Is there a rising concentration risk in the S&P 500?

Investors are right to pay attention to the increasing concentration in headline equity market indices. On the one hand, since we manage active funds with an index-agnostic approach, benchmarks play no part in our portfolio construction. On the other, though, we believe it is important to consider potential investments in terms of their quality and our conviction in them. In this insight, we apply some of that perspective to concentration in the S&P 500 and consider what it means for investors.

From Q1 of 2023, when ChatGPT captured the imagination of investors thanks to the potentially paradigm-shifting impact of generative artificial intelligence, a group of large, advantageously-exposed stocks began a striking period of outperformance. Perceived to be the best placed to facilitate (and eventually profit from) the development of this disruptive technology, Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla began to be referred to as the ‘Magnificent Seven’.

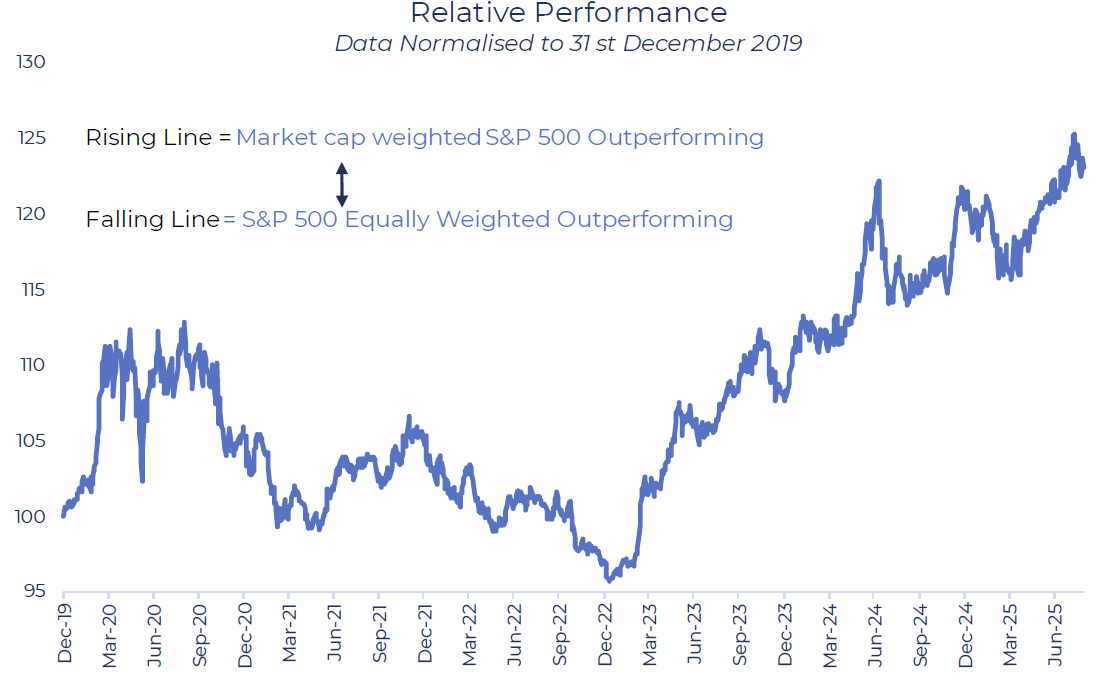

Due to their large weightings in the S&P 500, this outperformance brought the index significantly higher overall. This effect can be illustrated by comparing the return of the S&P 500 – which is a market-cap-weighted index – with the ‘equal weight’ version, where constituents each have a 0.2% weighting (with periodic rebalancing).

S&P 500 Vs S&P 500 Equal Weight

Source: Bloomberg, Guinness Global Investors, August 2025

The Magnificent Seven’s market leadership has outlasted even the most bullish of expectations and numerous ‘false dawns’ when the end seemed in sight. In August, however, weakness in the mega-caps created space for broader market participation after the release of an MIT report suggesting that corporate AI pilots had not yet translated into revenue growth, and the equal-weight S&P 500 outperformed its market-cap-weighted counterpart. This divergence served as a reminder that the dominance of a few stocks not only elevates concentration risk but can also leave investors vulnerable to abrupt reversals when sentiment toward those leaders turns.

Concentration of the S&P 500

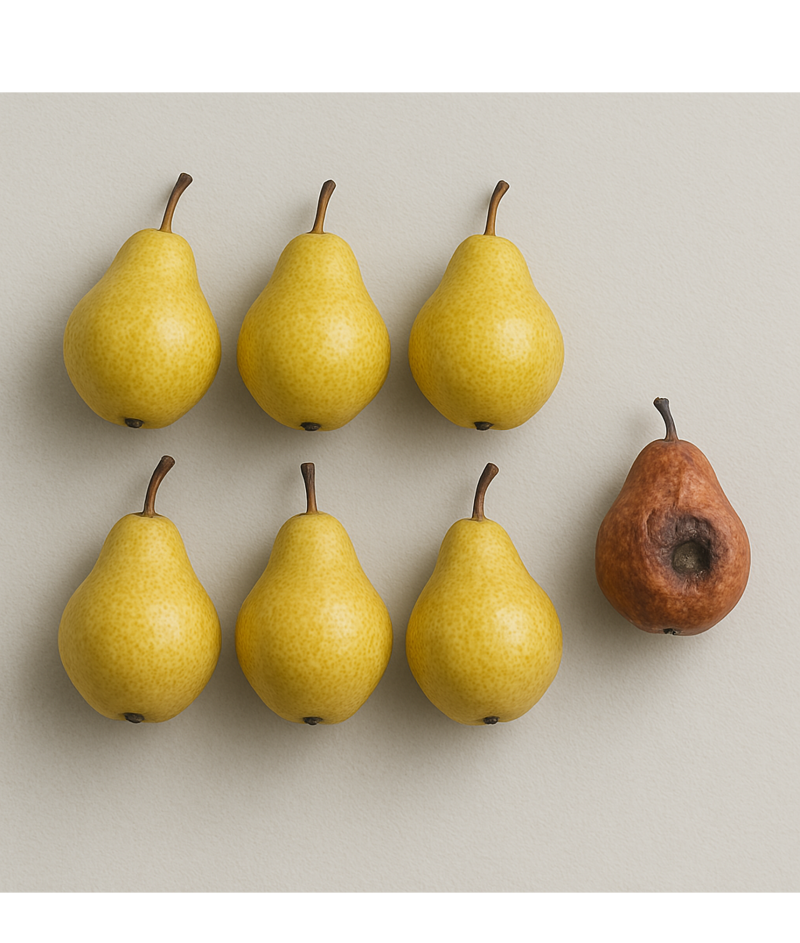

This increase in market concentration is a trend that actually emerged well before investors’ particular enthusiasm for generative AI, and may have even started between 2014 and 2016. Concentration in the S&P 500 is now at an all-time high, with the 10 largest companies in the index (hereafter referred to as the 'Top Ten’) now accounting for 40% of its total market capitalisation, roughly double the concentration seen in 2015/2016 (c.20%). Still, this doesn’t make the c.10 percentage point increase in concentration in the Top Ten stocks between 2020-2025 any less staggering – or any less worrying, for some.

Should investors be concerned?

Examples from history of notable market concentration might make investors wary. During the dot-com bubble, as technology stocks surged, the market-cap-weighted S&P meaningfully outpaced the equal-weight index, only to unwind sharply when the bubble burst. A similar pattern played out leading into the Global Financial Crisis, when financials became heavily concentrated in the index, and again during the covid pandemic with lockdown beneficiaries in the technology sector. Each period underscored how narrow leadership can amplify downside risk when sentiment shifts.

How is the current S&P 500 concentration different to the past?

Earnings concentration

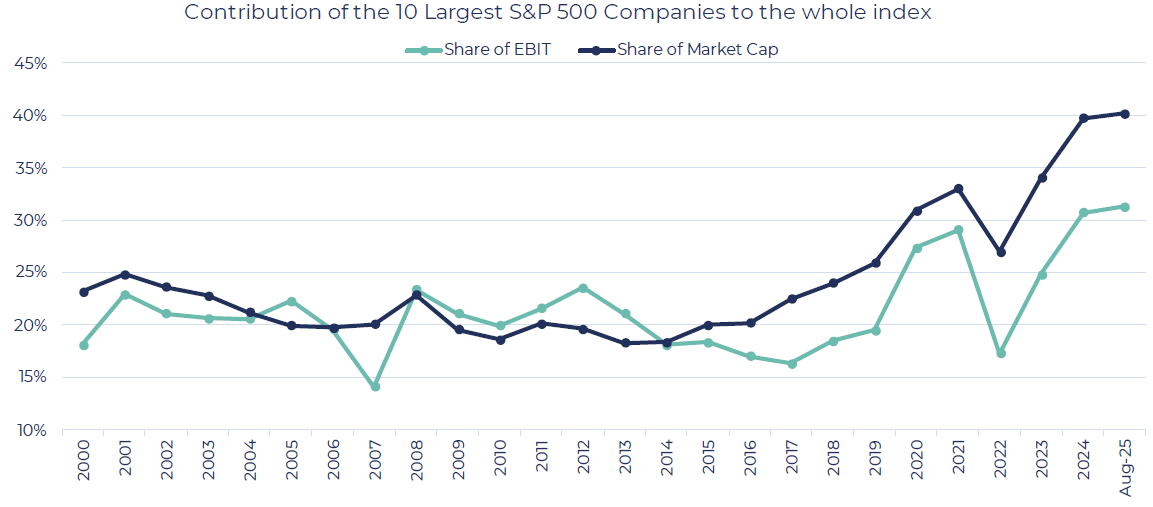

Market Concentration Vs Earnings Contribution

Source: Bloomberg, Guinness Global Investors, August 2025

Unlike previous periods of market concentration, the current Top Ten are supported by strong fundamentals. Accompanying the increase in market concentration over the past decade has been a rise in earnings concentration, as these companies’ share of earnings before interest and tax (EBIT) has also increased significantly. They accounted for c.20% of overall index EBIT in 2015, rising to c.30% today.

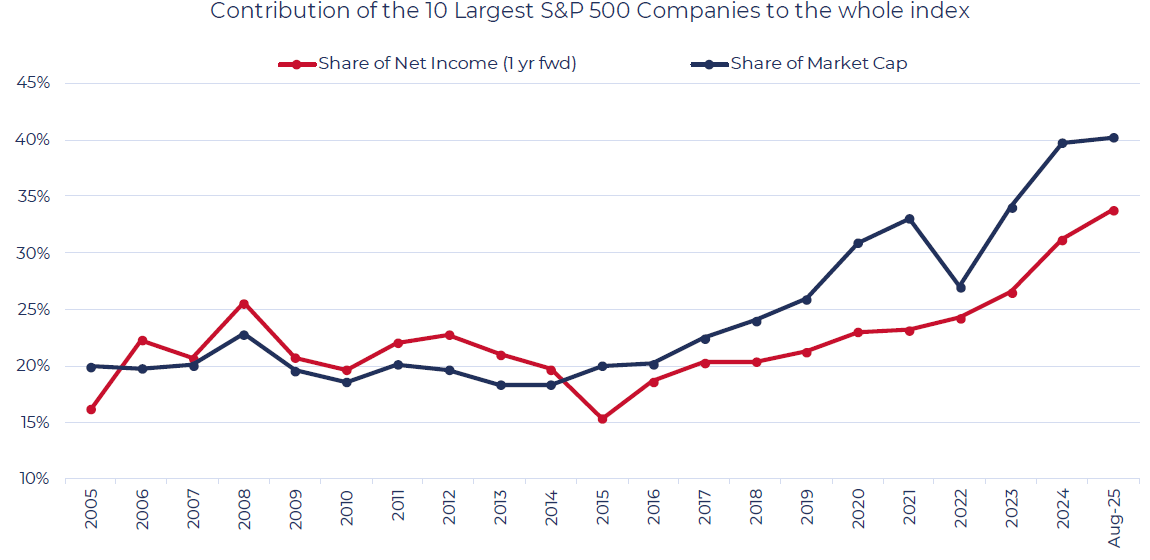

Still, there is a meaningful gap of c.10 percentage points (pp) between market cap concentration and earnings concentration. However, 12-month trailing EBIT is a backwards-looking metric. Using forward estimates for net income (1-year forward consensus estimates), the earnings share increases from less than 20% in 2015-2016 to c.34% in August 2025. A gap of c.6pp still remains.

Market Concentration Vs Earnings Concentration

Source: Bloomberg, Guinness Global Investors, August 2025

If this increase in market cap concentration is not totally underpinned by earnings (as it had been throughout much of the 2000s), are there other factors that justify the divergence? Looking at the average stock before and after the emergence of the gap is insightful.

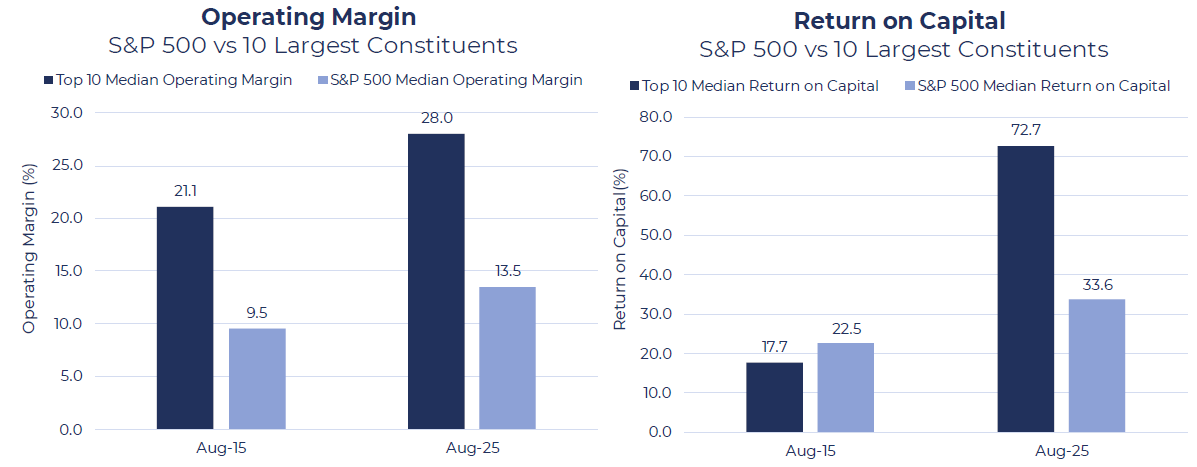

Quality

From a quality perspective, despite already having a superior margin profile compared to the rest of the S&P 500, the Top Ten saw greater margin improvement than the rest of the index between 2015 and 2025. The ‘median’ operating margin of the Top Ten increased by c.7pp, whilst the median stock in the index increased by just c.4pp. On a returns basis, the improvement was even more vast. At the beginning of the period, return on capital between the two groups looked relatively similar. Now, however, the median Top Ten stock has a return on capital over double that of the rest of the index, increasing from 18% to 73%, an increase of c.55pp, while the average S&P 500 company increased just c.11pp, to c.34%.

Source: Bloomberg, Guinness Global Investors, August 2025

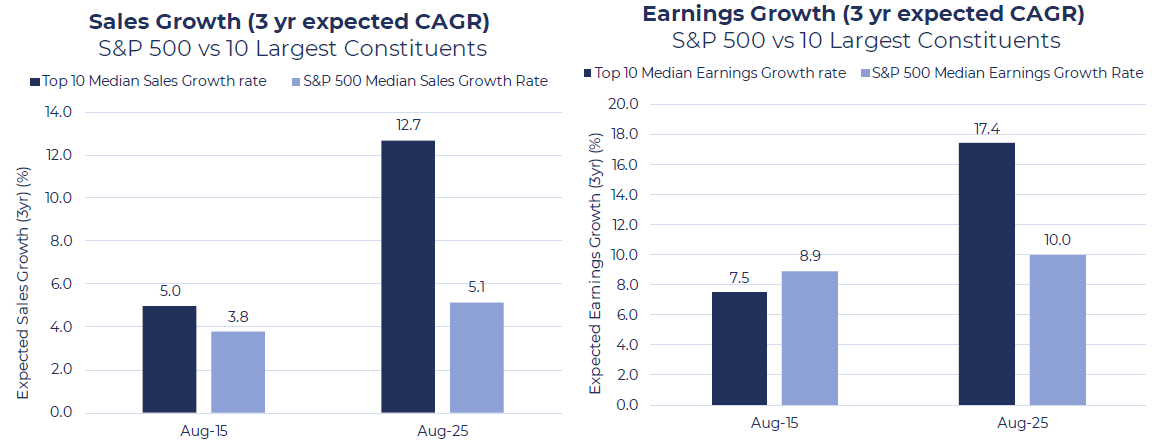

Sales and earnings growth

It is not just quality attributes that have underpinned the increase in this ‘gap’, however. Looking at both expected sales and earnings growth, in August 2015, the Top Ten largest constituents looked very similar to the rest of the S&P 500. While both the Top Ten and the broader index now have a superior growth outlook, sales for the Top Ten are now expected to grow at c.2.5x the rate (12.7% vs 5.1%) over the next three years than the rest of the index, and earnings at c.1.7x the rate.

Source: Bloomberg, Guinness Global Investors, August 2025

Throughout much of this century, market cap concentration and earnings concentration have tended to look very similar. Now, however, these stocks appear to have far superior quality in terms of margins, returns, and growth attributes. Therefore, the emergence of this ‘gap’ seems more about an improvement in fundamentals rather than simply unjustified multiple expansion. And while the companies constituting the Top Ten have shifted towards stocks with higher valuations, this is also a shift towards stocks with superior quality-growth metrics. As a result, this period of market concentration seems far more tolerable.

However, there is still a risk in focusing on the Top Ten in that they are heavily influenced by similar themes and trends, primarily the development and integration of AI. If there is a diminution in investor optimism about the technology or a serious barrier to its effectiveness emerges, a considerable realignment of market share in the S&P 500 could occur, leaving many investors behind. This is why Guinness Global Investors, while recognising the quality characteristics in some of the mega-cap tech leaders, has a portfolio construction methodology which balances concentration and diversification.

How we mitigate concentration risk

Within our fund range, not only do we ignore index weightings when constructing portfolios, but we also mitigate concentration risks through our equal weighting approach. By allocating evenly across holdings, we avoid dependence on just a handful of large stocks that dominate index performance. Instead, each of our 30-35 holdings has broadly equal potential to drive returns, rather than outcomes hinging disproportionately on a few names.

Importantly, performance isn’t reliant on a single ‘big call’ but on a consistent, systematic approach. Within the Guinness Global Innovators Fund, we hold six of the Magnificent Seven. The discipline of equal weighting, however, forces us to reassess these positions regularly – allowing winners to run, but trimming when appropriate to reduce stock-specific risk, and topping up laggards where we believe short-term weakness is not consistent with long-term fundamentals.

This approach instils natural diversification and ensures a high active share versus the benchmark. In short, an equal weighting philosophy mitigates the risks of index concentration, while maintaining a focus on bottom-up stock selection and preserving exposure to what we believe are the best long-term opportunities for total returns.

Learn why we believe in the Magnificent six over the Magnificent seven

Risk: The Guinness Global Innovators Fund and WS Guinness Global Innovators Fund are equity funds. Investors should be willing and able to assume the risks of equity investing. The value of an investment can fall as well as rise as a result of market and currency movement; you may not get back the amount originally invested. The Funds are actively managed with the MSCI World Index used as a comparator benchmark only. The Fund invests in global equities. The companies invested in will have, in the manager's opinion, innovation at the core of their business.

Disclaimer: This insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in this insight. This insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.