Consumer Staples: Sector & Stocks

What are Consumer Staples?

The Consumer Staples sector is made up of companies making or selling products that consumers tend to keep buying regardless of the economic conditions, such as food, drinks, tobacco, and regular household and hygiene purchases. This steady demand makes Consumer Staples businesses less cyclical.

The Consumer Discretionary sector contains companies with more cyclical businesses, such as those making and selling cars, homewares, clothing and luxury goods, alongside leisure businesses such as restaurants and hotels.

Examples of Consumer Staples Stocks

Their familiar products make the major Consumer Staples stocks well known themselves, such as Diageo, Mondelez, P&G, Henkel, PepsiCo, Coca-Cola, Unilever, Reckitt, Danone & Nestlé. These are mainly US and European stocks.

Categories of the sector

Behind the well-established brands, however, there are 12 industry groups within the Consumer Staples sector as defined by the Global Industry Classification Standard (GICS), and they are more diverse than one might think.

In brief, these include Brewers, Distillers & Vintners. Soft Drinks, Agricultural Products and Packaged Foods. The Distribution & Retail group covers Food Distributors and Retail, Merchandise Retail, but also Drug Retail. Household Products, Personal Care Products and Tobacco complete the sector.

How the companies in this sector grow over time

There are three key drivers of organic growth for Consumer Staples companies: Pricing, Volumes, and Product Mix.

Pricing

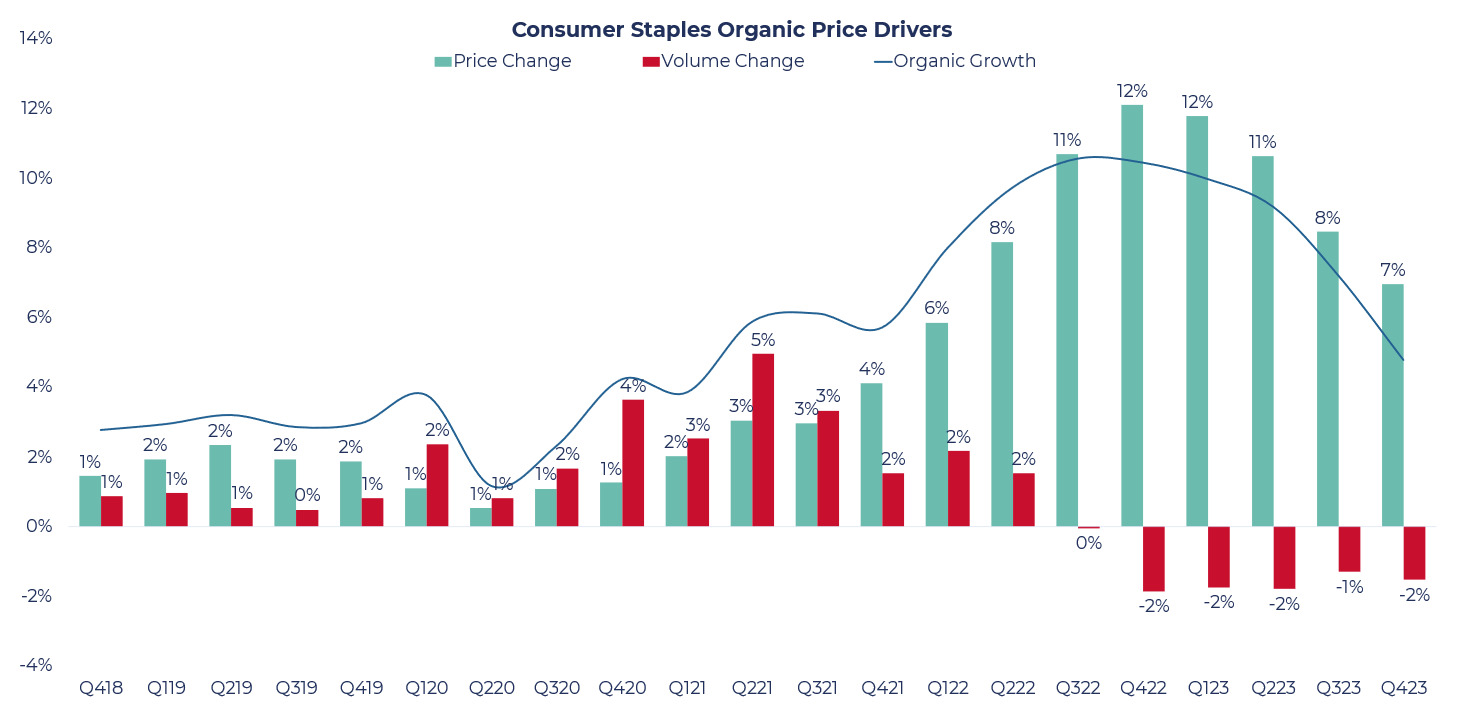

Pricing strategy and pricing power are key components of the organic growth picture and especially in the period since the end of 2021, when price increases have driven the majority of sector growth, since volumes for many sub-categories have faced substantial headwinds. It comes as no surprise that this has coincided with the large increase in global inflation rates. Many Staples businesses (owing to strong branding and customer loyalty, qualities discussed below) have managed to pass through price increases in excess of inflation rates and have therefore seen healthy organic growth figures. As inflation heads towards more normalised levels in many major economies, the ability to sustain these levels of price increases has diminished substantially, but we are still seeing mid to high single-digit price increases being passed through to the end consumer. The chart below shows how price increases have accelerated over the last five years before moderating over the past four or five quarters.

Source: Guinness Global Investors, Bloomberg, 29th February 2024. Price & Volume data is for a basket of Staples businesses

Volumes

In contrast to price increases, which have been strong across the board, volume trends been more varied. At the industry level, the chart above shows that volume growth peaked in mid-2021 and has declined since. This reflects the increased price sensitivity – and in some cases the financial stress – of the consumer, although the US market and parts of Europe are still holding up relatively well. Still, despite the more recent net volume declines, organic growth has remained strong. This is particularly noteworthy in that the ‘down-trading’ (switching from branded to cheaper alternatives) that many investors feared has been far less widespread than expected, as demonstrated by management commentary from a range of Consumer Staples companies.

Mondelez CEO Dirk Van de Put (on pricing dynamics in the European market): “there is very little or low down-trading … because everybody will have to (raise) prices. So, it's a joint movement between all the brands… we don't expect that there will be huge shifting of consumers.”

Mondelez CEO Dirk Van de Put (on pricing dynamics in the European market): “there is very little or low down-trading … because everybody will have to (raise) prices. So, it's a joint movement between all the brands… we don't expect that there will be huge shifting of consumers.”

![]() Coca-Cola CEO & Chairman James Quincey: “if you've got to save money, you don't trade down averagely across everything … our objective is to make sure [consumers] value our brands so that they make the choices in the shopping occasion… we preserve our brand strengths because we deliver value for them in the product, in the marketing and innovation.”

Coca-Cola CEO & Chairman James Quincey: “if you've got to save money, you don't trade down averagely across everything … our objective is to make sure [consumers] value our brands so that they make the choices in the shopping occasion… we preserve our brand strengths because we deliver value for them in the product, in the marketing and innovation.”

P&G CFO Andre Schulten: “the U.S. continues to be very solid and continues to impress. Consumers that are choosing P&G products continue to trade up within our portfolio… This speaks to the health of our proposition, but also the health of the consumer and their willingness to invest. Some consumers will look for value in private label, but an equal if not higher amount find better value in our propositions as we drive continued superiority via innovation.”

P&G CFO Andre Schulten: “the U.S. continues to be very solid and continues to impress. Consumers that are choosing P&G products continue to trade up within our portfolio… This speaks to the health of our proposition, but also the health of the consumer and their willingness to invest. Some consumers will look for value in private label, but an equal if not higher amount find better value in our propositions as we drive continued superiority via innovation.”

Product Mix

Often overlooked, the product mix is also an important part of overall growth. This refers to the different product forms offered by a company, including the type of product sold, the quantity it is sold in (single buy / multibuy) and the size of the packet itself. Faced with rising costs and an increasingly price-sensitive consumer, Staples businesses have been reducing the size of certain product ranges. Even alongside flat pricing, this has the effect of increasing the average cost per quantity sold and contributes to organic growth.

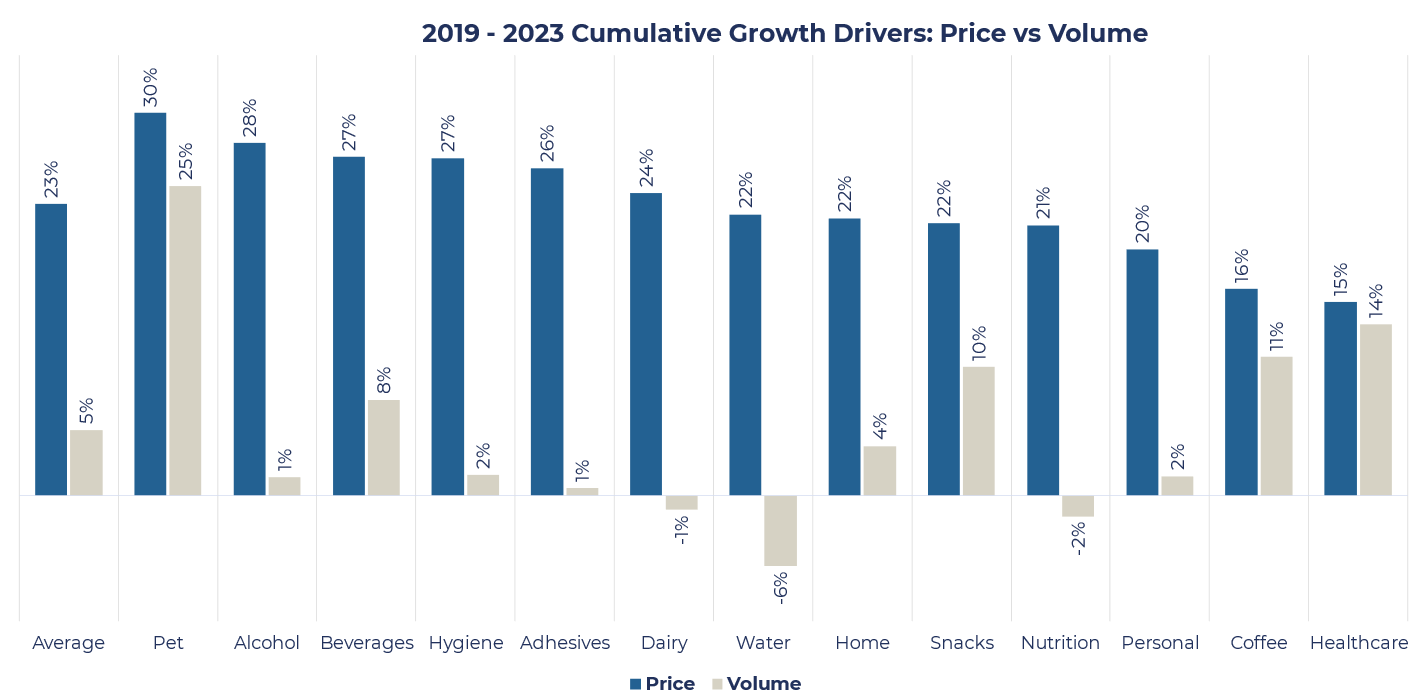

At the Category Level

There is wide variation by category. Some (Pet, Beverage, and Healthcare) have had tailwinds and managed to grow both volumes and price. Others (notably Water, Dairy, and Alcohol) have seen greater challenges, particularly on the volumes side, as shown by the chart below.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

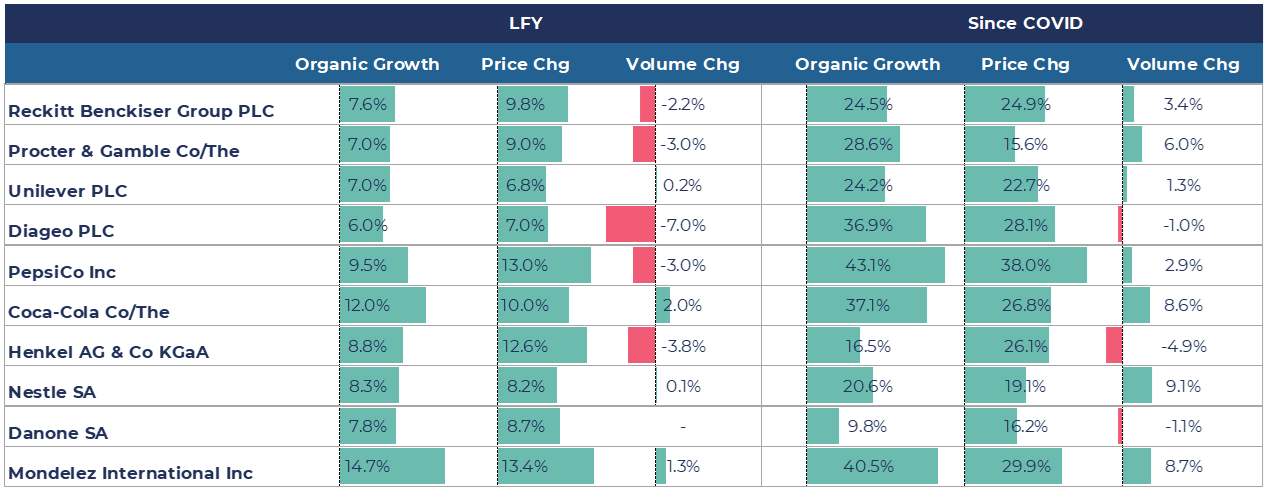

At the Stock Level

Source: Guinness Global Investors, Bloomberg, 29th February 2024. LFY: last fiscal year

Pricing growth has been strong for these 10 Consumer Staples stocks, both on a one-year basis and since COVID (Q1 2020). On a four-year basis, across all holdings, the average price increase has been 24.7%.

Even though volumes have lagged behind pricing, net volume growth still stands at 3.3% over the same time period, with all but three companies seeing positive growth.

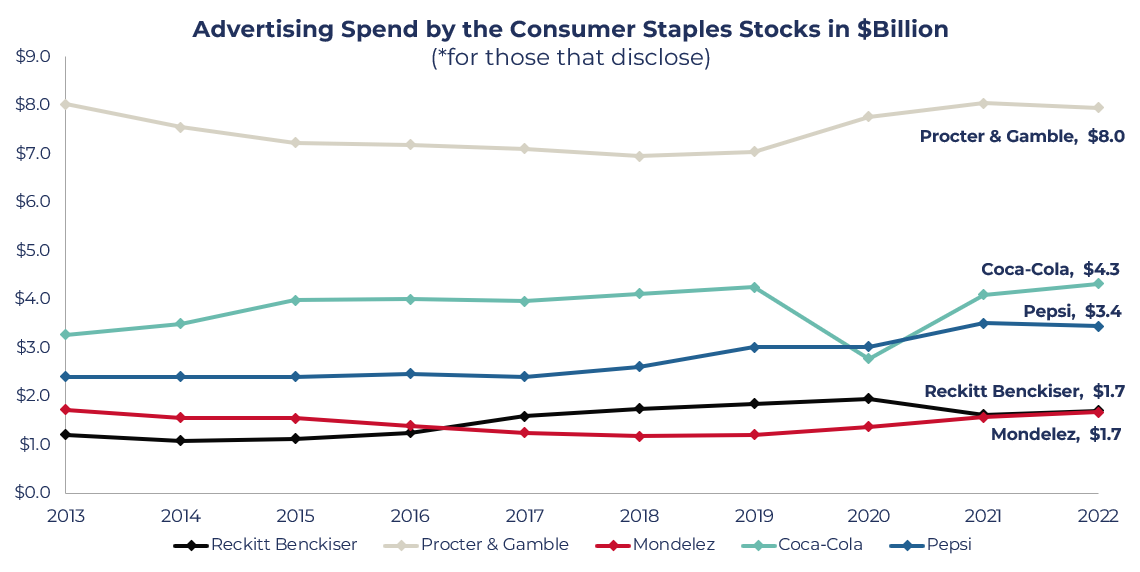

Brands

Branding is a key differentiator for Consumer Staples, perhaps more than in other sectors due to the core industry dynamics. Products are often purchased regularly, and purchasing decisions take place with limited planning or thought, due to their generally low cost. Staying front of mind is therefore paramount. This is achieved via consistent advertising campaigns which highlight the value proposition as well as the latest product innovations, helping to reinforce strong brand messaging and personal attachment. Such is its importance, Advertising & Promotional spend (A&P) is seen as an essential cost of doing business as without it, sales would likely tail off quickly. The 10 Consumer Staples stocks above have, we believe, a superior brand portfolio which continues to grow sales organically, and this is partly explained by their sizeable A&P investments. Not all businesses disclose their A&P spend, but for those that do (shown below) the total figures are substantial.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

Innovation Case Study: Alcohol

Sectors that have struggled to grow volumes organically have often turned to innovation to improve the value proposition of their products and drive growth in other ways. This has sometimes meant focusing on product niches, as is the case for the Alcohol category, which is undergoing a change in consumption patterns. IWSR (a drinks market research company) has noted that alcohol consumption by US adults (18 to 34) has declined 14% over the past decade, and other major markets are seeing similar declines. However, ongoing innovation (alongside large marketing budgets) has seen new product categories emerge. For example, demand for zero-alcohol product lines has exploded, reaching a total addressable market (TAM) of $13bn in 2023. In addition, the category has pivoted towards premiumisation, both in terms of ingredient quality and brand advertising, which has proved popular with consumers, as they increasingly switch to higher-quality areas of the market, enabling greater pricing growth. Thanks to product development and continued investments into brand and quality, the Alcohol category has seen a 26% growth in price over the past four years, more than any other Staples category.

Margins

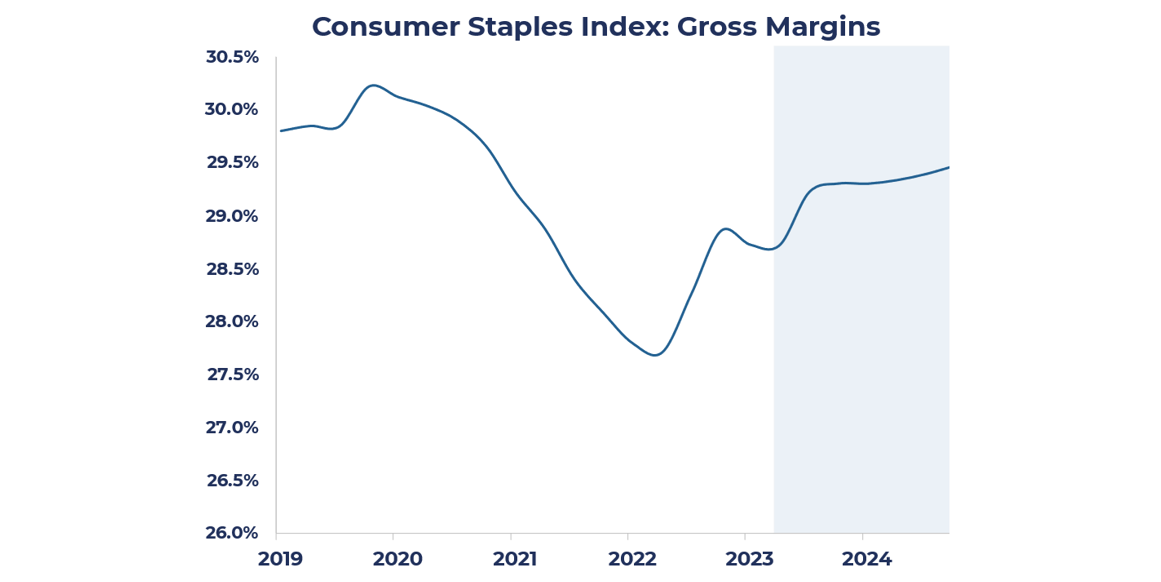

Gross Margins

Like many other industries, Staples businesses have faced a difficult few years, with rising costs across the entire supply chain. Commodity, shipping, manufacturing, labour and storage costs have all seen large increases and, as a result, the margin profile in mid-2022 deteriorated to the lowest level in the past five years. More recently, margins have rebounded thanks to input prices moderating (and even falling in some cases). As a result, sector gross margins have started to recover, reaching c.29% at the end of 2023 and poised for even further expansion.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

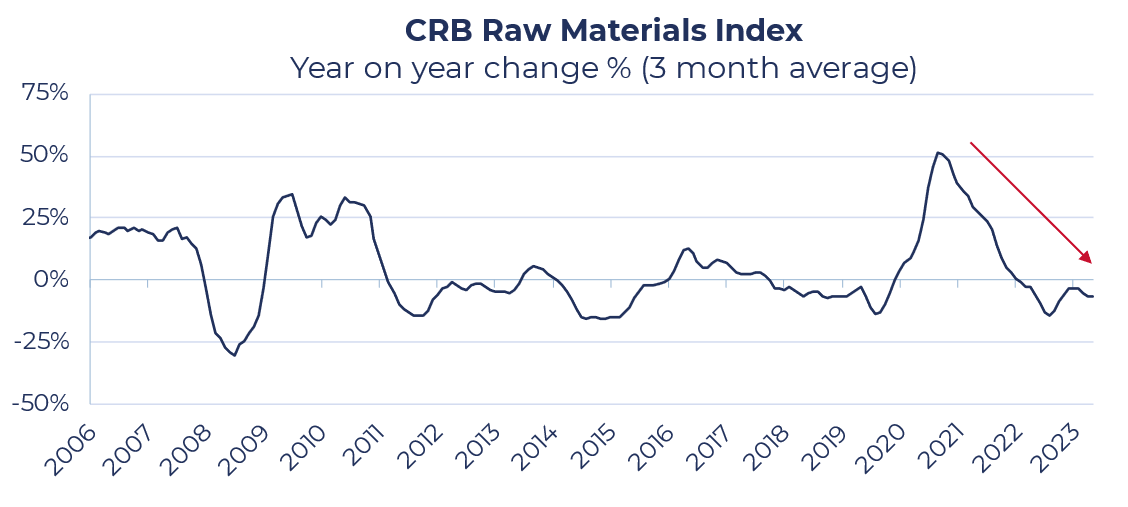

Inputs Trending Nicely

Much of the potential expansion is due to moderating input costs. The CRB Raw Materials Index, which tracks 19 global commodities, has seen substantial year-on-year declines from its 2021 peak and is now in negative territory on a 3-month rolling average basis. As input costs continue to fall and top-line growth continues, the potential for meaningful margin expansion grows.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

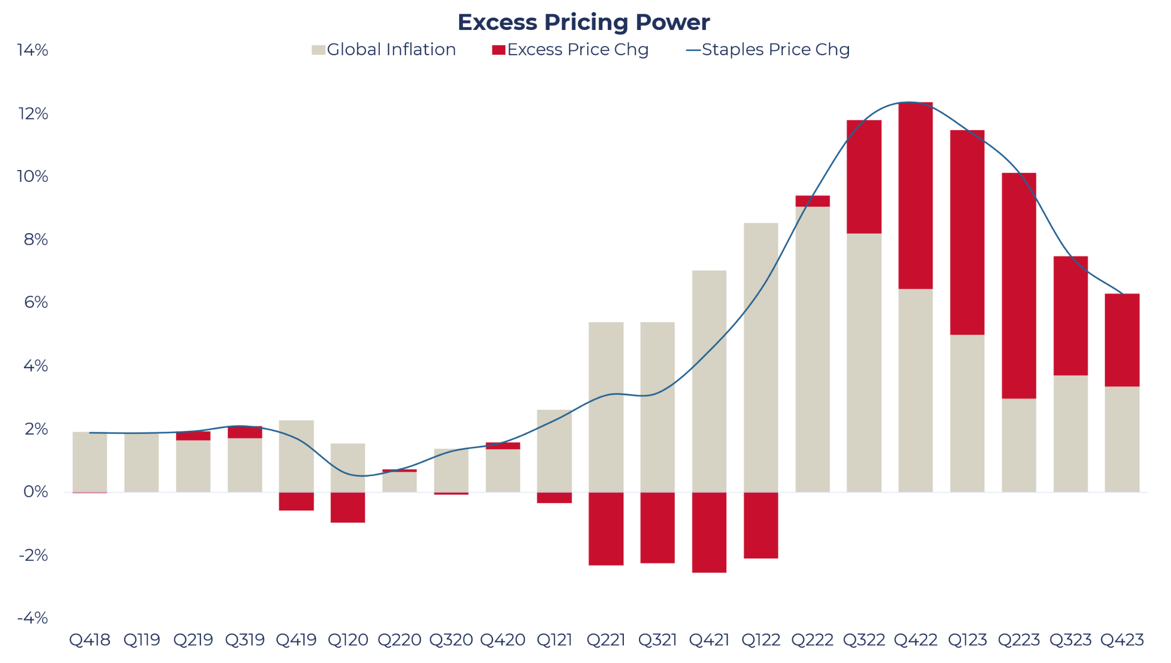

As Long as Pricing Holds

We have already discussed the industry pricing dynamics, but another route to conceptual price increases is via excess pricing power. This is manifest in the spread between the price increases companies are passing through and the rate of global inflation. As inflation began to rise in early 2021, the Staples industry was slow to raise prices and therefore excess pricing was negative (demonstrated by the red bars in the chart below). However, as companies continued to pass through higher prices to the consumer alongside falling headline inflation figures, excess pricing power has re-emerged.

Source: Guinness Global Investors, Bloomberg, 29th February 2024. Price & Volume data is for a basket of Staples businesses

In Investment Terms: Attractive Dividends

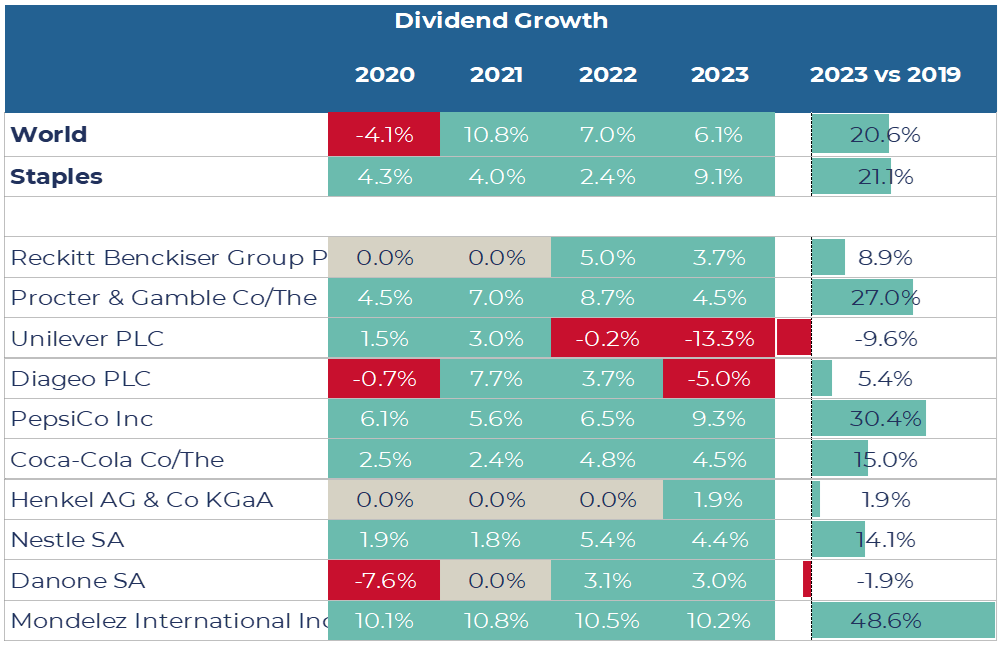

The Consumer Staples sector is characterised by companies that have stable revenues and defensive business models and which often produce high levels of free cash flow. As such, these businesses are often able to pay healthy dividends. Not only are the dividend yields solid in absolute terms, but the strong underlying free cash flows allow for healthy dividend growth over time. The average dividend yield across the 10 Staples names at end of February was 3.1%, well ahead of the MSCI World Index gross yield of 1.88%.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

When focusing on dividend growth, we can see that the Staples sector has grown dividends faster than the MSCI world by c.50bps over the last four years. Within these Consumer Staples stocks, Mondelez, PepsiCo and P&G have performed particularly well, growing their dividend well above the market over this period. However, even as names like Reckitt Benckiser, Henkel and Danone have not grown their dividend as fast over this period, it is encouraging to see that dividend growth is starting to reaccelerate as these firms show positive momentum within their dividend growth over the last one or two years.

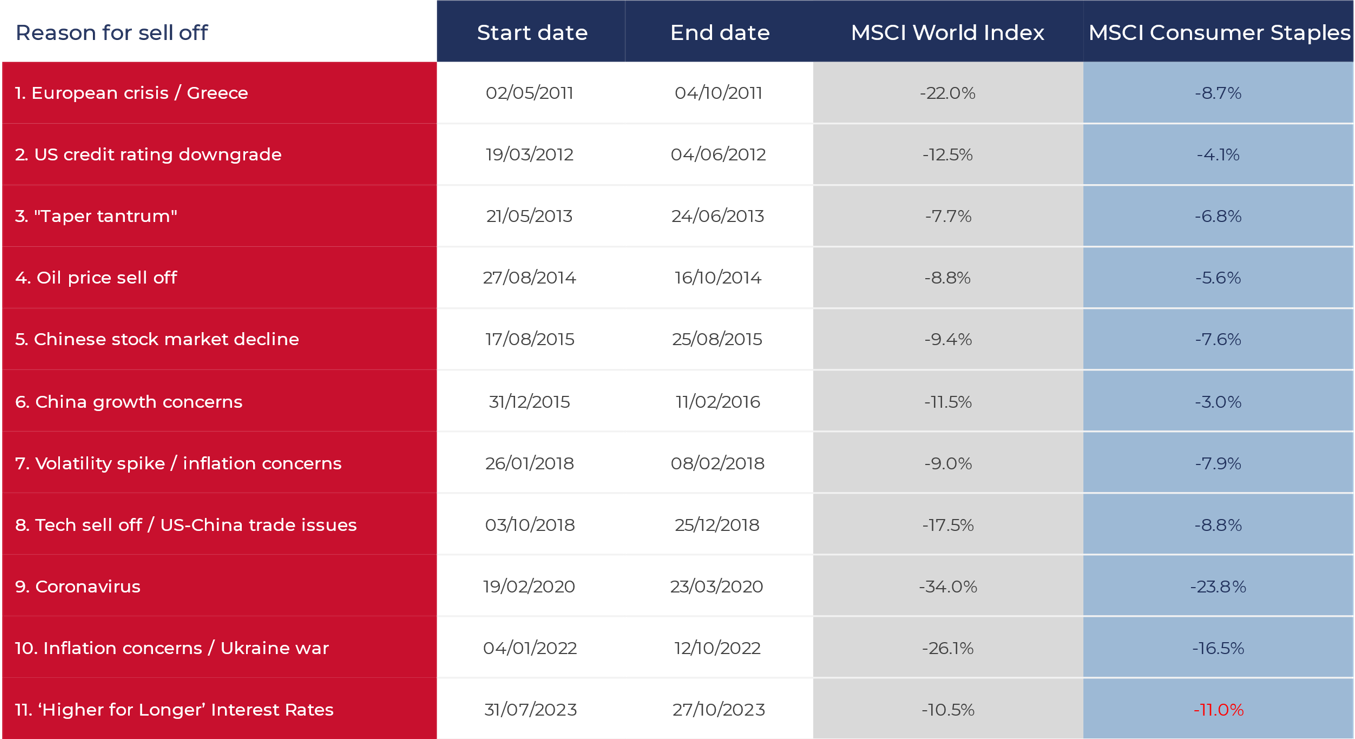

Defensiveness

Due to the nature of their businesses and predictable cash flows, Staples firms tend to outperform in a downturn, with a relative downside capture of just 78%. Looking back over the last 11 significant drawdowns (those characterised by a market pullback of 7% or more), the Consumer Staples sector has outperformed the MSCI World Index in all but the most recent example. Additionally, the average outperformance has been a substantial 5.9%. The chart below summarises the merits of the Staples sector, particularly in periods of greater volatility, as their more defensive and less cyclical characteristics have often led to outperformance.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

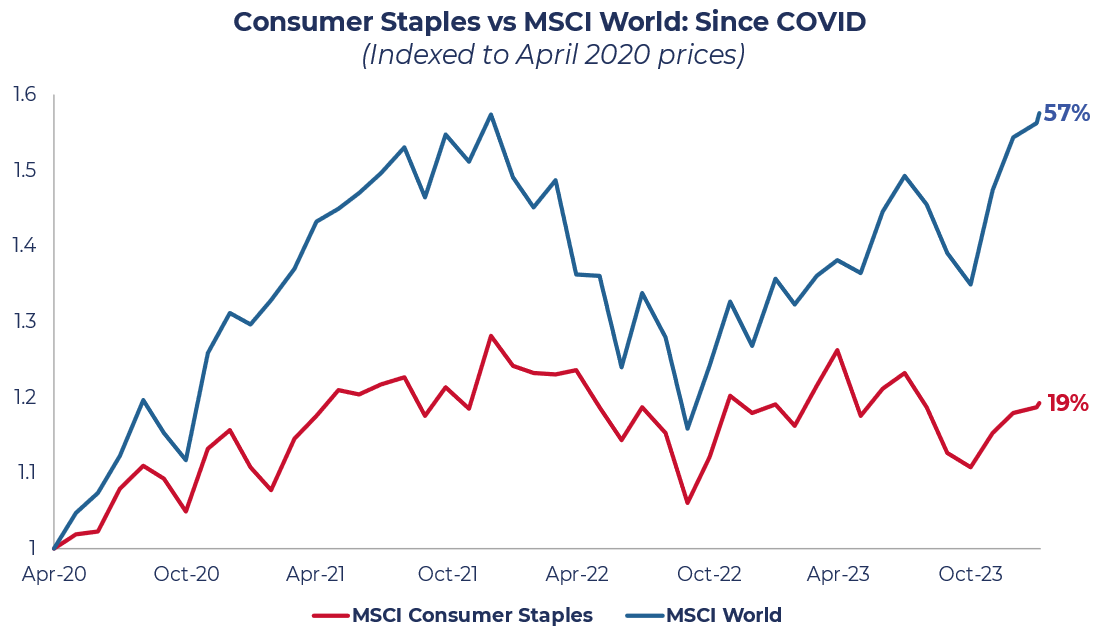

Performance

As a starting point, looking at relative performance over the past four years or so since the beginning of the COVID pandemic, it is clear that the Consumer Staples sector has underperformed the broader index:

Source: Guinness Global Investors, Bloomberg, 29th February 2024

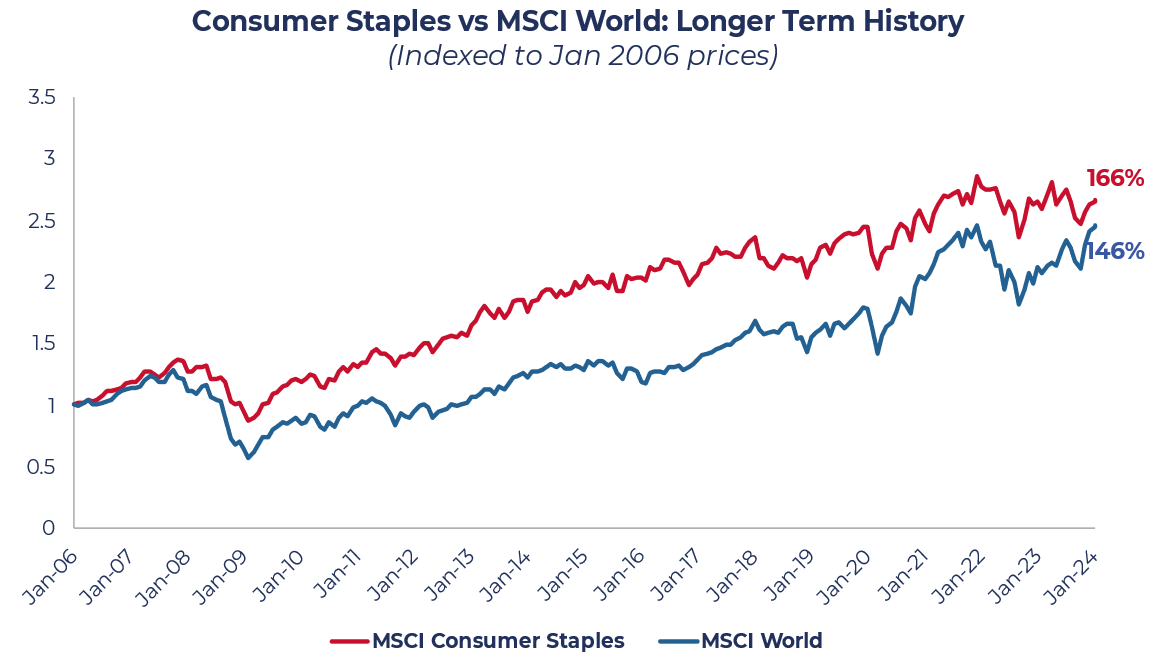

However, over a longer period, we can see outperformance from the sector, with lower volatility:

Source: Guinness Global Investors, Bloomberg, 29th February 2024

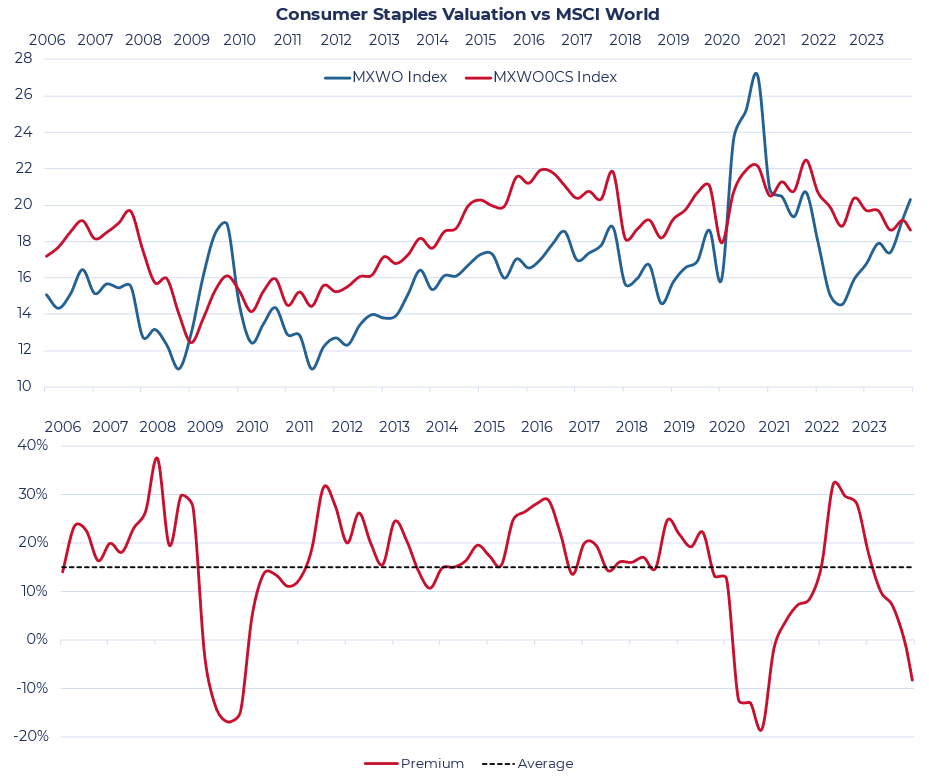

Valuations

With this superior performance over much of the past two decades, the Staples sector has traded at an average premium of 15% to the MSCI World. Over the past 10 years, this premium has in fact stood closer to 20% as the high-quality characteristics of the sector and the compounded organic growth have commanded a higher market multiple. However, since COVID, the valuation picture has been more volatile.

March 2020 to March 2021: markets rebounded sharply following the COVID crash as record-low interest rates benefited growth stocks in particular. Staples therefore underperformed and began trading at a discount to the wider market.

March 2021 to December 2022: As inflation began to feed through, Staples businesses managed to raise prices substantially, which, in many cases, reached double digits and spurred strong organic growth. Staples came back into favour and sector earnings multiples climbed above 22X, an all-time high. This was a 30% premium to the broader market.

2023 to present: As inflation began to moderate, the sector underperformed and earnings multiples fell to c.18x. This stands close to a 10% discount to the index at present.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

On a relative basis, vs history and vs the index, the Staples sector is looking attractive from a valuation standpoint. Even as the price increases they pass through are decelerating, Consumer Staples businesses are still capturing excess pricing, which is aided by falling input costs. The margin picture has improved substantially year-over-year, and this expansion looks set to continue. Despite their recent relative underperformance vs the index, there is a good case to be made for the Staples sector as a whole. The growth outlook looks solid and we remain confident in the long-term quality of the Sector. We therefore believe that these high-quality businesses with solid returns on capital and strong compounding characteristics can continue to perform well over the long term and represent a good source of dividend income, alongside steady compounded price returns.

Guinness Global Equity Income Fund

Risk: The Guinness Global Equity Income Fund is an equity fund. Investors should be willing and able to assume the risks of equity investing. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement, and you may not get back the amount originally invested. Further details on the risk factors are included in the Fund’s documentation, available on our website (guinnessgi.com/literature)

The Guinness Global Equity Income Fund holds the ten stocks mentioned throughout this insight, accounting for around 25% of the portfolio.

It is worth stressing that this overweight position is a function of our bottom-up process (where we seek to identify good quality companies, with consistently high returns on capital, strong balance sheets and a growing dividend). As a reminder, our bottom-up approach has four key tenets:

- Quality: We focus on companies with a long history of persistent high return on capital and avoid highly leveraged companies.

- Value: We try to identify companies that are cheap vs market, peers, and their own history.

- Dividend: We target a moderate dividend yield (we do not screen for high dividend yield companies) and aim to grow the dividend stream year-on-year.

- Conviction: The Fund typically has 35 approximately equally weighted positions. We target a low turnover with average investment horizon of 3-5 years.

However, while investing bottom-up, we have a favourable view of the sector due to its attractive characteristics. Throughout this insight, we have explored the underlying drivers of the sector and focused on the 10 Consumer Staples holdings.

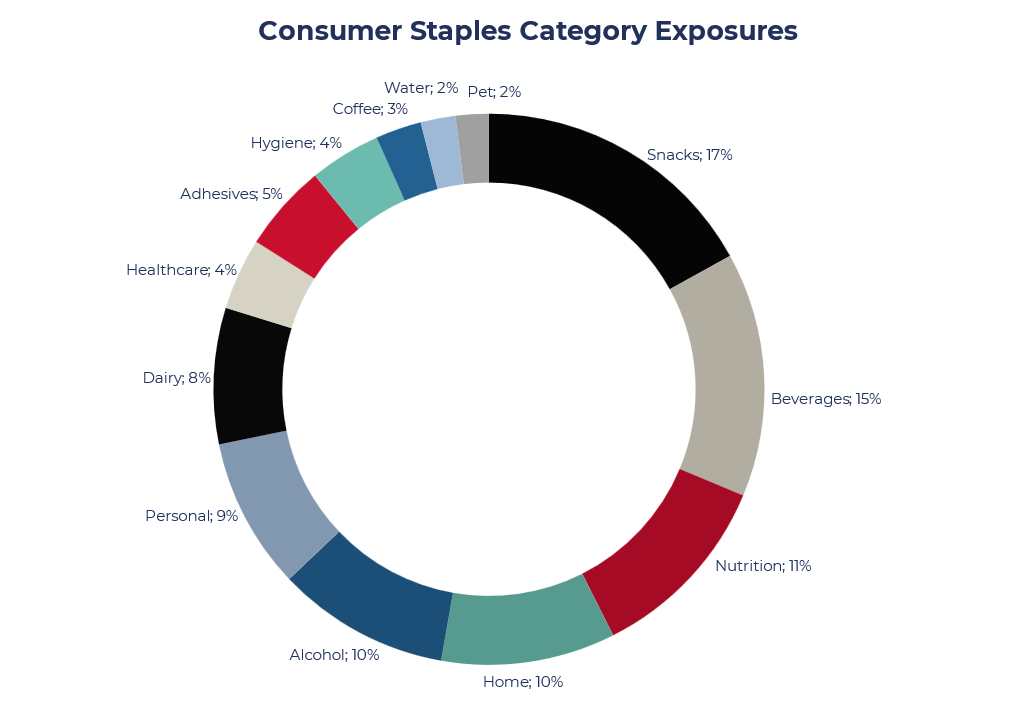

Sector allocation

Among the 10 Staples stocks in aggregate, the largest single allocation on a revenue basis is to Snacks (17%), followed by Beverages (15%) and Nutrition (11%). The remaining 57% allocation is split across 10 further categories, which leaves the Staples exposure relatively well diversified.

Source: Guinness Global Investors, Bloomberg, 29th February 2024

As we have seen, the Consumer Staples sector contains several stocks which offer the quality, value and dividend characteristics we seek for the Guinness Global Equity Income Fund.

Learn more about the Guinness Global Equity Income Fund

We've also gone in depth about the Industrials Industry.

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contain facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale. The Fund is actively managed, with the MSCI World Index used as a comparator benchmark only.