Global Quality Mid Cap - February Commentary

This is a marketing communication. Please refer to the prospectus, supplement and KID/KIID for the Funds before making any final investment decisions. The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

Past performance does not predict future returns.

Market Overview

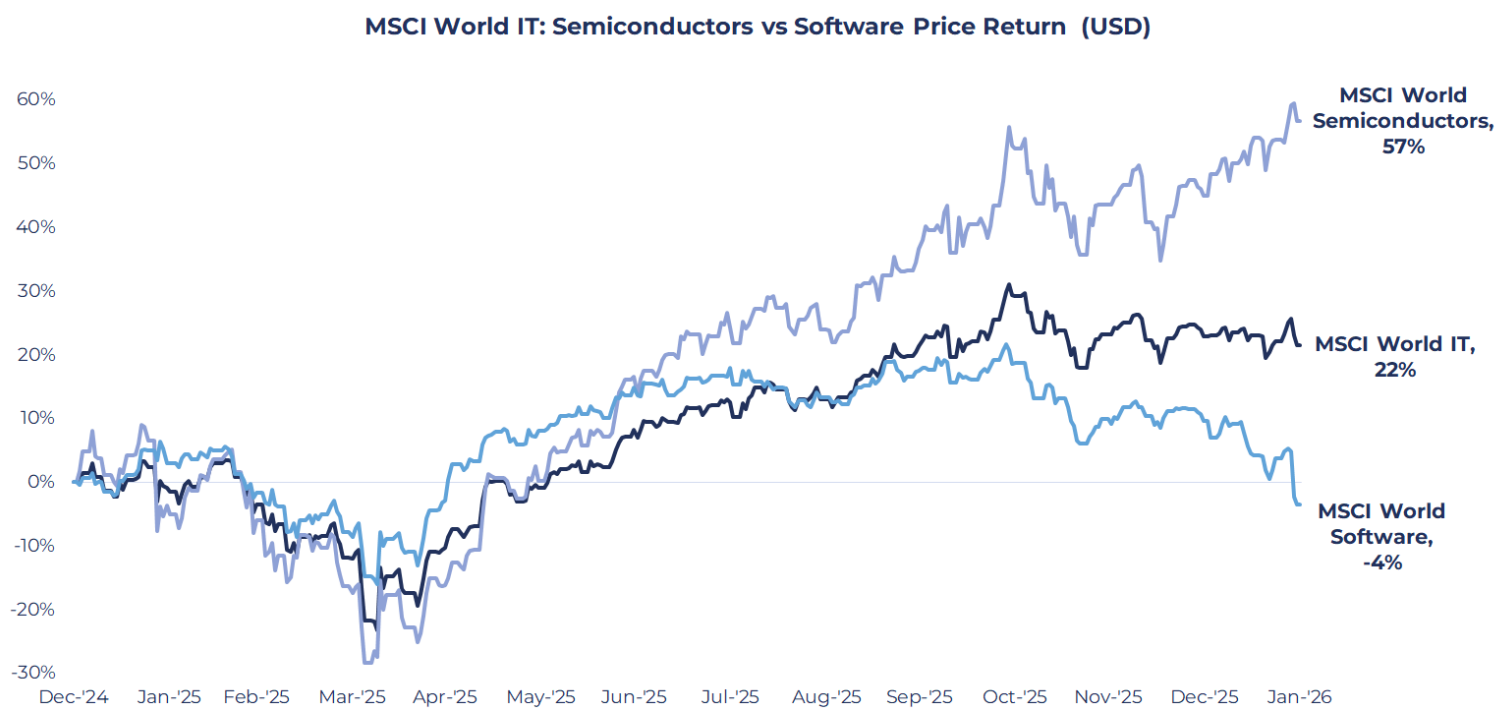

While 2025 was broadly a strong year for IT, January 2026 saw a sharp bifurcation between Software and Semiconductors, two of the sector’s constituent industries. Driven by rising concerns over AI displacement, Software ended the month as the worst-performing industry (-12.0% USD), in sharp contrast to the Semiconductor industry (+8.2%), which saw strong demand for chips as the AI build-out continues.

On 12th January, Anthropic released a preview of its Claude Cowork service, which can create a spreadsheet from a screenshot or produce a draft report from an assortment of notes. Software stocks suffered as investors viewed rapid advances in artificial intelligence as threatening to disrupt the market for software products.

Source: Guinness Global Investors, MSCI, Bloomberg as of 31/01/2026

Fund Tailwinds

In January, overweight exposure to the Semiconductors industry, combined with good stock selection, was the main driver of the Fund's performance. This is due to strong overall performance by several of its AI-exposed stocks, including Entegris, Inficon, and Delta Electronics.

Fund Headwinds

Having no exposure to Energy and Materials was a drag on performance, as they were the two best-performing sectors. Additionally, growth and quality lagged behind small caps and more speculative growth stocks.

The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

The information provided on this page is for informational purposes only. While we believe it to be reliable, it may be inaccurate or incomplete. Any opinions stated are honestly held at the time of publication, but are not guaranteed and should therefore not be relied upon. This content should not be relied upon as financial advice or a recommendation to invest in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale. Full details on Ongoing Charges Figures (OCFs) for all share classes are available here.

The Guinness Sustainable Global Equity Funds are designed to provide exposure to high quality growth companies with sustainable products and practices. The Funds hold a concentrated portfolio of mid-cap companies in any industry and in any region. The Funds are actively managed and use the MSCI World Index as a comparator benchmark only.

For the avoidance of doubt, if you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund

Guinness Global Quality Mid Cap Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Supplement, the Key Information Document (KID) / Key Investor Information Document (KIID) and the Application Form, is available from the website www.guinnessgi.com , or free of charge from:

- the Manager: Waystone Management Company (IE) Limited 2nd Floor 35 Shelbourne Road, Ballsbridge, Dublin DO4 A4E0; or,

- the Promoter and Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ.

Waystone IE is a company incorporated under the laws of Ireland having its registered office at 35 Shelbourne Rd, Ballsbridge, Dublin, D04 A4E0 Ireland, which is authorised by the Central Bank of Ireland, has appointed Guinness Asset Management Ltd as Investment Manager to this fund, and as Manager has the right to terminate the arrangements made for the marketing of funds in accordance with the UCITS Directive.

Investor Rights

A summary of investor rights in English, including collective redress mechanisms, is available here: https://www.waystone.com/waystone-policies/

Residency

In countries where the Funds are not registered for sale or in any other circumstances where their distribution is not authorised or is unlawful, the Funds should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & Regulation

The Guinness Sustainable Global Equity Fund is a sub-fund of Guinness Asset Management Funds PLC, an open-ended umbrella-type investment company, incorporated in Ireland and authorised and supervised by the Central Bank of Ireland, which operates under EU legislation. The Funds have been approved by the Financial Conduct Authority for sale in the UK. If you are in any doubt about the suitability of investing in these Funds, please consult your investment or other professional adviser.

WS Guinness Global Quality Mid Cap Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID) and the Application Form, is available in English from https://www.waystone.com/our-funds/waystone-fund-services-uk-limited/ or free of charge from:-

Waystone Management (UK) Limited, PO Box 389, Darlington DL1 9UF.

E-Mail: wtas-investorservices@waystone.com

Waystone Fund Services (UK) Limited is authorised and regulated by the Financial Conduct Authority.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.

Structure & regulation

The Fund is a sub-fund of WS Guinness Investment Funds, an investment company with variable capital incorporated with limited liability and registered by the Financial Conduct Authority.

This Fund is registered for distribution to the public in the UK but not in any other jurisdiction. In other countries or in circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.