Guinness Sustainable Energy Fund

The Guinness Sustainable Energy strategy is managed for capital growth and invests in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, biofuels and biomass).

Overview

The Guinness Sustainable Energy strategy is managed for capital growth and invests in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, biofuels and biomass).

We believe that over the next twenty years the sustainable energy sector will benefit from the combined effects of:

- Demand growth - The electrification of transportation and improved energy storage economics brings attractive long-term sustainable energy demand growth

- Improving Economics - Sustainable energy sources have become cost competitive with power from fossil fuels; we expect the cost of supply to continue to fall

- Public & Private Support - Both governments and companies are pursuing sustainable energy in order to achieve mandated carbon targets or to improve public perception

- Low current exposure - Poor profitability and need for subsidies has kept the weight of sustainable energy in global indices and broad global equity funds at a low level

Sustainability Theme - The sustainable energy sector offers ‘green’ credentials that some investors are targeting to help facilitate global de-carbonisation and to reduce carbon intensity of their portfolios

Investment Team

High quality funds are run by high quality people.

We are proud of our collegial culture, with teams across the business benefiting from each other’s expertise as they target long-term returns for investors.

Awards & Ratings

We have a firm commitment to delivering the very best. That commitment is reflected in the awards we have received, some of which are shown below.

Guinness Sustainable Energy Fund

Responsible A

Square Mile Investment Consulting & Research Limited

Guinness Sustainable Energy Fund

5 Crowns - FE FundInfo

Guinness Sustainable Energy Fund

Best Fund over 10 Years - Equity Theme - Alternative Energy

Refinitiv Europe Lipper Fund Awards 2022

2025 Investor Conferences

As political winds change but the battle against inflation continues, join our fund managers for a series of professional investor conferences.

Register your interest now for a rewarding half-day of investment ideas and expert opinion at locations around the UK.

How to Invest

We aim to make it simple to invest in our funds. All our funds are open to direct investment via an application form. They are widely available on investment platforms and are eligible for UK investors’ ISAs and SIPPs.

Investment Case

The Guinness Sustainable Energy strategy is positioned to benefit from the many opportunities associated with the sustainable energy transition. We identify four sub-sectors and have assembled a proprietary investment universe of around 250 companies with critical mass that are most directly exposed to them:

- Displacement: displacement or more efficient usage of hydrocarbon-based energy

- Electrification: the switching of hydrocarbon-based fuel demand towards electricity, especially for electric vehicles

- Installation: the manufacture of equipment for the generation and consumption of sustainable energy

- Generation: the production of sustainable energy, either pureplay companies or those transitioning from hydrocarbon-based fuels

We do not limit ourselves to ‘pure plays’, opening our universe up to some companies with existing hydrocarbon-based fuel exposure, but this must be allied with a commitment to transitioning their business models towards sustainable energy sources.

We conduct rigorous independent analysis of the fundamental drivers of sustainable energy markets: energy commodity prices; sustainable energy technology research and development; installation and equipment prices; political and economic support for the sector; government and private sector demand. This allows us to form a top-down view, which in turn informs our industry energy sub-sector allocation.

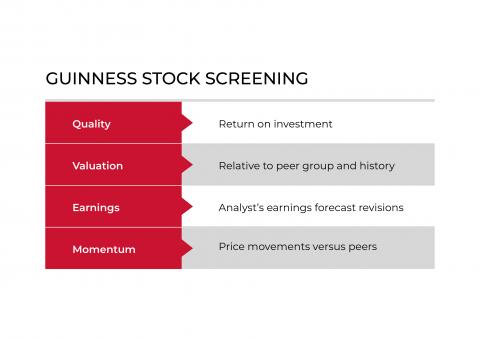

The team operates a disciplined stock screening process. We review our investment universe each week to identify companies which look attractive on return on investment, valuation, earnings sentiment and price momentum. We also use sub-sector specific screens. Ideas generated by screening are then subjected to due diligence centred around detailed financial modelling.

The portfolio comprises around 30 broadly equally weighted positions. This portfolio construction is designed to create a balance between maintaining fund concentration and managing stock-specific risk, and there is no reference to the benchmark. The portfolio is liquid, with 90% of the Fund normally invested in companies with a market capitalisation over US $500 million.

Why invest in the Guinness Sustainable Energy Fund?

Concentrated Exposure

The Guinness Sustainable Energy Fund aims to deliver investment returns via concentrated exposure to 33 sustainable energy companies with an equal-weight approach; available in a daily traded UCITS structure.

Specialist Team

The Guinness Energy Team has 20 years of experience of running energy investment strategies in a consistent manner and providing insight for investors into the energy markets.

Investment Process

The Fund is run using a Top Down and Bottom Up investment process based on an internally created Universe of 250 Sustainable Energy companies with detailed valuation models.

Valuation Opportunity

The fund selects the most attractive equities in the universe. The portfolio displays growth characteristics together with higher return on capital, lower valuation multiple and stronger balance sheets than the MSCI World Index.

Sustainability Theme

The strategy invests in companies playing a key role in global decarbonisation, providing a vehicle for investors to align their capital with this positive impact.

Investment process

We conduct rigorous independent analysis of the fundamental drivers of sustainable energy markets: energy commodity prices; sustainable energy technology research and development; installation and equipment prices; political and economic support for the sector; government and private sector demand. This allows us to analyse likely demand for sustainable energy equipment and services and creates our top-down view, which in turn informs our industry energy sub-sector allocation. Analysis of the key drivers of growth, scarcity, barriers to entry and economics informs our weighting to our internally generated Sustainable Energy subsectors.

Bottom-up stock screening

The team operates a disciplined stock screening process. We review a universe of around 179 sustainable energy stocks each week to identify companies which look attractive on their return on investment, valuation, earnings sentiment and price momentum. Other sub-sector specific screens are also employed to generate ideas.

Stock due diligence

Stock ideas are taken from our screens. We then conduct due diligence to establish whether we have conviction to include the stock in our portfolio. The due diligence centres around detailed financial modelling.

Portfolio construction

Equal-weight approach

The portfolio comprises around 30 broadly equally weighted positions. Our equal-weight portfolio construction approach is designed to create a balance between maintaining fund concentration and managing stock-specific risk. It also imposes a structural sell discipline: an existing position must be sold to purchase a new holding.

Sector weights

There is no benchmark adherence in the Fund’s sub-sector weights.

Portfolio Risk Controls

Stock specific risk

Stock specific risk in the sustainable energy sector tends to be higher than the broader market. By constructing the fund of 30 broadly equally weighted positions, we avoid significant exposure to any one individual stock.

Liquidity

The portfolio is liquid, with 90% of the Fund normally invested in companies with a market capitalisation over US $500 million.

Currency

The Fund is not hedged from a currency perspective.

Updates

KIIDS

| Fund | Class | ISIN | English | French | German | Spanish | Italian | Swedish | Finnish |

|---|---|---|---|---|---|---|---|---|---|

| Guinness Sustainable Energy Fund | C EUR Acc | IE00BGHQF417 | Download | ||||||

| Guinness Sustainable Energy Fund | C GBP Acc | IE00B3CCJ633 | Download | ||||||

| Guinness Sustainable Energy Fund | C USD Acc | IE00B2PGVK34 | Download | ||||||

| Guinness Sustainable Energy Fund | D EUR Acc | IE00B3CCJ740 | Download | ||||||

| Guinness Sustainable Energy Fund | D USD Acc | IE00B2PGVJ29 | Download | ||||||

| Guinness Sustainable Energy Fund | I USD Acc | IE00BMYPNB63 | Download | ||||||

| Guinness Sustainable Energy Fund | Y EUR Acc | IE00BFYV9M80 | Download | ||||||

| Guinness Sustainable Energy Fund | Y GBP Acc | IE00BFYV9L73 | Download | ||||||

| Guinness Sustainable Energy Fund | Y USD Acc | IE00BFYV9N97 | Download | ||||||

| Guinness Sustainable Energy Fund | C CNH Hedged Dist | IE000JUVS7B9 | Download |

KIDS

| Fund | Class | ISIN | English | French | German | Spanish | Italian | Swedish | Finnish |

|---|---|---|---|---|---|---|---|---|---|

| Guinness Sustainable Energy Fund | Y EUR Acc | IE00BFYV9M80 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Sustainable Energy Fund | C EUR Acc | IE00BGHQF417 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Sustainable Energy Fund | D EUR Acc | IE00B3CCJ740 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Sustainable Energy Fund | Y USD Acc | IE00BFYV9N97 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Sustainable Energy Fund | C CNH Hedged Dist | IE000JUVS7B9 | Download | Download | Download | Download | |||

| Guinness Sustainable Energy Fund | D USD Acc | IE00B2PGVJ29 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Sustainable Energy Fund | C USD Acc | IE00B2PGVK34 | Download | Download | Download | Download | Download | Download | |

| Guinness Sustainable Energy Fund | C GBP Acc | IE00B3CCJ633 | Download | Download | Download | Download | Download | Download | |

| Guinness Sustainable Energy Fund | Y GBP Acc | IE00BFYV9L73 | Download | Download | Download | Download | |||

| Guinness Sustainable Energy Fund | I USD Acc | IE00BMYPNB63 | Download | Download | Download | Download |

Documents

Fund Facts

For information on the Fund’s current investments, please see the latestfact sheet available on the literature tab above.

The Guinness Sustainable Energy strategy is also available to UK investors as a UK-domiciled vehicle denominated in GBP: the WS Guinness Sustainable Energy.

Will Riley (28/02/2019)

Share Classes

For full information on the share classes available for investment please refer to the Key Investor Information document.

Fund Prices

The Funds are priced every working day at 23.00 Dublin time and updated here the following day.

| Fund name | Isin | Fund price | (+/-) | Date |

|---|---|---|---|---|

| GUINNESS CHINA RMB INCOME FUND CLASS Y CNH DIST | IE000026G6J3 | 98.8976 | 0.0189 | 02/07/2025 |

| GUINNESS CHINA RMB INCOME FUND CLASS Y EUR DIST | IE000K4N4BW3 | 8.6542 | 0.0072 | 02/07/2025 |

| GUINNESS CHINA RMB INCOME FUND CLASS Y GBP DIST | IE000G9JHZF4 | 8.4369 | 0.0752 | 02/07/2025 |

| GUINNESS CHINA RMB INCOME FUND CLASS Y USD DIST | IE000FIQDRV0 | 9.6242 | -0.0011 | 02/07/2025 |

| GUINNESS CHINA RMB INCOME FUND CLASS F EUR DISTRIBUTION | IE0006534FS5 | 8.6829 | 0.0072 | 02/07/2025 |

| GUINNESS CHINA RMB INCOME FUND CLASS F GBP DISTRIBUTION | IE000K9NODM9 | 8.4696 | 0.0757 | 02/07/2025 |

| GUINNESS CHINA RMB INCOME FUND CLASS F USD DISTRIBUTION | IE000BEWEDQ4 | 9.6594 | -0.001 | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS C GBP ACC | IE0006BWJJW3 | 6.6072 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS C EUR ACC | IE0001VD9PN1 | 6.7732 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS C USD ACC | IE0005HP3H50 | 7.5411 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS I USD ACC | IE000IQ9D569 | 7.7356 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS Y GBP ACC | IE000I0OL207 | 6.7776 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS Y EUR ACC | IE000RSR0322 | 6.9479 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS Y CNH ACC | IE0002QAMMW4 | 79.4235 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS Y USD ACC | IE000JCEKTR0 | 7.7356 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS F GBP ACCUMULATION | IE0003ZZUKD7 | 6.863 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS F EUR ACCUMULATION | IE0001MJJCX1 | 7.0292 | #N/A | 02/07/2025 |

| GUINNESS CHINA A SHARE FUND CLASS F USD ACCUMULATION | IE000RSN6JG6 | 7.8332 | #N/A | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS D USD DISTRIBUTION | IE00B3QG6N78 | 24.4307 | 0.0024 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS C USD DISTRIBUTION | IE00B42XCP33 | 22.75 | 0.0019 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS C GBP DISTRIBUTION | IE00B3PB1722 | 26.2196 | 0.2391 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS D EUR DISTRIBUTION | IE00B66B5L40 | 27.9189 | 0.0287 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Z GBP DISTRIBUTION | IE00B754QH41 | 31.4443 | 0.2878 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS C EUR ACCUMULATION | IE00BGHQF631 | 28.2946 | 0.0288 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS C GBP ACCUMULATION | IE00BVYPNV92 | 25.9198 | 0.2364 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS C USD ACCUMULATION | IE00BVYPNW00 | 23.5772 | 0.0019 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Y EUR ACCUMULATION | IE00BVYPNZ31 | 23.521 | 0.0245 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Y EUR DISTRIBUTION | IE00BVYPP024 | 18.0274 | 0.0188 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Y GBP ACCUMULATION | IE00BVYPNY24 | 28.7338 | 0.2629 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Y GBP DISTRIBUTION | IE00BVYPP131 | 22.0626 | 0.2018 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Y USD ACCUMULATION | IE00BVYPNX17 | 26.1388 | 0.0029 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Y USD DISTRIBUTION | IE00BVYPP248 | 20.0163 | 0.0022 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS C EUR DISTRIBUTION | IE00BDGV0183 | 16.8863 | 0.0172 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS D EUR ACCUMULATION | IE00BDGV0290 | 21.6909 | 0.0223 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS I USD DISTRIBUTION | IE00BGK8P991 | 17.8062 | 0.0019 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS I USD ACCUMULATION | IE00BJBK7883 | 17.5958 | 0.0018 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS C CNH HEDGED DISTR | IE000OP91FK6 | 12.1744 | -0.0002 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Z GBP ACCUMULATION | IE000P7D8CD0 | 10.9862 | 0.1006 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Z EUR DISTRIBUTION | IE00051OJYP3 | 10.6806 | 0.0112 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Z EUR ACCUMULATION | IE000RSQ6GD6 | 10.9568 | 0.0115 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Z USD DISTRIBUTION | IE000YRPM569 | 11.7716 | 0.0013 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Z USD ACCUMULATION | IE0001B1ARB7 | 12.0792 | 0.0014 | 02/07/2025 |

| GUINNESS GLOBAL EQUITY INCOME FUND CLASS Z USD NON-RPT ACC | IE0008RSJOC5 | 10.459 | 0.0012 | 02/07/2025 |

| GUINNESS GLOBAL MONEY MANAGERS FUND CLASS C USD ACCUMULATION | IE00B3QW5Z07 | 29.8128 | 0.2472 | 02/07/2025 |

| GUINNESS GLOBAL MONEY MANAGERS FUND CLASS C GBP ACCUMULATION | IE00B64PRP62 | 34.4565 | 0.5947 | 02/07/2025 |

| GUINNESS GLOBAL MONEY MANAGERS FUND CLASS Y EUR ACCUMULATION | IE00B68GW162 | 37.8896 | 0.3507 | 02/07/2025 |

| GUINNESS GLOBAL MONEY MANAGERS FUND CLASS Y USD ACCUMULATION | IE00B3NSFR34 | 34.0798 | 0.2839 | 02/07/2025 |

| GUINNESS GLOBAL MONEY MANAGERS FUND CLASS Y GBP ACCUMULATION | IE00B7MJHM43 | 42.6093 | 0.7368 | 02/07/2025 |

| GUINNESS GLOBAL MONEY MANAGERS FUND CLASS C EUR ACCUMULATION | IE00BGHQF748 | 22.3145 | 0.2057 | 02/07/2025 |

| GUINNESS GLOBAL MONEY MANAGERS FUND CLASS I USD ACCUMULATION | IE00BMYPMW02 | 17.0479 | 0.1419 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS C EUR ACCUMULATION | IE00BGHQDW50 | 22.4756 | 0.0159 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS F GBP DISTRIBUTION | IE00BGHQF300 | 19.3283 | 0.1713 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS C GBP ACCUMULATION | IE00BVYPNS63 | 22.4874 | 0.1983 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS C USD ACCUMULATION | IE00BVYPNT70 | 20.4909 | -0.0046 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS Y GBP ACCUMULATION | IE00BYVHVZ98 | 17.3755 | 0.1537 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS Y GBP DISTRIBUTION | IE00BYVHWJ06 | 13.6547 | 0.1208 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS Y EUR ACCUMULATION | IE00BYVHW019 | 17.8483 | 0.0131 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS Y EUR DISTRIBUTION | IE00BYVHW126 | 14.0239 | 0.0104 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS Y USD ACCUMULATION | IE00BYVHW233 | 17.129 | -0.0034 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS Y USD DISTRIBUTION | IE00BYVHW340 | 13.4155 | -0.0026 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS I USD ACCUMULATION | IE00BMYPN382 | 16.2155 | -0.0032 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS I USD DISTRIBUTION | IE00BMYPN499 | 13.9008 | -0.0027 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS C EUR DISTRIBUTION | IE000AHX6WT2 | 11.0661 | 0.0078 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS C GBP DISTRIBUTION | IE000N9K9CQ4 | 11.2711 | 0.0993 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS C USD DISTRIBUTION | IE000RAMYLN7 | 10.9751 | -0.0025 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS F GBP ACCUMULATION | IE000YNWUZY0 | 11.5566 | 0.1024 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS F EUR ACCUMULATION | IE000A0PQ631 | 11.5394 | 0.0087 | 02/07/2025 |

| GUINNESS EUROPEAN EQUITY INCOME FUND CLASS F EUR DISTRIBUTION | IE000IUDXQX3 | 10.9429 | 0.0083 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS C EUR ACCUMULATION | IE00BGHQDM52 | 24.3344 | 0.1971 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Z GBP DISTRIBUTION | IE00BGHQDV44 | 18.2791 | 0.2958 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS C GBP ACCUMULATION | IE00BVYPNP33 | 20.7029 | 0.3342 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS C USD ACCUMULATION | IE00BVYPNQ40 | 18.829 | 0.1351 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Y EUR ACCUMULATION | IE00BDHSRG22 | 16.3589 | 0.133 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Y EUR DISTRIBUTION | IE00BDHSRH39 | 11.7471 | 0.0954 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Y GBP ACCUMULATION | IE00BDHSRD90 | 16.7636 | 0.2712 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Y GBP DISTRIBUTION | IE00BDHSRF15 | 12.0592 | 0.1951 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Y USD ACCUMULATION | IE00BDHSRJ52 | 17.6195 | 0.1268 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Y USD DISTRIBUTION | IE00BDHSRK67 | 12.6443 | 0.0911 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS I USD ACCUMULATION | IE00BMYPN051 | 14.0105 | 0.101 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS I USD DISTRIBUTION | IE00BMYPN168 | 11.5851 | 0.0836 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Z GBP ACCUMULATION | IE000658NZ19 | 12.3408 | 0.1998 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Z EUR DISTRIBUTION | IE000KN6J1X6 | 11.676 | 0.0948 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Z EUR ACCUMULATION | IE000UNWB7K2 | 12.3047 | 0.1001 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Z USD DISTRIBUTION | IE0007D42DP3 | 12.8445 | 0.0926 | 02/07/2025 |

| GUINNESS ASIAN EQUITY INCOME FUND CLASS Z USD ACCUMULATION | IE000D23O9K2 | 13.5852 | 0.098 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS C GBP ACCUMULATION | IE00BQXX3C00 | 35.4478 | 0.4973 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS C EUR ACCUMULATION | IE00BQXX3D17 | 32.0678 | 0.1913 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS C USD ACCUMULATION | IE00BQXX3F31 | 30.1197 | 0.1517 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS Y GBP ACCUMULATION | IE00BQXX3K83 | 39.5596 | 0.5561 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS Y EUR ACCUMULATION | IE00BQXX3L90 | 35.7488 | 0.2142 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS Y USD ACCUMULATION | IE00BQXX3M08 | 33.7043 | 0.1706 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS Z GBP ACCUMULATION | IE00BQXX3N15 | 40.4437 | 0.5688 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS Z EUR ACCUMULATION | IE00BQXX3P39 | 36.572 | 0.2193 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS Z USD ACCUMULATION | IE00BQXX3Q46 | 34.3637 | 0.1742 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS I USD ACCUMULATION | IE00BMYPNG19 | 16.1937 | 0.082 | 02/07/2025 |

| GUINNESS GLOBAL INNOVATORS FUND CLASS C CNH HEDGED DISTR | IE000PGA9O74 | 16.4254 | 0.0811 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS C EUR ACCUMULATION | IE00BZ08YS42 | 12.3253 | 0.0722 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS C GBP ACCUMULATION | IE00BZ08YR35 | 14.7132 | 0.2049 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS C USD ACCUMULATION | IE00BZ08YT58 | 13.2997 | 0.0656 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS Y EUR ACCUMULATION | IE00BZ08YW87 | 13.4675 | 0.0793 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS Y GBP ACCUMULATION | IE00BZ08YV70 | 16.0597 | 0.2242 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS Y USD ACCUMULATION | IE00BZ08YX94 | 14.4816 | 0.0718 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS F GBP ACCUMULATION | IE00BZ08YY02 | 16.7918 | 0.2346 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS I USD ACCUMULATION | IE00BMYPNC70 | 8.7033 | 0.0431 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS F EUR ACCUMULATION | IE000PL4LIL5 | 11.542 | 0.07 | 02/07/2025 |

| GUINNESS GREATER CHINA FUND CLASS F USD ACCUMULATION | IE000KYOJNN5 | 12.754 | 0.063 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS C USD ACCUMULATION | IE00BYV24P56 | 18.2916 | 0.1039 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS Y GBP ACCUMULATION | IE00BYV24Q63 | 17.967 | 0.2641 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS Y GBP DISTRIBUTION | IE00BYV24R70 | 13.2541 | 0.1948 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS Y EUR ACCUMULATION | IE00BYV24S87 | 17.6975 | 0.1174 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS Y EUR DISTRIBUTION | IE00BYV24T94 | 13.0401 | 0.0866 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS Y USD ACCUMULATION | IE00BYV24V17 | 19.928 | 0.1138 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS Y USD DISTRIBUTION | IE00BYV24W24 | 14.6741 | 0.0838 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS F GBP DISTRIBUTION | IE00BYV24X31 | 13.8364 | 0.2036 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS C EUR ACCUMULATION | IE00BMCWC346 | 13.5575 | 0.0895 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS C GBP ACCUMULATION | IE00BMCWC239 | 12.938 | 0.1898 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS I USD ACCUMULATION | IE00BMYPND87 | 13.7928 | 0.0787 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS I USD DISTRIBUTION | IE00BMYPNF02 | 11.4997 | 0.0656 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS C EUR DISTRIBUTION | IE0009746VI0 | 10.4931 | 0.0692 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS C GBP DISTRIBUTION | IE000UPHOYQ6 | 10.6862 | 0.1569 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS C USD DISTRIBUTION | IE000XFJTUO9 | 10.4165 | 0.0591 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS F GBP ACCUMULATION | IE000S23Y5E4 | 11.972 | 0.176 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS F EUR ACCUMULATION | IE000PRGIAG7 | 11.966 | 0.08 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS F EUR DISTRIBUTION | IE000EYWH6W0 | 11.3304 | 0.0765 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS F USD ACCUMULATION | IE000STEY2E9 | 13.212 | 0.076 | 02/07/2025 |

| GUINNESS EMERGING MARKETS EQUITY INCOME FUND CLASS F USD DISTRIBUTION | IE0002MGLE49 | 12.4956 | 0.0726 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS C GBP ACCUMULATION | IE00BF2VFX37 | 11.7287 | 0.1606 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS Y GBP ACCUMULATION | IE00BF2VFY44 | 12.6875 | 0.1742 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS Y EUR ACCUMULATION | IE00BF2VFZ50 | 13.0104 | 0.0738 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS Y USD ACCUMULATION | IE00BF2VG076 | 12.8375 | 0.0609 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS F GBP ACCUMULATION | IE00BF2VG183 | 13.0394 | 0.1792 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS I USD ACCUMULATION | IE00BMYPN275 | 11.1473 | 0.0528 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS C EUR ACCUMULATION | IE000IYIWG07 | 9.6696 | 0.0544 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS C USD ACCUMULATION | IE0004NN3YY8 | 9.6224 | 0.0453 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS F EUR ACCUMULATION | IE000IPJNIR0 | 11.812 | 0.068 | 02/07/2025 |

| GUINNESS BEST OF ASIA FUND CLASS F USD ACCUMULATION | IE0006E14U67 | 13.0571 | 0.0619 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS C GBP ACCUMULATION | IE00BG5QQP10 | 14.9063 | 0.1563 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS C EUR ACCUMULATION | IE00BG5QQQ27 | 15.5201 | 0.0364 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS C EUR HEDGED ACC | IE00BG5QQR34 | 12.4818 | 0.1278 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS C USD ACCUMULATION | IE00BG5QQS41 | 15.9746 | 0.0233 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS C USD HEDGED ACC | IE00BG5QRJ25 | 13.764 | 0.1428 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS O GBP ACCUMULATION | IE00BG5QRK30 | 15.8143 | 0.1662 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS O EUR ACCUMULATION | IE00BG5QRL47 | 16.4725 | 0.0391 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS O EUR HEDGED ACC | IE00BG5QRM53 | 13.2048 | 0.1356 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS O USD ACCUMULATION | IE00BG5QRN60 | 16.9483 | 0.0252 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS O USD HEDGED ACC | IE00BG5QRP84 | 14.5034 | 0.1508 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS R GBP ACCUMULATION | IE00BG5QRQ91 | 14.7147 | 0.1542 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS R EUR ACCUMULATION | IE00BG5QRR09 | 15.3333 | 0.0359 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS R EUR HEDGED ACC | IE00BG5QRS16 | 12.3236 | 0.1259 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS R USD ACCUMULATION | IE00BG5QRT23 | 15.7569 | 0.0229 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS R USD HEDGED ACC | IE00BG5QRV45 | 13.6058 | 0.1411 | 02/07/2025 |

| GUINNESS MULTI-ASSET GROWTH FUND CLASS Y GBP ACCUMULATION | IE00BG5QRW51 | 16.1045 | 0.1694 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS C GBP ACCUMULATION | IE00BG5QQV79 | 13.8396 | 0.1369 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS C EUR ACCUMULATION | IE00BG5QQW86 | 14.4101 | 0.0251 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS C EUR HEDGED ACC | IE00BG5QQX93 | 11.6964 | 0.1128 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS C USD ACCUMULATION | IE00BG5QQY01 | 14.8312 | 0.0127 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS C USD HEDGED ACC | IE00BG5QQZ18 | 12.8526 | 0.1257 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS O GBP ACCUMULATION | IE00BG5QR034 | 14.6832 | 0.1456 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS O EUR ACCUMULATION | IE00BG5QR141 | 15.2925 | 0.0272 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS O EUR HEDGED ACC | IE00BG5QR257 | 12.386 | 0.1198 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS O USD ACCUMULATION | IE00BG5QR364 | 15.7343 | 0.0139 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS O USD HEDGED ACC | IE00BG5QR471 | 13.6098 | 0.1335 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS R GBP ACCUMULATION | IE00BG5QR588 | 13.6588 | 0.135 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS R EUR ACCUMULATION | IE00BG5QR695 | 14.2271 | 0.0248 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS R EUR HEDGED ACC | IE00BG5QR703 | 11.5618 | 0.1108 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS R USD ACCUMULATION | IE00BG5QR810 | 14.627 | 0.0125 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS R USD HEDGED ACC | IE00BG5QR927 | 12.7585 | 0.1249 | 02/07/2025 |

| GUINNESS MULTI-ASSET BALANCED FUND CLASS Y GBP ACCUMULATION | IE00BG5QRB49 | 14.947 | 0.1483 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS F USD ACCUMULATION | IE00BN0W3529 | 11.8475 | 0.052 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS F GBP ACCUMULATION | IE00BN0W3305 | 11.6855 | 0.1565 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS F EUR ACCUMULATION | IE00BN0W3412 | 12.2538 | 0.0653 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS I GBP ACCUMULATION | IE00BN0W2X30 | 11.4557 | 0.1534 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS I EUR ACCUMULATION | IE00BN0W2Y47 | 12.0013 | 0.0638 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS I USD ACCUMULATION | IE00BN0W2Z53 | 11.6148 | 0.0509 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS Y GBP ACCUMULATION | IE00BN0W3073 | 11.4553 | 0.1533 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS Y EUR ACCUMULATION | IE00BN0W3180 | 12.0016 | 0.0637 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS Y USD ACCUMULATION | IE00BN0W3297 | 11.6191 | 0.0508 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS C GBP ACCUMULATION | IE00BN0W2T93 | 10.8996 | 0.1455 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS C EUR ACCUMULATION | IE00BN0W2V16 | 11.4194 | 0.0603 | 02/07/2025 |

| GUINNESS GLOBAL QUALITY MID CAP FUND CLASS C USD ACCUMULATION | IE00BN0W2W23 | 11.058 | 0.0481 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS C EUR ACC | IE000QE5CYY9 | 9.9128 | 0.0022 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS C EUR DIST | IE0004BNHDF9 | 9.6713 | 0.0026 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS C GBP ACC | IE000MDEL2K5 | 10.3638 | 0.0869 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS C GBP DIST | IE000ZUMIYN4 | 10.1132 | 0.0848 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS C USD ACC | IE0002QUHW33 | 11.1887 | -0.0074 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS C USD DIST | IE000616PPY9 | 10.9179 | -0.0073 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS F EUR ACC | IE000U1HO3Y6 | 9.9716 | 0.0031 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS F EUR DIST | IE00011MGKP6 | 9.7313 | 0.0031 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS F GBP ACC | IE0006HJR2U0 | 10.4269 | 0.0878 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS F GBP DIST | IE000OF3L0L0 | 10.175 | 0.0857 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS I USD ACC | IE000IL9H7B6 | 11.2341 | -0.0072 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS I USD DIST | IE000CCV9AJ8 | 10.9626 | -0.007 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS Y EUR ACC | IE000GYHWEK5 | 9.9493 | 0.0029 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS Y EUR DIST | IE000XCBZKS2 | 9.709 | 0.0028 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS Y GBP ACC | IE000C6KDI61 | 10.4061 | 0.0875 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS Y GBP DIST | IE000CQOX716 | 10.1551 | 0.0854 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS Y USD ACC | IE00028D2911 | 11.2341 | -0.0072 | 02/07/2025 |

| GUINNESS PAN-EUROPEAN EQUITY INCOME FUND CLASS Y USD DIST | IE000H8KD8J4 | 10.9626 | -0.007 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS D USD ACCUMULATION | IE00B2PGVJ29 | 5.0172 | 0.0771 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS C USD ACCUMULATION | IE00B2PGVK34 | 4.5953 | 0.0705 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS C GBP ACCUMULATION | IE00B3CCJ633 | 7.8043 | 0.1893 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS D EUR ACCUMULATION | IE00B3CCJ740 | 7.9726 | 0.1299 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS C EUR ACCUMULATION | IE00BGHQF417 | 15.8321 | 0.2576 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS Y GBP ACCUMULATION | IE00BFYV9L73 | 20.6745 | 0.5021 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS Y EUR ACCUMULATION | IE00BFYV9M80 | 21.1644 | 0.3451 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS Y USD ACCUMULATION | IE00BFYV9N97 | 20.0167 | 0.308 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS I USD ACCUMULATION | IE00BMYPNB63 | 10.5855 | 0.1629 | 02/07/2025 |

| GUINNESS SUSTAINABLE ENERGY FUND CLASS C CNH HEDGED DISTR | IE000JUVS7B9 | 8.9898 | 0.1373 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS D USD ACCUMULATION | IE00B2Q91T05 | 9.4818 | 0.1515 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS C USD ACCUMULATION | IE00B2Q91V27 | 8.8014 | 0.1405 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS C GBP ACCUMULATION | IE00B3CCJ963 | 11.9192 | 0.2963 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS D EUR ACCUMULATION | IE00B3CCJB88 | 12.1745 | 0.2057 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS Y USD ACCUMULATION | IE00B3CCJC95 | 10.382 | 0.166 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS Y GBP ACCUMULATION | IE00B6XV0016 | 11.8759 | 0.2956 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS C EUR ACCUMULATION | IE00BGHQF524 | 9.4415 | 0.1594 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS Y USD DISTRIBUTION | IE00BG6L7638 | 7.2415 | 0.1158 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS Y EUR ACCUMULATION | IE00BFMGVR44 | 11.1496 | 0.1886 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS I USD ACCUMULATION | IE00BMYPN507 | 20.4509 | 0.327 | 02/07/2025 |

| GUINNESS GLOBAL ENERGY FUND CLASS C CNH HEDGED DISTR | IE000P8HSFB7 | 9.8983 | 0.1571 | 02/07/2025 |

| WS GUINNESS UK EQUITY INCOME FUND O OVERSEAS ACCUMULATION | GB00BYX94F49 | 100.47 | -0.18 | 03/07/2025 |

| WS GUINNESS UK EQUITY INCOME FUND O OVERSEAS INCOME | GB00BYX94G55 | 71.96 | -0.14 | 03/07/2025 |

| WS GUINNESS UK EQUITY INCOME FUND Y CLEAN ACCUMULATION | GB00BYX94H62 | 109.6 | -0.2 | 03/07/2025 |

| WS GUINNESS UK EQUITY INCOME FUND Y CLEAN INCOME | GB00BYX94J86 | 78.94 | -0.14 | 03/07/2025 |

| WS GUINNESS UK EQUITY INCOME FUND Z EARLY INVESTOR ACCUMULATION | GB00BYX94K91 | 111.41 | -0.2 | 03/07/2025 |

| WS GUINNESS UK EQUITY INCOME FUND Z EARLY INVESTOR INCOME | GB00BYX94L09 | 80.11 | -0.14 | 03/07/2025 |

| WS GUINNESS GLOBAL EQUITY INCOME FUND Y ACCUMULATION GBP | GB00BNGFN776 | 170.32 | 0.87 | 03/07/2025 |

| WS GUINNESS GLOBAL EQUITY INCOME FUND Y INCOME GBP | GB00BNGFN669 | 152.55 | 0.78 | 03/07/2025 |

| WS GUINNESS ASIAN EQUITY INCOME FUND Y ACCUMULATION GBP | GB00BMFKG667 | 126.72 | 0.8 | 03/07/2025 |

| WS GUINNESS ASIAN EQUITY INCOME FUND Y INCOME GBP | GB00BMFKG774 | 105.49 | 0.67 | 03/07/2025 |

| WS GUINNESS EUROPEAN EQUITY INCOME FUND Y ACCUMULATION GBP | GB00BP5J6M04 | 138.53 | 0.93 | 03/07/2025 |

| WS GUINNESS EUROPEAN EQUITY INCOME FUND Y INCOME GBP | GB00BP5J6N11 | 127.11 | 0.84 | 03/07/2025 |

| WS GUINNESS EUROPEAN EQUITY INCOME FUND F ACCUMULATION GBP | GB00BP5J6P35 | 140.42 | 0.94 | 03/07/2025 |

| WS GUINNESS EUROPEAN EQUITY INCOME FUND F INCOME GBP | GB00BP5J6Q42 | 129.05 | 0.86 | 03/07/2025 |

| WS GUINNESS GLOBAL INNOVATORS FUND Y ACCUMULATION GBP | GB00BP5J5Y50 | 164.89 | 1.14 | 03/07/2025 |

| WS GUINNESS SUSTAINABLE ENERGY FUND Y ACCUMULATION GBP | GB00BP5J6198 | 88.93 | 1.41 | 03/07/2025 |

| WS GUINNESS SUSTAINABLE ENERGY FUND Z ACCUMULATION GBP | GB00BP5J6206 | 89.31 | 1.41 | 03/07/2025 |

| WS GUINNESS GLOBAL QUALITY MID CAP FUND F ACCUMULATION GBP | GB00BP5J7D87 | 107.32 | 1.19 | 03/07/2025 |

| WS GUINNESS GLOBAL QUALITY MID CAP FUND Y ACCUMULATION GBP | GB00BP5J7C70 | 105.9 | 1.18 | 03/07/2025 |

| WS GUINNESS GLOBAL EQUITY INCOME FUND Z ACCUMULATION GBP | GB00BLGT0N04 | 106.2 | 0.54 | 03/07/2025 |

| WS GUINNESS GLOBAL EQUITY INCOME FUND Z INCOME GBP | GB00BLGT0P28 | 103.97 | 0.54 | 03/07/2025 |

| WS GUINNESS ASIAN EQUITY INCOME FUND Z ACCUMULATION GBP | GB00BLGT0Q35 | 116.74 | 0.74 | 03/07/2025 |

| WS GUINNESS ASIAN EQUITY INCOME FUND Z INCOME GBP | GB00BLGT0R42 | 112.71 | 0.71 | 03/07/2025 |

| WS GUINNESS GLOBAL INNOVATORS FUND Z ACCUMULATION GBP | GB00BLGT0S58 | 104.53 | 0.72 | 03/07/2025 |

| WS GUINNESS GLOBAL ENERGY FUND I ACCUMULATION | GB00B56FW078 | 46.63 | 0.74 | 03/07/2025 |

Trustnet - The Article 9 funds topping their sectors over 5 years

Citywire - A winning dirty-green approach to the energy transition

Citywire - Energy imbalance: Guinness on clean power’s ‘rough 18 months’

Guinness Sustainable Energy Fund - Webcast - Covering Q1 2024

Portfolio Adviser - Guinness: The road ahead for electric vehicles

Sustainable Energy - Looking ahead for 2024

Guinness Sustainable Energy Fund - Webcast - Covering Q4 2023

Impact Report 2023

Morningstar - The UK’s Greenest Funds

PROPELLED BY DEMAND

FUN FACT

Q: Who has a bigger brain, Dolphins or Humans?

A: Dolphins.

PROPELLED BY DEMAND

FUN FACT

Q: How fast can a dolphin swim without a propellor?

A: Short-beaked common dolphins can swim up to 60km/h.

How to Invest

We’ve tried to make investing in our Funds as simple as possible. All of our funds are available to invest directly via an application form, we also have good availability across a number of investment supermarkets whilst being eligible for ISAs & SIPPs.

Guinness Sustainable Energy Fund is an equity fund. Investors should be willing and able to assume the risks of equity investing. The Fund invests only in companies involved in the sustainable energy sector; it is therefore susceptible to the performance of that one sector, and can be volatile. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement, you may not get back the amount originally invested. For full information on the risks, please refer to the Prospectus, Supplement, and KID/KIID for the Fund, which are available on our website (guinnessgi.com/literature). If you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund. Past performance does not predict future returns.

Simulated past performance: Performance prior to the launch date of the Y class of the Fund (16.02.2018) is a composite simulation for Y class performance being based on the actual performance of the Fund's E class which has an OCF of 0.74%. Source: FE fundinfo. Net of fees. Investors should note that fees and expenses are charged to the capital of the Fund. This reduces the return on your investment by an amount equivalent to the Ongoing Charges Figure (OCF). The current OCF for the share class used for the fund performance returns is 0.66%. Returns for share classes with a different OCF will vary accordingly. Transaction costs also apply and are incurred when a fund buys or sells holdings. The performance returns do not reflect any initial charge; any such charge will also reduce the return.