Sustainable Energy - November Commentary

This is a marketing communication. Please refer to the prospectus, supplement and KID/KIID for the Funds before making any final investment decisions. The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

Past performance does not predict future returns.

Data Centres and US Electricity Demand

After two decades of stagnation, US electricity demand is rising again. The primary driver of load growth is the rapid build-out of AI data centres, underpinned by record capital expenditure from the US hyperscalers. At the same time, the reshoring of manufacturing and broader electrification are causing power demand to grow at its fastest rate since the 1990s. To meet this demand, the US must build generation capacity rapidly and at scale, and at the same time overcome emerging supply constraints such as long-interconnection queues, ageing grids, and increasing complexity as intermittent renewables displace baseload capacity. In this note, we examine the impact of the AI build-out on US power demand and comment on the likely constraints on growth.

Hyperscaler capex and US power demand

Power demand in the US is reaching an inflection. Over the previous two decades, energy consumption has remained broadly flat, with growth of around 0.4% per year, as energy-intensive industries have been offshored, and efficiency gains have tempered growth. Over the same period, the energy intensity of GDP has fallen by more than a third. This dynamic is set to change, driven primarily by the build-out of AI data centres, but also by the reshoring of manufacturing and broad electrification of the economy:

- AI data centres: AI data centres operate continuously and consume power at far higher densities than conventional facilities. The IEA estimates that AI queries can use 10-40 times more electricity per than traditional search functions. Data centres are also getting larger and more complex as hyperscalers consolidate workloads to capture scale efficiencies.

- Reshoring: according to Wood Mackenzie, investment in new US manufacturing facilities has risen 184% since 2020, led by sectors such as semiconductors, batteries, and advanced materials. The CHIPS Act and the Inflation Reduction Act have catalysed hundreds of billions of dollars in private investment, with over $500 billion in announced projects since 2021.

- Broad electrification: the electrification of transport, buildings and industry as the economy moves away from fossil fuels.

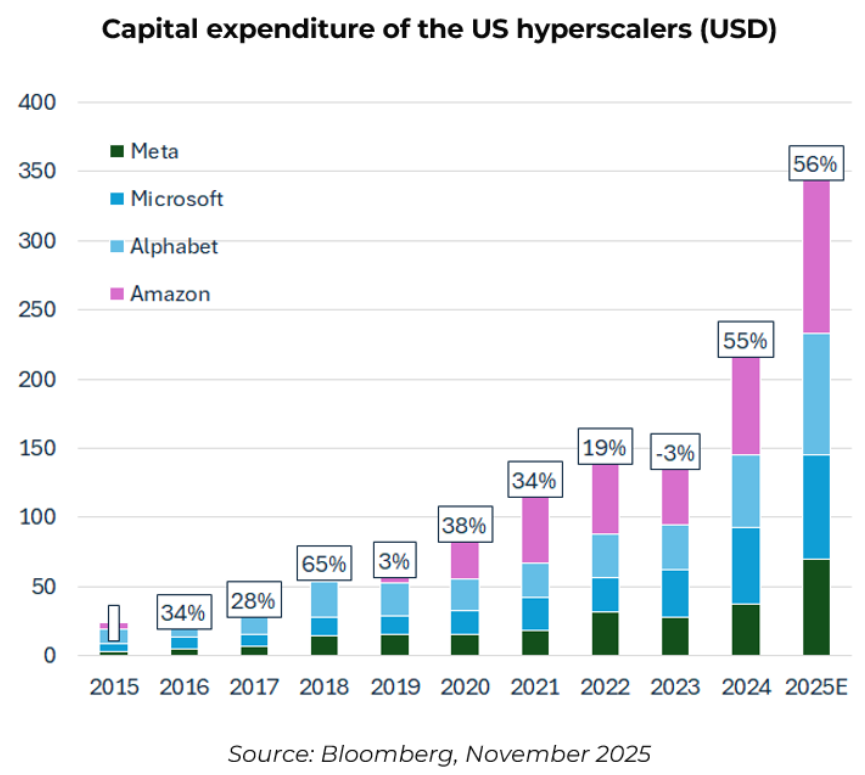

In the short term, Morgan Stanley expect AI data centres to contribute to around 50% of incremental power demand. In 2025 alone, the largest hyperscalers, Meta, Microsoft, Alphabet, and Amazon, are expected to make c.$350 billion in capital expenditure to build out their AI capabilities, and all have said that they plan to spend more next year.

Source: Bloomberg, Guinness Global Investors estimates; 30 September 2025

The impact of AI data centres on US power demand

Estimates for the increase in power demand from AI data centres are particularly difficult to forecast and, as such, vary considerably. They are difficult to predict because both the efficiency of computing hardware and the scale of AI workloads are changing rapidly: each new generation of chips uses less energy per operation, but model sizes and usage are growing much faster, making future electricity needs highly uncertain.

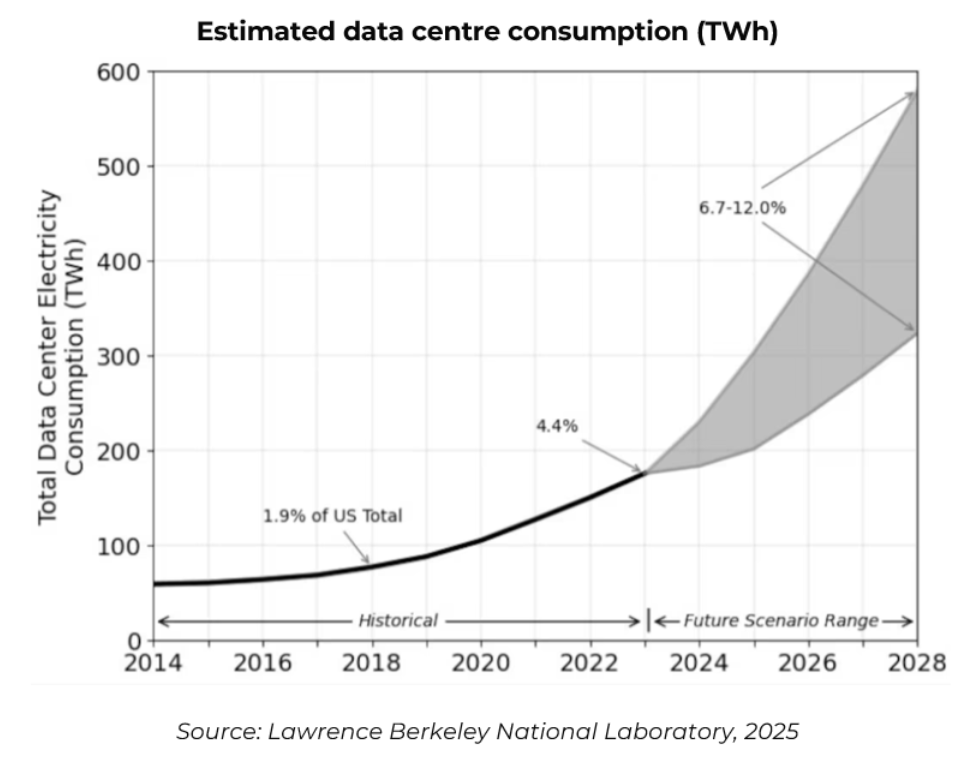

Estimating existing data centre demand is similarly difficult, though the IEA puts its electricity consumption at around 180-200TWh in 2024, accounting for roughly 4% of total US demand.

Given this uncertainty, we see a range of forecasts:

- The IEA projects that data centre electricity consumption will grow by c.12-15% per year, increasing by approximately 240 TWh to reach c.420 TWh in total by 2030.

- The Lawrence Berkeley National Laboratory (LBNL) forecasts demand growing by 8-12% per year to reach between 325–580 TWh annually and account for 7–12% of total electricity demand by 2028.

- More bullish still, consultancies and sell-side analysts expect US data centre consumption to at least double by 2030, adding an additional 325–600 TWh of demand to the grid.

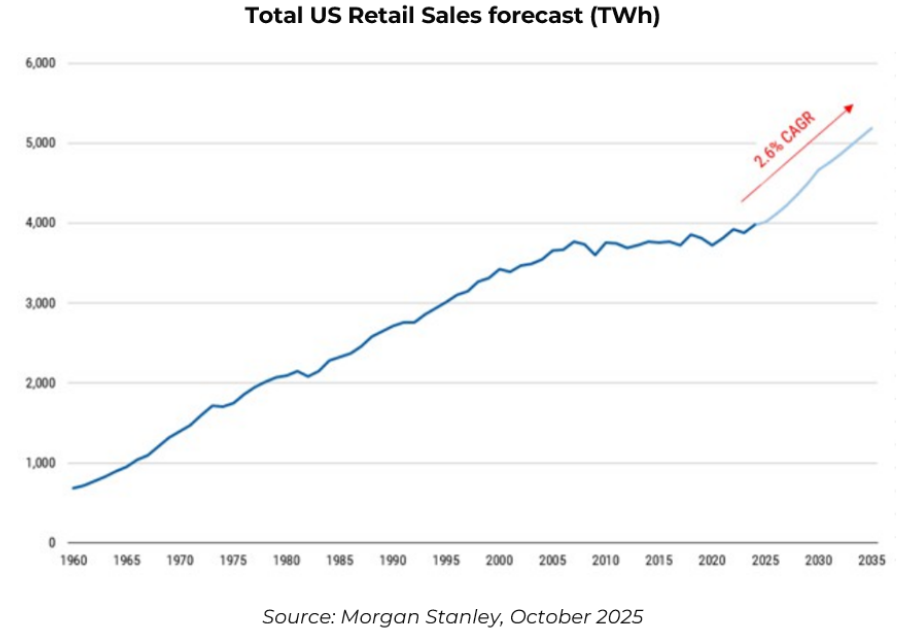

While forecasting exact demand figures is challenging, the direction of travel is clear. Assuming data centre demand grows by around 12% per annum, rising from c.180 TWh in 2024 to about 400 TWh by 2030, the US would need to add c.40 TWh of incremental generation capacity each year. That equates to about a 1% annual increase in total electricity output before factoring in additional demand from reshoring and broader electrification. Morgan Stanley estimate that in combination, AI, reshoring and electrification are likely to add c.900TWh of incremental demand by 2035, taking total US consumption above 5,000TWh. This would imply load growth of 2.6% per annum, requiring c.90TWh of incremental generation a year.

How can the US meet this demand?

Meeting this surge in demand will require new generation capacity after years of under-investment. The US grid currently supplies c.4,300 TWh of electricity each year, meaning that supply will have to grow at c.2% pa., to add 90TWh of incremental demand to 2030.

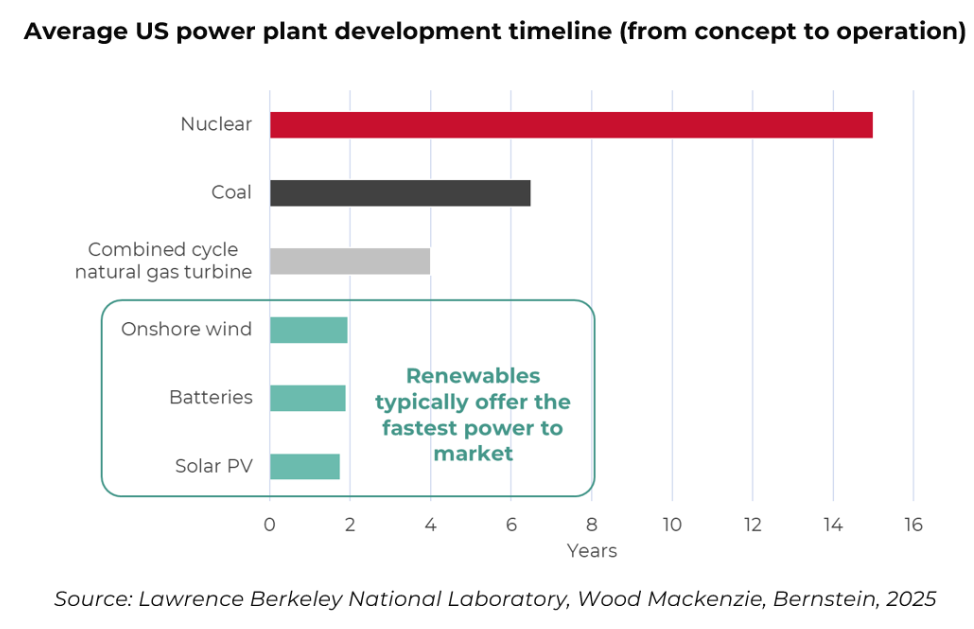

NextEra, a portfolio holding and an operator of both fossil-fuel and low-carbon assets, outlines a scenario of rapid renewable build-out, supported by long-term capacity additions from natural gas and eventually, nuclear. Underpinning this roadmap is the scale and speed of projected demand growth and the need for cost-efficient technologies that can be deployed rapidly at scale. NextEra argues that the advantage of renewable technologies lies in their speed to market, flexibility, and cost advantages:

- Renewables and storage: existing and well-developed supply chains support rapid development, as does the availability of battery equipment. Storage projects can also be built on existing sites and connected to existing grids, and at the same time, battery costs have fallen sharply as the technology has matured and scaled.

- Natural gas: longer lead times, cost inflation, and underdeveloped supply chains mean that new or unplanned natural gas projects cannot meet all of the near-term demand, and in the long term, natural gas is a more expensive solution. However, given the rise of intermittent renewables, natural gas will play an important role in providing baseload generation.

- Nuclear: after decades of underinvestment, supply chains need to be rebuilt, and technology developed before nuclear can contribute meaningfully to the generation mix. Plans to restart retired nuclear reactors are not expected to add generation until closer to 2030. If they come online as planned, they will be able to add c.15TWh of generation per year. However, timelines remain uncertain, with potential risks around regulatory approvals, financing, and construction delays.

Given these characteristics, NextEra see “firmed” generation (intermittent renewables backed by storage) as having the lowest levelized cost of generation in 2030. The company reports an estimated cost of $25-$50/MWh for new onshore wind (including storage) and $35-$75/MWh for new solar (including storage). This is considerably cheaper than new combined cycle natural gas at $85-$115/MWh and a small modular reactor (in 2035) at $130-$150/MWh.

This reality is playing out. As of the end of July 2025, 93% of new capacity has been renewables, with 83% being solar and storage. The economics and scalability mean that renewables, in combination with storage, are the cheapest and fastest way to meet incremental demand.

The interconnection queue is a genuine constraint

Although utility-scale renewables are the best placed to meet electricity demand, the US is finding it increasingly difficult bring new generation online. Supply has become constrained by an outdated interconnect process, permitting delays, and supply chain constraints.

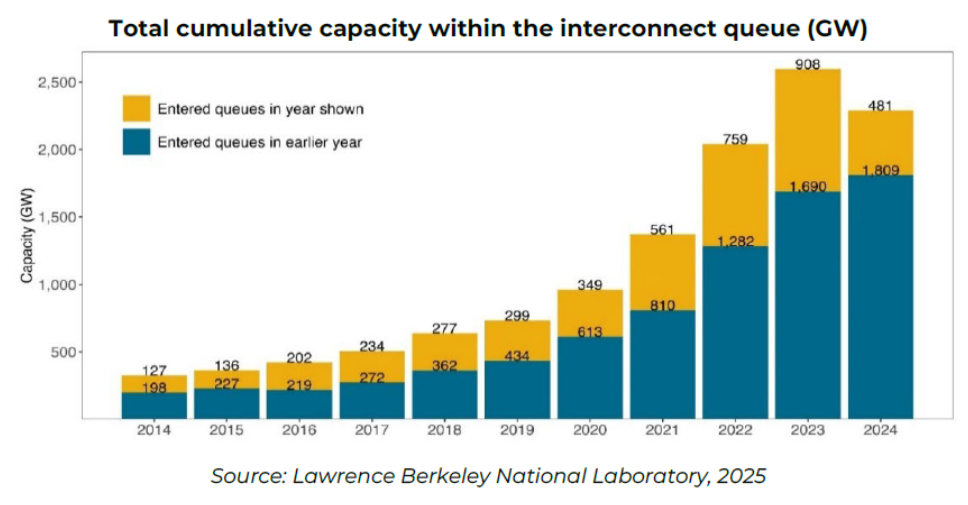

Official interconnection queues suggest that the US can meet incremental demand effectively, and quickly. As of 2024, some 2.2 TW of projects await connection. Around 42% of this pipeline is solar, 39% battery storage, 9% wind, and only 6% natural gas. If realised in full, it would represent a profound reshaping of the generation mix towards renewables and storage. However, in reality, much of this interconnection won’t translate into real projects as developers have flooded the queue to try and reserve place on the grid. At the same time, it doesn’t take into account actual grid constraints like the availability of power equipment and turbines.

In practice, however, the queue has become the central bottleneck. Developers report interconnection waits of four to ten years, with some markets, such as Northern Virginia, facing a minimum seven-year delay.

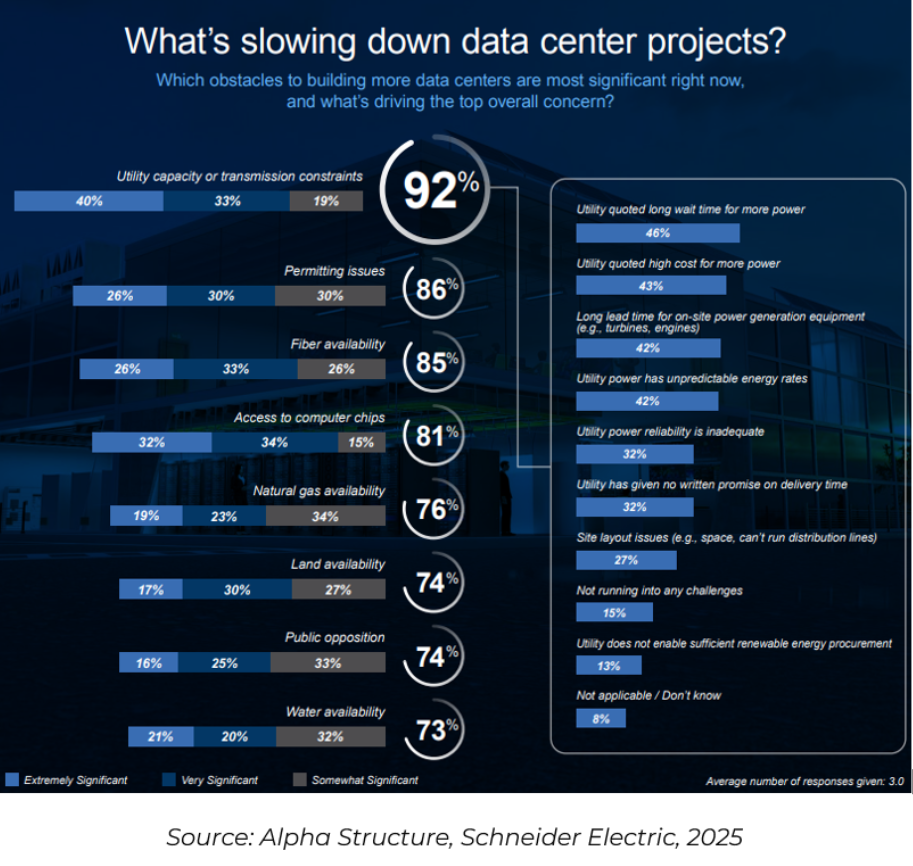

Given these factors, ‘time-to-power’ is likely the single largest constraint to the data centre build out in the US, as reflected in a recent survey conducted by Schneider Electric. In the survey, respondents ranked utility interconnection delays and power availability well ahead of factors such as financing or equipment supply. Nearly half reported wait times of four years or longer to secure grid connections, and many cited a lack of available high-voltage capacity in prime data-centre regions like Northern Virginia, Dallas and Silicon Valley.

To achieve these efficiency gains and integrate battery technologies, significant investment is needed to upgrade an already ageing grid. Morgan Stanley estimate that annual US transmission and distribution spending will need to double by 2030, from roughly $30–35 billion today to $60–70 billion per year, simply to connect planned generation and maintain reliability. This current grid was designed for a flat or declining load, and without major expansion, the 2TW of capacity within the interconnection queue is at risk of becoming stranded.

Beyond expansion, the system also needs substantial reinforcement and modernisation. William Blair estimates that more than $250 billion of upgrades will be required this decade to strengthen ageing infrastructure, integrate storage, and support rising variability from renewables. In total, $400–500 billion of cumulative grid investment through 2035 may be needed to maintain reliability and enable electrification and data centre growth. Encouragingly, policy momentum is building: the US Department of Energy’s Grid Deployment Office has begun allocating over $20 billion in grants and loan guarantees, the Federal Energy Regulatory Commission has finalised new long-term transmission-planning rules, and utilities such as NextEra, Exelon and PPL have already raised their grid capex guidance in response.

Conclusion

The build-out of US data centres is advancing rapidly and is backed by substantial, long-term investment from the country’s leading hyperscalers. In combination with the reshoring of manufacturing and broader electrification, the US will see its electricity demand grow at around 2.6% over the next decade. To enable growth on this scale, the US must accelerate investment into transmission and distribution infrastructure, address persistent interconnection bottlenecks, and take a pragmatic view of which generation sources can meet near-term needs.

To read the full report, click the link below.

The information provided on this page is for informational purposes only. While we believe it to be reliable, it may be inaccurate or incomplete. Any opinions stated are honestly held at the time of publication, but are not guaranteed and should therefore not be relied upon. This content should not be relied upon as financial advice or a recommendation to invest in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale. Full details on Ongoing Charges Figures (OCFs) for all share classes are available here.

The Guinness Sustainable Energy Funds invest in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, biofuels and biomass). We believe that over the next twenty years the sustainable energy sector will benefit from the combined effects of strong demand growth, improving economics and both public and private support and that this will provide attractive equity investment opportunities. The Funds are actively managed and use the MSCI World Index as a comparator benchmark only.

For the avoidance of doubt, if you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund

Guinness Sustainable Energy Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID), Key Information Document (KID) and the Application Form, is available in English from www.guinnessgi.com or free of charge from the Manager: Waystone Management Company (IE) Limited, 2nd Floor 35 Shelbourne Road, Ballsbridge, Dublin DO4 A4E0, Ireland; or the Promoter and Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ.

Waystone IE is a company incorporated under the laws of Ireland having its registered office at 35 Shelbourne Rd, Ballsbridge, Dublin, D04 A4E0 Ireland, which is authorised by the Central Bank of Ireland, has appointed Guinness Asset Management Ltd as Investment Manager to this fund, and as Manager has the right to terminate the arrangements made for the marketing of funds in accordance with the UCITS Directive.

Investor Rights

A summary of investor rights in English, including collective redress mechanisms, is available here: https://www.waystone.com/waystone-policies/

Residency

In countries where the Funds are not registered for sale or in any other circumstances where their distribution is not authorised or is unlawful, the Funds should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & Regulation

The Funds are sub-funds of Guinness Asset Management Funds PLC, an open-ended umbrella-type investment company, incorporated in Ireland and authorised and supervised by the Central Bank of Ireland, which operates under EU legislation. The Funds have been approved by the Financial Conduct Authority for sale in the UK. If you are in any doubt about the suitability of investing in these Funds, please consult your investment or other professional adviser.

Switzerland

This is an advertising document. The prospectus and KID for Switzerland, the articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative in Switzerland, Reyl & Cie SA, Ru du Rhône 4, 1204 Geneva. The paying agent is Banque Cantonale de Genève, 17 Quai de l'Ile, 1204 Geneva.

WS Guinness Sustainable Energy Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID) and the Application Form, is available in English from www.waystone.com/our-funds/waystone-fund-services-uk-limited/ or free of charge from Waystone Management (UK) Limited, PO Box 389, Darlington DL1 9UF.

General enquiries: 0345 922 0044

E-Mail: wtas-investorservices@waystone.com

Waystone Management (UK) Limited is authorised and regulated by the Financial Conduct Authority.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.

Structure & regulation

The Fund is a sub-fund of WS Guinness Investment Funds, an investment company with variable capital incorporated with limited liability and registered by the Financial Conduct Authority.

Guinness Sustainable Energy UCITS ETF

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID), Key Information Document (KID) and the Application Form, is available in English from www.guinnessgi.com, www.hanetf.com or free of charge from the Administrator: J.P Morgan Administration Services (Ireland) Limited, 200 Capital Dock, 79 Sir John Rogerson’s Quay, Dublin 2 DO2 F985; or the Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & regulation

The Fund is a sub-fund of HANetf ICAV, an Irish collective asset management vehicle umbrella fund with segregated liability between sub-funds which is registered in Ireland by the Central Bank of and authorised under the UCITS Regulations.