Asian Equity Income - February Commentary

This is a marketing communication. Please refer to the prospectus, supplement and KID/KIID for the Funds before making any final investment decisions. The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

Past performance does not predict future returns.

As elsewhere, emerging market equities in Asia started the year strongly, while developed markets lagged. Within Asia, Korea led returns in another month of market leadership by memory-related semiconductor stocks.

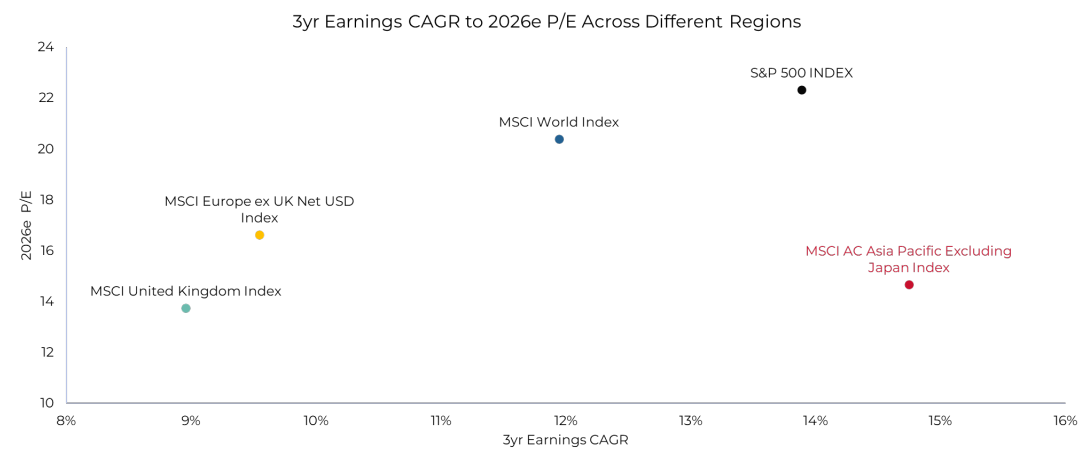

Although Tech continues to drive near-term market moves, when we look at the market’s expectations for earnings growth in Asia over the next three years, it is clear that it is not the only driver. In fact, consumer-driven sectors are also expected to play a significant role in Asia's growth. The Fund’s portfolio is well positioned to benefit from this. At the same time, the region's valuation remains low relative to the rest of the world on a price/earnings basis, and especially when we consider that the compound annual growth rate of company earnings is expected to be higher than in in other major regions.

Source: Bloomberg, MSCI, Guinness Global Investors. Data as of 31.12.2025

In this commentary we review market and Fund performance in January and the growth expectations for equity sectors in Asia Pacific.

The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

The information provided on this page is for informational purposes only. While we believe it to be reliable, it may be inaccurate or incomplete. Any opinions stated are honestly held at the time of publication, but are not guaranteed and should therefore not be relied upon. This content should not be relied upon as financial advice or a recommendation to invest in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale. Full details on Ongoing Charges Figures (OCFs) for all share classes are available here.

The Funds are designed to provide investors with exposure to high quality dividend-paying companies in the Asia Pacific region. The Funds are managed for income and capital growth and invest in profitable companies that have generated persistently high return on capital over the last decade, and that are well placed to pay a sustainable dividend into the future. The Funds are actively managed. The Guinness Asian Equity Income Fund uses the MSCI AC Pacific ex Japan Index as a comparator benchmark only. The WS Guinness Asian Equity Income Fund uses the MSCI AC Asia Pacific ex Japan Index as a comparator benchmark only.

For the avoidance of doubt, if you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund

Guinness Asian Equity Income Fund

Documentation

The documentation needed to make an investment, including the Prospectus, Supplement, the Key Information Document (KID) / Key Investor Information Document (KIID) and the Application Form, is available from the website www.guinnessgi.com , or free of charge from:

- the Manager: Waystone Management Company (IE) Limited, 2nd Floor 35 Shelbourne Road, Ballsbridge, Dublin DO4 A4E0; or,

- the Promoter and Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ

Waystone IE is a company incorporated under the laws of Ireland having its registered office at 35 Shelbourne Rd, Ballsbridge, Dublin, D04 A4E0 Ireland, which is authorised by the Central Bank of Ireland, has appointed Guinness Asset Management Ltd as Investment Manager to this fund, and as Manager has the right to terminate the arrangements made for the marketing of funds in accordance with the UCITS Directive.

Investor Rights

A summary of investor rights in English, including collective redress mechanisms, is available here: https://www.waystone.com/waystone-policies/

Residency

In countries where the Fund is not registered for sale or in any other circumstances where distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & Regulation

The Fund is a sub-fund of Guinness Asset Management Funds PLC, an open-ended umbrella-type investment company, incorporated in Ireland and authorised and supervised by the Central Bank of Ireland, which operates under EU legislation. The Fund has been approved by the Financial Conduct Authority for sale in the UK.

If you are in any doubt about the suitability of investing in these Funds, please consult your investment or other professional adviser.

WS Guinness Asian Equity Income Fund

Documentation

The documentation needed to make an investment, including the Prospectus, Supplement, the Key Investor Information Document (KIID) and the Application Form, is available in English from https://www.waystone.com/our-funds/waystone-fund-services-uk-limited/ or free of charge from:-

Waystone Management (UK) Limited, PO Box 389, Darlington DL1 9UF

E-Mail: wtas-investorservices@waystone.com

Waystone Fund Services (UK) Limited is authorised and regulated by the Financial Conduct Authority.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.

Structure & regulation

The Fund is a sub-fund of WS Guinness Investment Funds, an investment company with variable capital incorporated with limited liability and registered by the Financial Conduct Authority.

This Fund is registered for distribution to the public in the UK but not in any other jurisdiction. In other countries or in circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.