Sustainable Energy - February Commentary

This is a marketing communication. Please refer to the prospectus, supplement and KID/KIID for the Funds before making any final investment decisions. The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

Past performance does not predict future returns.

With record global installations and a number of material developments across the major wind markets in recent weeks, we take this opportunity to review the global wind industry in 2025 and comment on the outlook for 2026 and beyond. With Europe and China reaffirming their commitment to developing the industry, we remain confident that wind’s attractive relative economics will continue to drive further adoption.

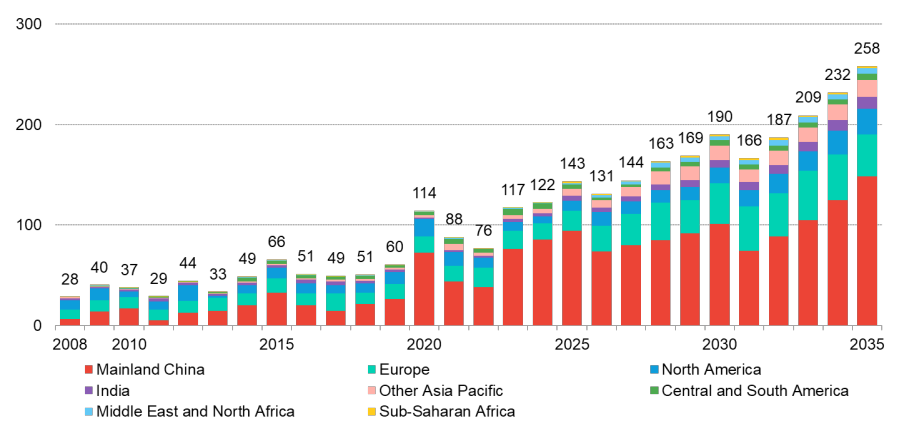

2025 in review: Global installations reached record levels, led by China

The global wind market looks to have grown around 17% in 2025, with installations reaching an all-time high of 143 GW. This was led by a reacceleration of onshore wind installations, with an anticipated record 130 GW of capacity added, representing 18% annual growth.

Global wind: annual installations GW

Source: BNEF, February 2025

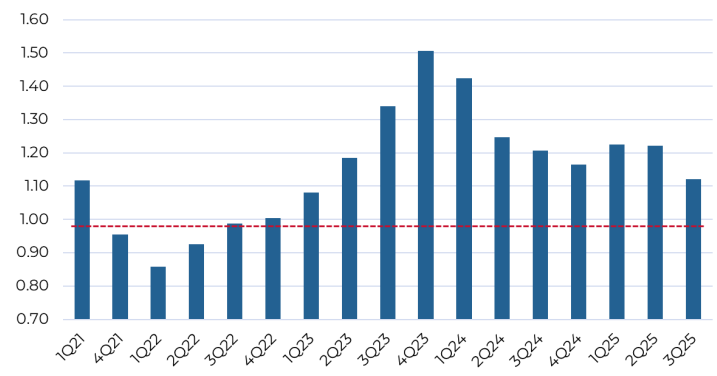

Similar to the last ten years, mainland China was the largest market in 2025, with installations of around 85 GW. Elsewhere, India continues to see strong growth and is likely to surpass 5 GW of annual installed capacity for the first time. However, 2025 is also expected to have been a record year for Europe, the Middle East, and Africa with 17 GW of capacity added, due to a rebound in key markets such as Germany, Sweden and France. Consistent book-to-bill ratios over 1x in Europe suggest that the outlook for demand in this market will remain strong over the coming years. In the Americas, onshore installations are expected to grow 11% year-over-year, with a rebound in the US offsetting weakness in Latin America. Encouragingly, growth looks to be increasingly demand-driven rather than subsidy-driven, with corporate power purchase agreements (PPAs), data centre expansion and electrification producing structural support across Europe, the US and parts of the Asia Pacific.

Trailing 12-month Book to Bill for European Wind Turbine OEMs

Source: Guinness Global Investors, Bloomberg, February 2026

Offshore wind installations continued to expand in 2025, anchored by strong activity in Europe and sustained large-scale deployment in China. The sector has faced headwinds in recent years, with higher interest rates, cost inflation and supply chain disruptions putting pressure on project economics. However, with some of these headwinds easing, capacity additions are likely to have surpassed 13 GW in 2025. China was the largest market for offshore wind in 2025, with additions of 9.6 GW, supported by domestic supply chains and supportive financing policies. Elsewhere, the US offshore wind industry has come under pressure from the Trump administration, and the outlook for the sector looks to be more challenging in the short term.

Developments in the wind market and the outlook for 2026

While 2025 marked a year of record installations and increasingly diversified growth, we move into 2026 with some questions around the Chinese market, following recent power market reforms. That said, numerous recent announcements and policy developments point to continued positive momentum in most markets, particularly Europe. Here, we review the most material developments.

The UK Department for Energy Security and Net Zero announced a record offshore wind auction

Despite being the world’s second-largest offshore wind market, the UK has faced challenges in recent years, with cost inflation and higher interest rates contributing to a decline in capacity awarded in the 2023 auction round. Against this backdrop, it was encouraging to see the UK government’s latest Contracts for Difference (CfD) auction award over 8.4 GW of offshore wind capacity, comprising 8.2 GW of bottom-fixed projects and two floating offshore wind projects totalling approximately 0.2 GW. The auction set a new record for offshore volumes and materially exceeded market expectations of 4–5 GW.

The strong auction outcome was supported in October by a doubling of the annual budget for UK offshore wind CfDs from £0.9bn to £1.8bn. The increased financial support enabled the government to raise strike prices to around £90/MWh, a level sufficient to support viable bidding following recent inflationary pressures and higher interest rates, while remaining below the threshold Aurora Energy Research believes would raise UK electricity prices. The improved funding also enabled contracts to be offered for 20-year terms, compared with 15 years in earlier rounds.

Encouragingly, around 1.7 GW of awarded capacity is expected to come online in 2028–29, implying near-term construction activity and earlier-than-expected turbine ordering. On the back of these results, the UK is on track to have approximately 36 GW of offshore wind capacity operational within the next four years, broadly aligning with its 2030 targets and reinforcing its position as the world’s second-largest offshore wind market.

Europe reaffirmed its long-term commitment to offshore wind with a multilateral target

In January, a collection of ten European countries signed the Hamburg Declaration, committing to the development of 100 GW of cross-border offshore wind capacity in the North Sea by 2050. The agreement builds on the earlier Esbjerg and Ostend declarations and sits within a broader ambition to reach 300 GW of offshore wind capacity over the same period.

The Hamburg Declaration is notable for its emphasis on cross-border collaboration, shifting away form a model where offshore wind is planned and delivered on a country-by-country basis. Under the agreement, the proposed capacity is intended to deliver power across borders, with the aim of improving security of supply and reducing overall system costs. Once fully deployed, the projects are estimated to provide sufficient electricity to power nearly 150 million households. For European wind developers, the Declaration signals a sustained and coordinated pipeline of large-scale projects, providing visibility that should support investment into the sector.

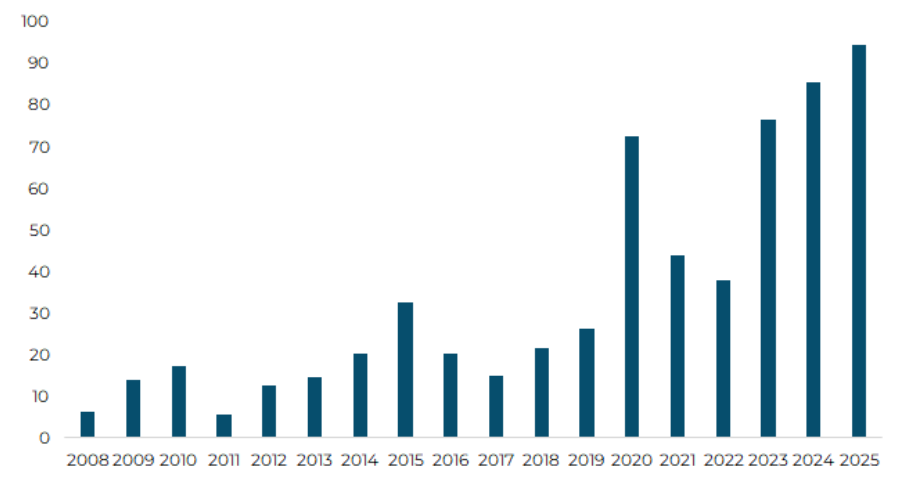

China upgraded its national targets via the Beijing Declaration on Wind Energy 2.0

Since the signing of the first Beijing Declaration on Wind Energy in 2020, global wind industry growth has been driven primarily by the large-scale build-out of capacity in mainland China, which accounted for around 50% of the global installed base as of 2024. This dominance has continued in the near term, with China expected to have contributed approximately 66% of global wind installations in 2025.

While China’s share of global installations remains substantial, the introduction of a market-based power regime has led to uncertainty about the outlook for the region’s growth. Under the new regime, feed-in tariffs have been replaced with liberalised market trading, meaning that renewables are competing head-on with fossil fuels. Although this will likely introduce short-term headwinds and lower expectations for installations in the coming years, we are encouraged to see that Beijing has updated its capacity targets in its Declaration on Wind Energy 2.0. Under the new plan, China will aim to install no less than 120 GW of new capacity every year between 2026 and 2030, including 15 GW of offshore capacity. This would ensure that China’s cumulative wind power capacity reaches 1,300 GW by 2030 and 2,000 GW by 2035, and puts them on track to achieve Beijing’s longer-term target of installing 5,000 GW of wind capacity by 2060.

China wind installations 2008-2025 (GW)

Source: BNEF, February 2026

Despite policy headwinds, rising power demand should support industry growth in the US

Since coming into office, the Trump administration has taken steps that have increased policy uncertainty for the US wind industry. While amendments to President Biden’s Inflation Reduction Act (IRA) were ultimately less restrictive than feared, the One Big Beautiful Bill Act (OBBBA) accelerated the phase-out of utility-scale wind Investment and Production Tax Credits, raising the cost of developing new projects. Subsequent clarifications, however, materially improved the outlook by extending the eligibility windows for remaining tax credits, and wind-related manufacturing tax credits were confirmed to remain in place through 2027.

In offshore wind, the administration has adopted a more interventionist stance, issuing stop-work orders on five major projects despite construction already being underway. While these actions introduced near-term disruption, projects have been able to proceed following successful legal challenges, with the US still expected to add around 5.8 GW of offshore wind capacity between 2025 and 2029.

Despite these policy headwinds, we continue to see a supportive backdrop for wind in the US for the medium to long term, underpinned by structurally rising electricity demand. Utilities and policymakers are facing sustained growth in power consumption driven by AI data centres, the reshoring of manufacturing, and the broader electrification of transport, buildings and industry. Meeting this demand requires new generation capacity to be deployed at speed and at scale, where wind remains well-positioned on both cost and delivery timelines.

In this context, the outlook for onshore wind remains constructive. Installations are estimated to have increased by around 25% in 2025 to approximately 7 GW, with growth expected to average close to 9% per annum over the next decade as US power demand inflects structurally higher. Given its competitive economics and its ability to be deployed quickly, we continue to believe onshore wind will play a central role in the evolution of the US electricity mix.

Outlook for 2026

Looking ahead to 2026, the outlook for global wind demand will depend upon how China adjusts to its new market-based power regime. As mentioned earlier, the country has replaced fixed feed-in tariffs with liberalised market trading, potentially introducing short-term headwinds for developers. However, with Beijing announcing new targets of no less than 120 GW of capacity additions per year, we take confidence that China will continue to expand its domestic industry as its electricity demand continues to grow. Outside of China, the global wind market is increasingly diversifying, with strong contributions from India, Europe and parts of Southeast Asia expected in 2026. The offshore market is set for a step up in 2026, with project completions due across a range of markets such as the UK, Vietnam and France.

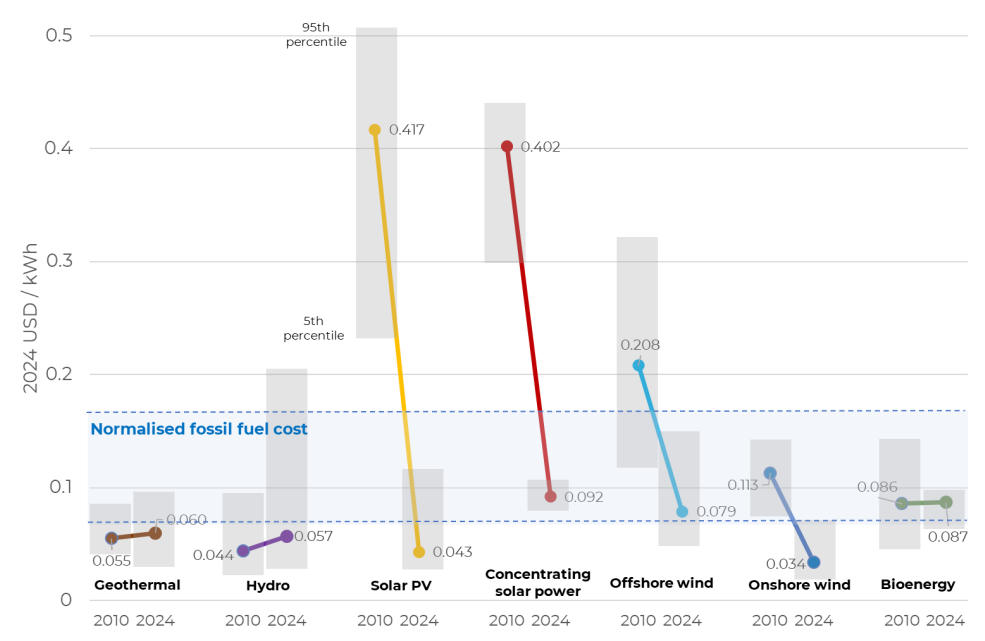

In the longer term, we continue to believe that wind will increase its share of the global electricity mix, underpinned by favourable economics and improvements in technology. Research from the International Renewable Energy Agency (IRENA) in 2025 demonstrates that both onshore and offshore wind generation are among the cheapest forms of new electricity in most situations. With an estimated Levelized Cost of Electricity (LCOE) ranging between $0.03-0.08/kWh, new wind generation from projects commissioned in 2024 are now competitive with the cheapest fossil fuel generation, which also produces power at $0.08kWh. Pleasingly, LCOE’s for wind have remained broadly flat versus 2024 data, as the impact of higher interest rates, plus the 2022/23 inflation cycle were offset by greater economies of scale. Conversely, with inflation in gas turbine prices, we would expect estimates for the cheapest new fossil fuel generation to trend upwards in the coming years.

Global LCOE of newly commissioned utility-scale renewable power generation technologies (2010-2024)

Source: IRENA; Guinness Global Investors, August 2025, percentile ranges from 2024 or 2023 if data if not available

As such, we expect longer-term wind installations to grow at 6-7% per year through 2030, with the smaller offshore market to grow at a higher rate of around 20%.

Conclusion

The global wind industry continues to grow at pace and is becoming increasingly diversified across geographies. We believe wind generation is well positioned to capture a growing share of rising global electricity demand, supported by continued improvements in technology and economies of scale that enhance its relative economics. With long-term targets now updated in both China and Europe, the industry benefits from improved visibility, while in the US we see structurally higher power demand providing support for growth despite ongoing political headwinds.

The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

The information provided on this page is for informational purposes only. While we believe it to be reliable, it may be inaccurate or incomplete. Any opinions stated are honestly held at the time of publication, but are not guaranteed and should therefore not be relied upon. This content should not be relied upon as financial advice or a recommendation to invest in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale. Full details on Ongoing Charges Figures (OCFs) for all share classes are available here.

The Guinness Sustainable Energy Funds invest in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, biofuels and biomass). We believe that over the next twenty years the sustainable energy sector will benefit from the combined effects of strong demand growth, improving economics and both public and private support and that this will provide attractive equity investment opportunities. The Funds are actively managed and use the MSCI World Index as a comparator benchmark only.

For the avoidance of doubt, if you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund

Guinness Sustainable Energy Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID), Key Information Document (KID) and the Application Form, is available in English from www.guinnessgi.com or free of charge from the Manager: Waystone Management Company (IE) Limited, 2nd Floor 35 Shelbourne Road, Ballsbridge, Dublin DO4 A4E0, Ireland; or the Promoter and Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ.

Waystone IE is a company incorporated under the laws of Ireland having its registered office at 35 Shelbourne Rd, Ballsbridge, Dublin, D04 A4E0 Ireland, which is authorised by the Central Bank of Ireland, has appointed Guinness Asset Management Ltd as Investment Manager to this fund, and as Manager has the right to terminate the arrangements made for the marketing of funds in accordance with the UCITS Directive.

Investor Rights

A summary of investor rights in English, including collective redress mechanisms, is available here: https://www.waystone.com/waystone-policies/

Residency

In countries where the Funds are not registered for sale or in any other circumstances where their distribution is not authorised or is unlawful, the Funds should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & Regulation

The Funds are sub-funds of Guinness Asset Management Funds PLC, an open-ended umbrella-type investment company, incorporated in Ireland and authorised and supervised by the Central Bank of Ireland, which operates under EU legislation. The Funds have been approved by the Financial Conduct Authority for sale in the UK. If you are in any doubt about the suitability of investing in these Funds, please consult your investment or other professional adviser.

Switzerland

This is an advertising document. The prospectus and KID for Switzerland, the articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative in Switzerland, Reyl & Cie SA, Ru du Rhône 4, 1204 Geneva. The paying agent is Banque Cantonale de Genève, 17 Quai de l'Ile, 1204 Geneva.

WS Guinness Sustainable Energy Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID) and the Application Form, is available in English from www.waystone.com/our-funds/waystone-fund-services-uk-limited/ or free of charge from Waystone Management (UK) Limited, PO Box 389, Darlington DL1 9UF.

General enquiries: 0345 922 0044

E-Mail: wtas-investorservices@waystone.com

Waystone Management (UK) Limited is authorised and regulated by the Financial Conduct Authority.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.

Structure & regulation

The Fund is a sub-fund of WS Guinness Investment Funds, an investment company with variable capital incorporated with limited liability and registered by the Financial Conduct Authority.

This Fund is registered for distribution to the public in the UK but not in any other jurisdiction. In other countries or in circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.

Guinness Sustainable Energy UCITS ETF

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID), Key Information Document (KID) and the Application Form, is available in English from www.guinnessgi.com, www.hanetf.com or free of charge from the Administrator: J.P Morgan Administration Services (Ireland) Limited, 200 Capital Dock, 79 Sir John Rogerson’s Quay, Dublin 2 DO2 F985; or the Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & regulation

The Fund is a sub-fund of HANetf ICAV, an Irish collective asset management vehicle umbrella fund with segregated liability between sub-funds which is registered in Ireland by the Central Bank of and authorised under the UCITS Regulations.