG considerations play a direct role in managing company-specific risks, and thus can have the potential for a meaningful impact on long-term returns.

ESG INTEGRATION – QUANTITATIVE ANALYSIS

Our bottom-up ESG framework has been developed in-house and is used to assess quantitatively the sustainability risk associated with current and potential underlying investments. Using the Sustainability Accounting Standards Board (SASB) materiality map we have developed a scorecard that is used to evaluate a company based on various industry-specific ESG criteria. The scorecard compares a company’s ESG metrics with its relevant industry average and its peer group. By using a systematic quantitative approach at the start of our assessment, we are able to quickly identify strengths and weaknesses in a company’s operations from an ESG perspective – both on an absolute level and versus peers. This can form a basis for further due diligence.

We believe – as active managers – that building our own methodology to assess ESG factors is important to our understanding of the underlying data. We also access external ESG research as a comparator to our own work, and the data used in our scorecard comes from a wide variety of sources including third parties and individual company disclosures.

The two key components of our ESG scorecard are ‘materiality’ and ‘transparency’:

MATERIALITY

We use the standards set out by SASB to identify only the material factors relevant to a company’s industry. In this way, we focus on the key risk factors that may materially affect a company’s operations. We believe this is a superior way to assess the impact of ESG metrics on a company compared to using a generic, one-size-fits-all framework. We map the material risk factors laid out by SASB to a combination of absolute metrics (point in time), trend metrics (change over time), and policy metrics (has or does not have), to assess the business’s management of said risks. This is further complemented with a company’s industry average value and Guinness-defined narrow peer group value to assess the extent to which a company is leading or lagging its peers

TRANSPARENCY

By using an in-house scorecard, we have access to greater granularity and thus can more accurately determine the drivers of a given score to identify specific areas of strength and weakness – as opposed to an overall score that may mask these nuances. Drivers of a weak score, for example, might derive from either a lack of company disclosure, or conversely strong disclosure but weak absolute and growth levels.

Whilst the ESG scorecard provides us an insight in the ESG practices of a company, we remain aware of the drawbacks that may exist in existing data and the issues around disclosure, quality of self-reporting, consistency, and frequency:

- Disclosure – Most ESG data has been provided for less than a decade, and with often no regulatory requirement for disclosure, reporting can vary significantly across companies. Though disclosure is improving, particularly driven by new European regulations, coverage generally is lower among smallercaps and Asian and Emerging Market domiciled companies. This can make comparison to businesses outside these areas difficult.

- Quality and consistency – ESG data is largely self-reported and requires caution in assessing reliability and consistency of approach.

- Frequency – Many ESG metrics are only updated annually. This makes it harder to find timely insights and therefore any significant changes in business model must consider this.

ESG INTEGRATION – QUALITATIVE ANALYSIS

Data deficiencies and a lack of contextualisation mean there is a need to go beyond headline metrics for ESG insights. To fully understand the ESG risks and opportunities, therefore, we supplement our quantitative analysis with a rigorous qualitative assessment. This qualitative review covers:

- an assessment of the SASB risk metrics covered in the quantitative scorecard

- exposure to negative externalities and controversies

- a good governance assessment

- an executive remuneration assessment

- a carbon transition assessment

- a summary of our engagements and proxy voting record

We use public sources of information including annual company reports, sustainability (or similar) reports, press releases, NGO research and company presentations, in addition to third party and proxy voting provider research.

QUALITATIVE RISK FACTOR ASSESSMENT

Our qualitative assessment begins with an in-depth analysis into the ESG risks and opportunities for a company. Using our quantitative scorecard, alongside the other sources outlined above, we evaluate the magnitude of exposure to the material risk factors, the company’s management of said risks and whether there are any relevant company initiatives that mitigate these risks. Our assessment enables us to evaluate the nuances between various companies within an industry, delving into whether a certain risk factor is material to the company specifically.

NEGATIVE EXTERNALITIES & CONTROVERSIES

Understanding what each company does and how it operates enables us to assess whether a company creates negative externalities, and whether any past or current controversies could have meaningful investment implications in the future

GOVERNANCE

We believe a strong and effective board with the necessary skills, background and experience to provide objective oversight of management is an important driver of successful businesses. We have constructed a governance checklist to identify any areas we believe are suboptimal or go against best practice. The checklist covers board structure and independence, the structure of the audit and compensation committee, shareholder rights, diversity, and any issues regarding potential entrenchment or overboarding.

REMUNERATION

In many cases, performance-based pay can make up the majority of overall remuneration for CEOs, and there is strong evidence to suggest that management incentive packages do indeed influence decision making and company strategy. We believe remuneration structures should comprise of clear, specific and challenging longterm performance criteria which are fully disclosed to shareholders. Our assessment takes a checklist approach based on the transparency, design, and alignment of short and long-term remuneration. For more information, please refer to our ‘Approach to Executive Remuneration’ paper on our website

CARBON TRANSITION RISK AND CARBON INTENSITY

Another key feature of our qualitative ESG assessment involves analysing the carbon transition risk of a company. Whilst environmental factors may not be deemed material for every company, we believe it is an important exercise nonetheless to assess how a company is contributing to the global risk of climate change and the company’s financial flexibility given changing regulations and policies. As such, we look at a company’s emissions over time and stress test the company’s margins, earnings, return on equity, and net debt to equity to differing carbon prices. Alongside this we assess the company’s broader ability to cover higher ESG-related costs (such as higher cost of goods from more sustainable sources) and increase investment in more ESG-related projects through higher capital expenditure or R&D (such as more energy efficient machinery). Ultimately, our scenario analysis allows us to assess a company’s exposure to possible carbonrelated costs – through either internal investment or externally imposed costs.

As part of our carbon intensity review, we also look at the company’s initiatives to reduce its carbon footprint. Initially we find out whether the company reports data to the Carbon Disclosure Project (CDP), and then aim to evaluate whether the company has adequate sciencebased emission reduction targets.

SUMMARY

Overall, our ESG assessment enables us to understand the materiality and fairness of ESG scores, the risks to business models and valuations, and company-specific issues. It allows us to form more complete and meaningful investment conclusions, and for this reason, both the quantitative and qualitative ESG reviews are conducted in-house by the investment analysts and portfolio managers working on the Fund; we do not outsource this responsibility to an internal or external ESG team. The analysis described above often forms the basis of our proxy votes and engagement, which we describe in more detail below.

SCREENING

The second approach to ESG Incorporation, according to the UN PRI, is the application of screening. The PRI defines this as “applying filters to lists of potential investments to rule companies in or out of contention for investment, based on investor’s preferences, values or ethics.”

POSITIVE SCREENING

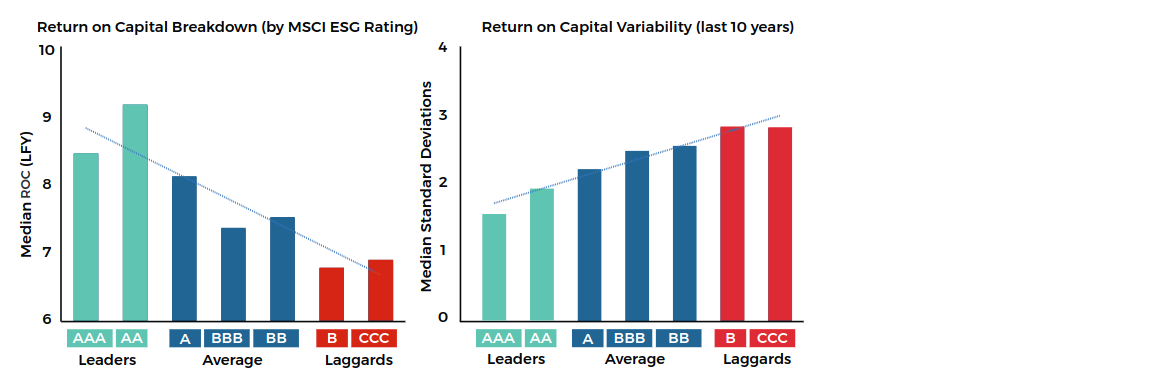

For the Guinness Global Quality Mid Cap strategy, our starting point in selecting our investment universe is to identify companies with persistently high return on capital. Specifically, we start by looking for companies that have a persistently high return on capital across a 10-year period. It is a rare achievement for a company to meet this criterion, and we believe it shows a mark of genuine quality. On average, only 3% of global listed companies achieve our threshold.

We find that quality characteristics positively correlate with better ESG scores, using MSCI ESG research methodology. The graphs below show that on average, ESG Leaders have a higher – and less variable – return on capital. The opposite is true for ESG Laggards.

Hence, we find that by first screening for high-quality businesses, we indirectly exclude many businesses that are deemed to have below-average or inadequate management of ESG issues.

NEGATIVE SCREENING

We exclude some companies from the portfolio based on their activities

FIRM-WIDE EXCLUSIONS

CONTROVERSIAL WEAPONS

We exclude companies that have been identified by credible third parties as being directly involved in the design, manufacture or sale of cluster munitions, landmines and biological and chemical weapons.

THERMAL COAL

In addition to the exclusion of companies that extract coal, we exclude companies with significant thermal coal generation activities - specifically, those companies that generate more than 30% of revenues from thermal coal-based power generation.

FUND-SPECIFIC EXCLUSIONS

TOBACCO

We exclude all tobacco producers and exclude companies that have a revenue contribution of 10% or more from tobacco-related products or services

STEWARDSHIP - ENGAGEMENT

We believe that engagement is an effective tool to achieve meaningful change and we undertake engagement activities, where relevant, to encourage investee companies to improve aspects of some or all of their environmental, social or governance practices.

THE GUINNESS ENGAGEMENT FRAMEWORK

All engagement is conducted by the investment management team. This helps to ensure that the results of our engagement and monitoring activities feed directly into the investment decision making process.

We focus on issues which we determine to be most material to the long-term value of our investee holdings. When material and relevant, we believe that companies that address these factors may drive improved business and financial performance, and in some cases wider stakeholder improvements.

Our engagement framework is composed of three tenets: dialogue, monitoring, and escalation. We prioritise the quality and materiality of our engagements over the volume of activity

Dialogue

Our quantitative and qualitative fundamental and ESG assessments play a pivotal role in highlighting issues which may present an opportunity to engage with an investee company to improve or move towards best practice in that area.

Monitoring

In order to track and monitor our engagement activity, we have created a central engagement database used by all investment teams in the firm to record interactions with investee companies. The database allows us to analyse the range of interactions that have occurred over a period and the range of topics that have been discussed.

Monitoring includes recording the following:

- When the engagement was initiated

- The nature of the issue raised

- The company’s acknowledgement of the engagement and issue

- Description of the desired outcome

Result of the engagement The result of the engagement can often include a commitment to change or an implementation of change, or it may require escalation. Whilst we regularly monitor progress against the engagement objectives, we recognise that the length of time to achieve an objective will vary depending upon its nature, and that key strategic changes will take time to implement into a company’s business processes.

A measurable outcome from our engagement upon completion of an objective could take a range of forms, including additional disclosure by a company, influencing the company strategy on a particular issue, or a change to the governance of an issue. We recognise that success factors may be subjective, and that our influence is rarely the sole driving force for change. Regardless, we believe it is critical to track companies’ progress and measure the outcomes of our engagement.

Escalation

We recognise that effective engagement requires continuous monitoring and ongoing dialogue. Where we have engaged repeatedly and seen no meaningful progress, we will escalate our concerns. Decisions on whether and how to escalate are based on the materiality of each issue, its urgency, the extent of our concern and whether the company has demonstrated progress through previous engagements.

We identify a number of methods to escalate our engagements. These may take place in any order or frequency:

- Further formal correspondence signalling discontent

- Additional meetings or communication with executives or non-executive directors

- Signal discontent via exercising our votes against individual directors or non-director resolutions

Whilst divestment is also an option, we believe that divestment can simply transfer ownership of problematic companies to less responsible owners.

Ultimately, our preference is to influence and affect change through engagement and the escalations identified above. However, if we have exhausted our options, have seen insufficient progress, or believe that there is a clear risk to shareholder value, we may choose to divest if we believe it is in the best interest of our clients.

COLLABORATIVE ENGAGEMENT

We may also participate in collaborative action around ESG issues.

For example, we participate in the CDP non-disclosure campaign, which offers investors the opportunity to engage with companies that have received the CDP disclosure request but have not yet provided a response. The objective of the annual campaign is to drive further corporate transparency around climate change, deforestation and water security, by encouraging companies to respond to CDP’s disclosure requests. As part of this, we also have the opportunity to lead engagements with investee companies where relevant.

STEWARDSHIP - PROXY VOTING

As portfolio managers we manage the voting rights of the shares entrusted to us and are responsible for voting for the companies held within our funds. Proxy votes are cast in a prudent and diligent manner, based on the managers’ judgment of what is in the best interests of clients. Records of voting activities are maintained and reviewed on a quarterly basis by the Responsible Investment Committee.

To assist in filing proxies, we retain proxy voting advisory services. While we take note of proxy research and recommendations, we are under no obligation to follow them; our portfolio managers vote according to their own views and research insights.

In order to vote, some markets require shares to be temporarily immobilised from trading until after the shareholder meeting has taken place. Other markets require a local representative to be hired, under a Power of Attorney, to attend the meeting and vote on our behalf. In such instances, it may sometimes be in clients’ best interests to refrain from voting. But in all other circumstances we endeavour to exercise our voting responsibilities on clients’ behalf.

Guinness Global Investors has a companylevel proxy voting policy which covers resolutions on ESG issues. The policy and a summary of proxy voting activity is available at https://www.guinnessgi.com/ about-us/responsible-investment#tabliterature.

ASSOCIATIONS

We understand that participation in relevant industry initiatives is essential to the development of best practice in responsible investment. We participate in several initiatives in order to promote proper functioning of markets, improve our understanding in the area and contribute to the industry. These include the following:

The Investment Association (IA) has over 200 full members managing over £8.5 trillion in assets. As the trade body for the UK investment management industry, it seeks not only to represent the interests of that industry but also to improve the investment landscape for investors through initiatives which highlight certain topics – such as diversity and inclusion in the industry – and by improving standards and best practice. In addition to its membership of the Association, Guinness Global Investors participates in the Compliance Discussion Group, which provides an informal discussion to share issues, concerns, and solutions within the compliance function. The effect of our membership is to promote the good functioning of the investment market in the UK through these initiatives to the benefit of investors and the economy.

The UK Sustainable Investment and Finance Association (UKSIF) aims to support its members to grow sustainable and responsible finance in the UK. It also seeks to influence policymaking that promotes the growth of sustainable finance. Our membership constitutes part of a collective effort to promote sustainable finance in the UK. The Independent Investment Management Initiative (IIMI) aims to contribute to effective financial regulation and promote client-centred models of investment management.

Our membership, among that of over 40 firms, aims to promote initiatives which improve the functioning of the investment management industry. Most recently, a call with the UN PRI allowed members to discuss concerns and recommendations for their reporting system, to contribute to a more effective reporting procedure for future reporting periods. Our CEO, Edward Guinness sits on the board of IIMI.

Climate Action 100+ is a collaborative engagement programme through which Guinness Global Investors engages with Imperial Oil, a $34bn Canadian-listed oil & gas producer with operations mainly in Canada. The collaborative nature creates a programme of concentrated engagement with focus companies, where the sum of the parts is significantly more effective than if each participant attempted to engage across the whole sector.

CFA UK’s mission is to build a better investment profession by serving the public interest by educating investment professionals, by promoting and enforcing ethical and professional standards and by explaining what is happening in the profession to regulators, policymakers, and the media. A member of staff at Guinness is part of the Sustainability Community Champions group.

The FAIRR Initiative (FAIRR) is a collaborative investor network that raises awareness of the material risks and opportunities in the global food sector. By providing research and coordinating engagement, it helps investors drive more sustainable practices in the agriculture and protein sectors.

Risk: The Guinness Global Quality Mid Cap Fund and WS Guinness Sustainable Global Equity Fund are equity funds. Investors should be willing and able to assume the risks of equity investing. The value of an investment can fall as well as rise as a result of market and currency movement; you may not get back the amount originally invested. The Funds are actively managed with the MSCI World Index used as a comparator benchmark only. The Funds invest primarily in global equities which provide a yield above the yield of the benchmark (MSCI World Index).

The brochure, which can be accessed via the article links above and below, contains important information about the Funds and further details on the risk factors are included in the Funds’ documentation, available on our website (guinnessgi.com/literature)

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.