Our Approach to Responsible Investment and ESG

DEFINING RESPONSIBLE INVESTMENT

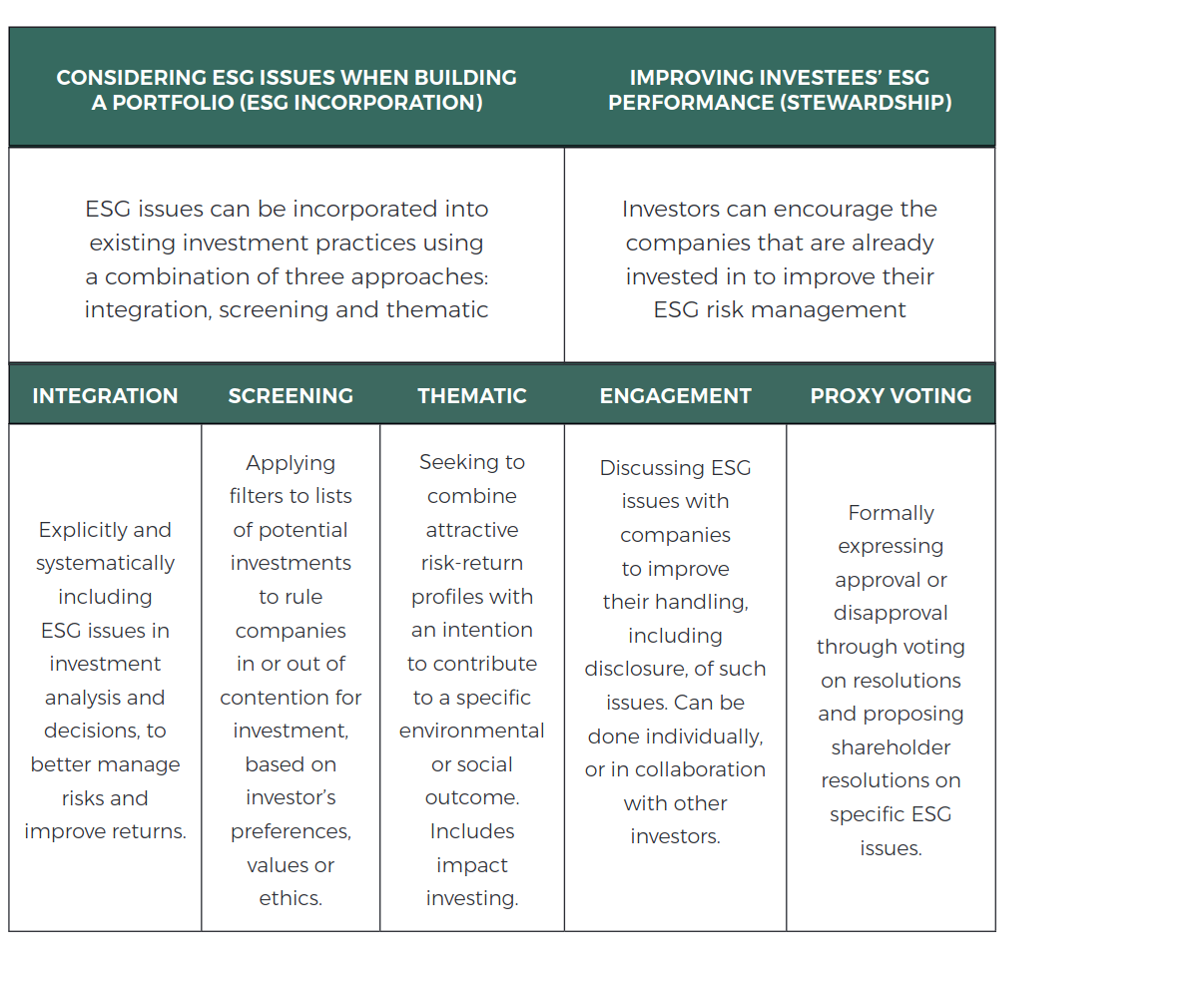

The UN PRI defines responsible investment (RI) as “a strategy and practice to incorporate environmental, social and governance (ESG) factors in investment decisions and active ownership”. There are several components to responsible investing, which the PRI summarises as follows:

DEFINING ESG

Fundamental data and rigorous research have always been the cornerstones of our investment process at Guinness Global Investors. Whilst Environmental, Social and Governance (ESG) factors have inherently been integral in our company analyses, the emergence and evolution of new data sources has allowed us to establish a more thorough framework and thus harness additional investment insights.

ESG refers to measuring and assessing the potential risk and opportunities from environmental, social and governance factors. Environmental criteria consider how a company performs as a steward of nature; Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates; and Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Environmental concerns are growing and forcing regulators to take notice and take action. One example of this is a textile manufacturer which was improperly discharging wastewater from its Vietnamese facilities. This led to factory closure, local protests and fines from regulators, leading to a significant drop in cash return on capital. These negative factors clearly affected the financial results of these (and other) firms.

Similarly, the social impact of a company’s behaviour is increasingly being felt on the bottom line. A building materials company sold defective drywall to US customers, leading to a lawsuit which the company eventually settled for $298m. This impacted the return on capital, which fell from 17% in 2018 to 3% in 2019.

We believe that a company following good governance practices should follow the corporate governance laws and listing requirements required of a typical company of its size, maturity, region, and industry. These corporate governance practices would cover management structures, disclosure, compensation, and compliance.

In assessing good governance, among other factors, we consider management structures, employee relations, staff remuneration, and tax compliance covering some or all of the following factors:

- Sound management structures

- Employee relations

- Remuneration of staff

- Tax compliance

For more on information on our approach to governance, please see our company Good Governance Policy, which can be found on our website.

In the asset management industry, interest in ESG has soared since the launch of the United Nations sponsored Principles for Responsible Investments (PRI) in 2006. As proud signatories of the United Nations PRI ourselves, we are committed to adopting and implementing responsible investment principles in a manner that is consistent with our fiduciary responsibilities to clients. We do this by integrating ESG analysis into our investment process and where relevant, engaging with investee companies on ESG issues.

ESG DEVELOPMENT IN ASIA

Adoption of ESG regulations in Asia has accelerated, and average levels of disclosure are now at the same level or exceeding that of the US. Asia is still some way behind Europe, which has the advantage of a single regulatory body in order to coordinate and champion ESG improvements. Investors are increasingly acting to drive higher standards, both from outside the region and via the increasing focus on ESG products from within the region.

Good progress has been achieved on corporate governance in Asia, with rules and disclosures for both developed and emerging market countries in the region approaching those seen in western markets. A combination of local company laws and exchange requirements dictate corporate behaviours in a variety of areas, including board structure and composition, management remuneration, related party transactions and treatment of shareholders. While specific rules vary from country to country, many best-practice principles have been shared across western and Asian markets.

Environmental regulations can be split into those that target carbon emission reduction and those that help manage climate-related risks. Some governments have already announced carbon reduction targets. Notably, Hong Kong, Japan, South Korea and Vietnam have all committed to net zero emissions by 2050. China, whilst also committed to achieving carbon neutrality, has targeted the year 2060. Other methods governments are implementing to promote carbon reduction is to create emissions trading schemes (ETS), much like the one created by the EU. Within the region, China, Japan, South Korea and New Zealand already have their own schemes, whilst countries in the ASEAN region (Indonesia, Thailand, Vietnam) are in the process of developing theirs.

With regards to managing climate- related risks, we have seen governments in large financial hubs push for financial institutions to help their clients improve their ESG performance. As one example, the Monetary Authority of Singapore (MAS) released a set of Guidelines on Environmental Risk Management to banks. The guidelines expect banks to incentivise customers to establish and achieve carbon reduction targets via incentives such as lower costs of borrowing. Conversely, if a bank’s customer refuses to manage its climate risk, the bank is allowed to raise loan pricing, or to withdraw from the customer relationship.

Social issues related to ESG in Asian markets are often different to those in more developed markets. Human capital management and labour rights are of particular interest, especially given the region’s dependence on highly labour- intensive industries. Another example is the distinct lack of policy disclosure from many Asian companies, in part driven by the fact that disclosure is largely still voluntary.

Regulation and guidance from governing bodies in Greater China (China, Hong Kong, Taiwan) around environmental and social policy disclosures are improving, but the road ahead is long. China introduced its first Guidance for ESG Disclosure Standard in June 2022 which covers a total of 118 ESG metrics. But companies are only required to disclose a subset of these metrics and are not strictly bound to the Guidance. In the same vein, Hong Kong has required listed companies to publish annual ESG reports, but while there are governance disclosure requirements, not all climate and social policy disclosures are mandatory. The Taiwan Stock Exchange (TWSE) introduced a new ESG reporting mandate in June 2022 which requires all companies listed on the exchange to disclose relevant ESG information annually. Whilst this is a good first step, the disclosed ESG information is not always complete or audited.

A similar landscape of voluntary reporting related to ESG disclosure can be seen in much of the rest of Asia. For example, in Korea, ESG disclosures will continue to be voluntary until 2025, at which point the Korea Exchange will start phasing in mandatory ESG reporting. The aim is for all companies to be undertaking mandatory ESG reporting by 2030. Meanwhile, Singapore already requires annual ESG reporting from listed companies but acknowledge that there are still improvements to be made, particularly when it comes to the depth of these ESG reports.

As we can see, ESG will continue to develop in the coming years as regulations and targets change and issues around reporting are addressed. With these changes, our methodology around ESG analysis will also continue to evolve.

ESG INCORPORATION

The first approach to ESG Incorporation, according to the UN PRI, is the integration of ESG factors. The PRI defines this as “explicitly and systematically including ESG issues in investment analysis and decisions, to better manage risks and improve returns.” As long-term investors seeking to identify good quality companies across our portfolios, we believe that ESG considerations play a direct role in managing company specific risks, and thus can have the potential to have a meaningful impact on long-term returns.

COMPANY AND INVESTMENT ANALYSIS

To understand how we integrate ESG into our investment process, it is first worth discussing how we approach company and investment analysis.

Any investment in a company begins with a thorough analysis of both financial information and non-financial information. Financial information consists of the income statement, balance sheet, cashflow statements and key performance indicators. We look at both current and historical data to build up a picture of how the financials have evolved over time and what they say about the current health of the business.

Non-financial information is wide- ranging but consists of information that is more qualitative in nature. Among the areas we look at, some of the key considerations are:

- The industry in which a company operates

- The company’s business model

- Source of competitive advantage

- The competitive environment

- Management’s role in operations and strategy

- The general macro and business environment, both on a global and country level

Understanding non-financial information improves our understanding of financial information and vice versa. For example, by understanding the source of a company’s competitive advantage, we can understand how a company has achieved persistently high returns on capital. We are also able to form a view on whether the conditions that have pertained in the past, which have helped the company earn above-average returns, are likely to persist into the future.

In the other direction, problems may show up in financial data before they become more widely apparent. For example, a reduction in margins could indicate greater pricing pressure, or a build-up in working capital could be due to mismanagement of inventory.

As well as analysing a company’s business activity, we will also analyse the potential drivers of shareholder return. This considers the extent to which returns are likely to come from the valuation re-rating, earnings growth and dividend income. We form a view on company valuations by looking at valuation multiples on an absolute basis and relative to history, peers and sector norms. We also look at a discounted cash flow valuations, taking the free cash flow generated by a company and discounting it back at an appropriate rate.

Good ESG behaviours from our companies (e.g., robust risk management and long-term planning, allocating capital wisely and integrating well with the communities in which they operate) are important components in defining future return on capital employed and their valuation.

Our ESG research is conducted by the investment analysts and portfolio managers working in the investment team, as part of the stock analysis and investment process. We do not ‘outsource’ this responsibility to an internal or external ESG team because we believe ESG issues need to be fully understood by those allocating capital.

We also believe – as active managers – that building our own methodology to assess ESG factors is better than relying solely on third-party scores or using an exclusionary criterion. We use external ESG research as a starting point for our own analysis. The data used in our ESG Integration methodology comes from a wide range of third parties (including MSCI and Bloomberg) and from individual company disclosure.

ESG INTEGRATION

ESG factors and considerations can affect many of the areas of our investment analysis above, depending on the specific element within E, S and G and the data that are associated with it.

Some areas are more easily translated into financial data, and we can incorporate these within our models. For example, given a company’s emissions figures, we can incorporate the effects of a carbon tax or increased carbon pricing on that company’s returns on capital. We can then compare these results with those for peer companies.

We are of course mindful of the potential issues with data, namely consistency, frequency and timeliness. Levels of disclosure and quality of self-reporting also vary. Data deficiencies mean that if we are to obtain detailed understanding, we are required to go beyond headline scores for ESG insights.

Other areas may be harder to quantify and lend themselves more to a qualitative appraisal. This type of ESG assessment dovetails with our non- financial analysis and can help to enhance our understanding of business risks (particularly any threats that might exist to a business model).

In all cases, we ask what can pose a material risk to the company’s financial results and to our results as shareholders: severe risks can impact both the numerator (free cash flow) in our valuation as well as the denominator (discount rate).

While we will consider owning a company that has poor ESG characteristics, if there are material risks relating to very poor governance or key areas of concern that lack disclosure, then we would be more likely to refrain from investing.

METHODOLOGY

As a starting point, we use third-party research to identify the key ESG risks and opportunities within each industry.

Once the key risks have been identified, we perform our own due diligence and analysis on each of the three ESG pillars. This is because we have found there are two main issues with relying on third party ESG research when investing in Asian companies.

First, third-party ESG ratings can contain errors. We have come across examples where a company has been poorly scored by a third-party provider on the grounds that there is no evidence of mitigation against certain risks. However, in these cases, after conducting our own due diligence, we have found clear evidence that management do a good job in addressing the risk.

Secondly, Asian companies are often penalised for poor or lack of disclosure on key risks. When assessing ESG factors, we are mindful of the differences in disclosure requirements between markets and we reflect this in our evaluations accordingly. We believe this tailored, individual company-based analysis is a superior way to assess the impact of ESG metrics compared to using a generic, one-size-fits-all framework. Lack of policy disclosure does not necessarily equate to a lack of policies in place – it may indicate the company is subject to poor disclosure requirements. Therefore, we have started a process of engaging with our portfolio holdings to understand their approach to the relevant risks where disclosure is lacking.

Within the environmental and social pillars, we consider the materiality of each risk in addition to how well management does to mitigate the risk. We use third-party reports to gain an initial understanding of the issues, but then conduct our own due diligence to form a conclusion. Our due diligence typically consists of analysing annual reports, sustainability (or similar) reports, press releases, proxy research and company presentations as well as broker research and media sources.

We look for proactive policies to address key risks. Ideally, we look for a quantitative target to be set as this can be measured. Failing this, more general policies to address risks are acceptable. Another way of assessing management’s mitigation policies is to search for evidence of controversial events, as these can imply management are failing to consider the risk.

We also analyse carbon data and labour management for all companies regardless of industry. When looking at carbon data, we:

- Consider the carbon output of the business – that is, carbon output per million dollars of sales. This takes into account the environmental impact of the business.

- Analyse the sensitivity of the return on capital to increasing costs of carbon. This takes into account the financial impact of higher carbon costs.

A company which is carbon intensive is likely to see a significant difference between its return on capital when carbon is priced at $200/tCO2e versus when priced at $25/tCO2e. This sensitivity analysis is carried out for each company relative to its broader industry and its direct competitors, to better understand the company’s exposure to carbon pricing. All else being equal, we would avoid a company with greater sensitivity to higher carbon prices, which if imposed by regulators could diminish returns.

EXAMPLE: EMISSIONS OUTPUT ANALYSIS

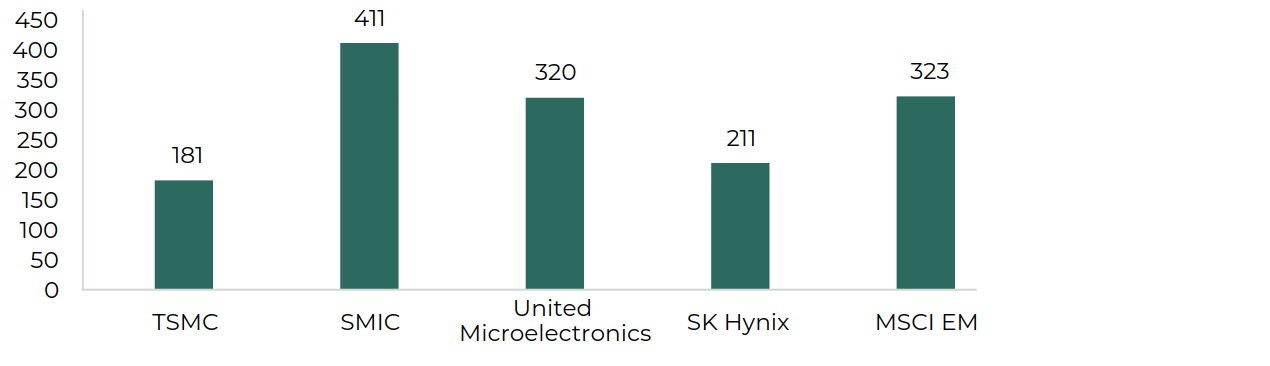

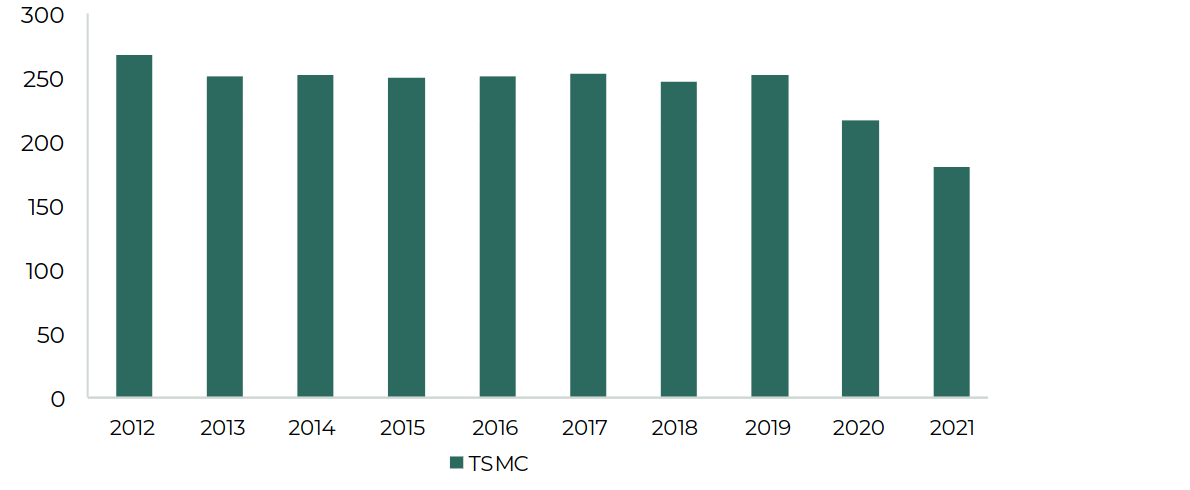

The two charts below demonstrate how we approach carbon output analysis for any given stock – in this case Taiwan Semiconductor Manufacturing Co (TSMC). Our first port of call is to compare TSMC’s Greenhouse Gas (GHG) Emissions/Sales metric against peers and relevant indices. As indicated below, TSMC outperforms both its peers, Semiconductor Manufacturing International Corporation (SMIC) and United Microelectronics, and the MSCI Emerging Markets Index.

GHG Emissions/ $m Sales (2021)

As mentioned earlier, we also consider the carbon-adjusted return on capital (ROC) of any stock within our portfolio. This is done by looking at the adjusted ROC of the company across five different prices. In TSMC’s case, a sharp increase in carbon prices to $200/tCO2e would only lead to an 8% ROC reduction, whilst the industry would see an 18% ROC decline.

We also consider any emissions-related targets that are reported. TSMC has raised its renewable energy target to 40% of its power consumption by 2030, up from 25% previously. For reference, energy consumption contributes over 60% of TSMC’s carbon emissions output. In March 2022, Nikkei Asia and others reported that TSMC has also disclosed that it will spend up to 2% of annual revenues (up to $1.13bn) on an ESG budget to help it achieve carbon neutrality by 2050. Given the company has reduced GHG emission intensity by more than 30% in the last decade, we believe that management will be able to achieve these targets.

GHG Emissions/ $m Sales

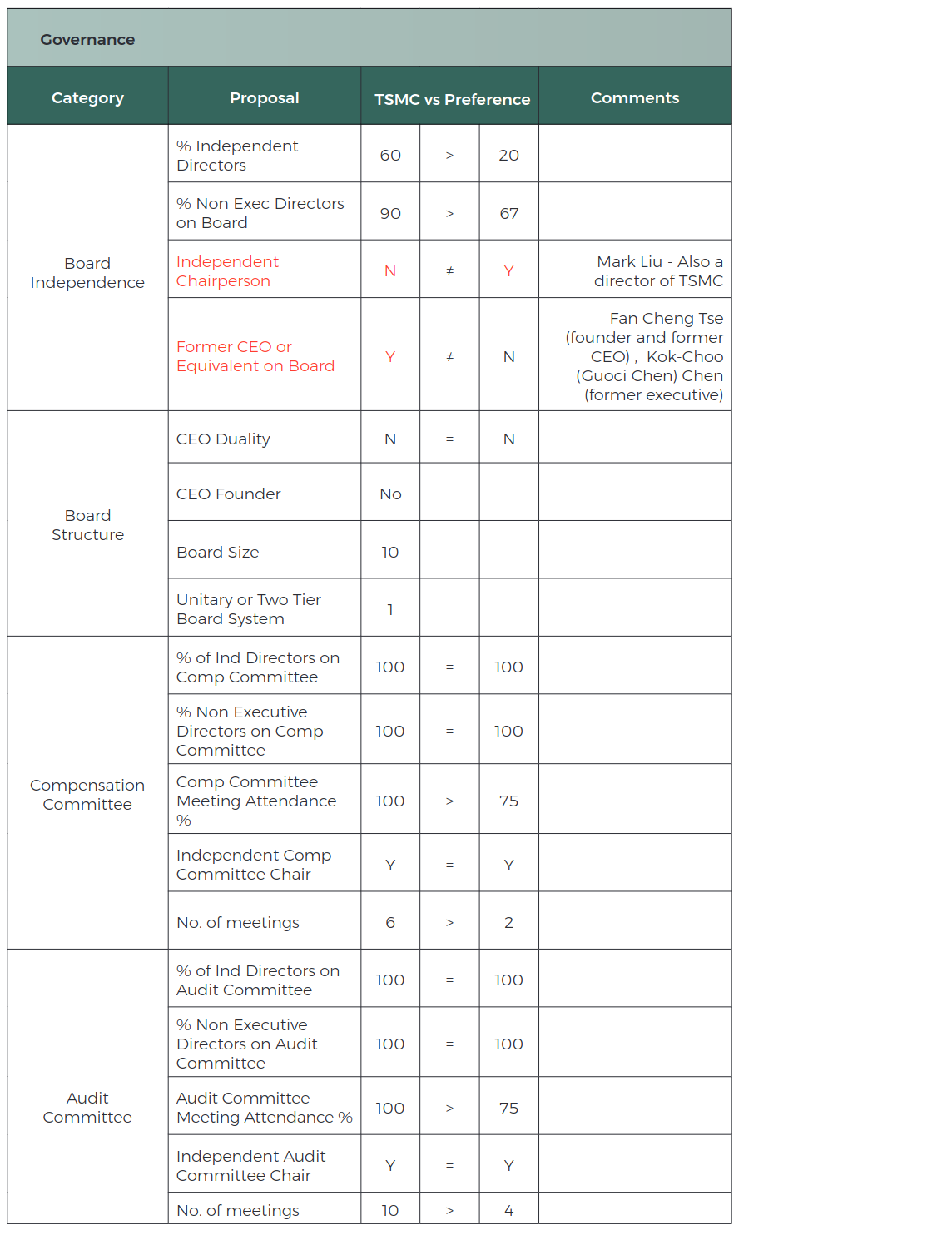

EXAMPLE: GOVERNANCE CHECKLIST

Below is a small section covering the board Independence section of our governance checklist, in this case for TSMC.

Through the comprehensive checklist for each company, we are able to identify areas of concern. Where required, we carry out further analysis to add context and identify which risks are material and which are not.

Proxy voting (typically carried out annually) provides us with an opportunity to reassess governance for our holdings, noting both shortfalls that may exist as well as improvements in particular areas. Voting gives us the opportunity to express our views, but we may also take the opportunity to engage directly with company management or their representatives. Often the proxy voting process involving all shareholders acts as an important ‘check and balance’ on the board and on management and can provide an impetus for change, particularly in respect of improved governance.

By reviewing and incorporating quantitative data in this way, we consider whether a company’s disclosure is improving or worsening, how well the company ranks versus its peers, and how each measure compares to the company’s history and its peer group.

Upon completing our own due diligence on each key risk and opportunity, we summarise and categorise the company’s behaviour towards each ESG pillar as either low, medium or high risk. We then collate all the information to give the company an overall score based on the same categories.

For existing investments, we will regularly monitor them for controversies that might arise in the course of business and investigate further those that have the potential to become severe. We will also be alert to controversies that may affect either peers or whole industries.

The analysis and monitoring of existing investments from an ESG perspective also assists us with keeping our understanding of the company up to date and informs our ongoing company analysis. This feeds into future portfolio management decisions.

Key to our assessment overall is seeing a positive direction of travel. We want company management to be engaging with the specific ESG issues facing their business and seeking to make improvements. We believe there is strong alignment between good corporate practice, strong financial results, and shareholder returns.

SCREENING

The second approach to ESG Incorporation, according to the UN PRI, is the application of screening. The PRI defines this as “applying filters to lists of potential investments to rule companies in or out of contention for investment, based on investor’s preferences, values or ethics.”

POSITIVE SCREENING

Our investment philosophy places emphasis on identifying high-quality companies. Our starting point in assembling the investment universe for each fund is to identify companies with high returns on capital – such companies have a track record of creating economic value. We also exclude highly leveraged businesses and those below a level of market capitalisation.

Intuitively, in seeking to invest in businesses with favourable ESG characteristics, filtering for quality businesses who have already demonstrated an ability to create above- average economic value, makes sense.

NEGATIVE SCREENING

We rule out some companies from the investment universes of our funds based on their activities. We have a company level Exclusions Policy (available on our website) which excludes companies involved in the manufacture of cluster munitions and anti- personnel mines, and companies which generate revenue from thermal coal.

CONTROVERSIAL WEAPONS

There are two major international conventions that specifically address cluster munitions and landmines:

• The Convention on Cluster Munitions (2008): This Convention restricts the manufacture, use, and stockpiling of cluster munitions and the components of these weapons.

• The Convention on the Prohibition of the Use, Stockpiling, Production and Transfer of Anti-Personnel Mines and on Their Destruction (1997): This Convention aims to eliminate anti- personnel landmines around the world.

Consistent with the aims of these two Conventions, The Fund excludes active investments in companies that have been identified, by credible third parties, as being directly involved in the design, manufacture or sale of such weapons.

THERMAL COAL

In addition to the exclusion of companies that extract coal, the Fund excludes companies with significant thermal coal generation activities. Specifically, the Fund excludes companies that generate more than 30% of revenues via thermal coal- based power generation.

In the event that a company already held in our portfolios is added to one of our exclusions lists or an excluded company is added to a portfolio in error, we will, following internal confirmation of the company’s involvement in the excluded activity, seek to divest of the holding within 90 business days.

A company-level Exclusion Policy is available at https://www.guinnessgi.com/about-us/responsible-investment#tab-literature.

STEWARDSHIP – PROXY VOTING

Guinness has a company level Proxy Voting Policy, which covers resolutions on ESG issues. Proxy voting for companies in the Asian and Emerging Markets funds are carried out by the portfolio managers of the funds.

Our proxy voting policy and a summary of proxy voting activity is available on our website https://www.guinnessgi.com/about-us/responsible-investment#tab-literature.

ASSOCIATIONS

We understand that participation in relevant industry initiatives is essential to the development of best practice in responsible investment. We participate in several initiatives in order to promote proper functioning of markets, improve our understanding in the area and contribute to the industry. These include the following:

The Investment Association (IA) has over 200 full members managing over £10 trillion in assets. As the trade body for the UK investment management industry, it seeks not only to represent the interests of that industry but also to improve the investment landscape for investors through initiatives which highlight certain topics – such as diversity and inclusion in the industry – and by improving standards and best practice. In addition to its membership of the Association, Guinness Global Investors participates in the Compliance Discussion Group, which provides an informal discussion to share issues, concerns, and solutions within the compliance function. The effect of our membership is to promote the good functioning of the investment market in the UK through these initiatives to the benefit of investors and the economy.

The UK Sustainable Investment and Finance Association (UKSIF) aims to support its members to grow sustainable and responsible finance in the UK. It also seeks to influence policymaking that promotes the growth of sustainable finance. Our membership constitutes part of a collective effort to promote sustainable finance in the UK. One member of our investment team is the Chair of the UKSIF analyst committee.

The Independent Investment Management Initiative (IIMI) aims to contribute to effective financial regulation and promote client-centred models of investment management. Our membership, among that of over 40 firms, aims to promote initiatives which improve the functioning of the investment management industry. Most recently, a call with the UN PRI allowed members to discuss concerns and recommendations for their reporting system, to contribute to a more effective reporting procedure for future reporting periods.

The Task Force on Climate-related Financial Disclosures (TCFD) seeks to improve the availability of information needed for climate-related risk management. By being a supporter, we are part of the effort to promote informed capital allocation.

Climate Action 100+ is a collaborative engagement programme through which Guinness Global Investors engages with Devon Energy, a $15bn US-listed oil & gas producer with operations mainly in the US. The collaborative nature creates a programme of concentrated engagement with focus companies, where the sum of the parts is significantly more effective than if each participant attempted to engage across the whole sector.

CFA UK’s mission is to build a better investment profession by serving the public interest by educating investment professionals, by promoting and enforcing ethical and professional standards and by explaining what is happening in the profession to regulators, policymakers, and the media. A member of staff at Guinness is part of the leadership team of the CFA UK Impact Investing Special Interest Group.

Octo Members is a private group for financial services professionals. The community showcases good people, writing and talking about what they do and how they do it. They debate hot topics and share good short, actionable thought leadership amongst peers. It is a pan sector approach to allow all to discuss that affect us from individual perspectives. This leads to exploring better business practices and client outcomes. Videos, podcasts, questions, answers, panel discussions all enable members to connect, share and engage.

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.

Environmental criteria consider how a company performs as a steward of nature;

Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates;

and Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

A combination of local company laws and exchange requirements dictate corporate behaviours in a variety of areas, including board structure and composition, management remuneration, related party transactions and treatment of shareholders.

While specific rules vary from country to country, many best-practice principles have been shared across western and Asian markets.