Global Energy - November Commentary

This is a marketing communication. Please refer to the prospectus, supplement and KID/KIID for the Funds before making any final investment decisions. The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

Past performance does not predict future returns.

Decline rates and energy security

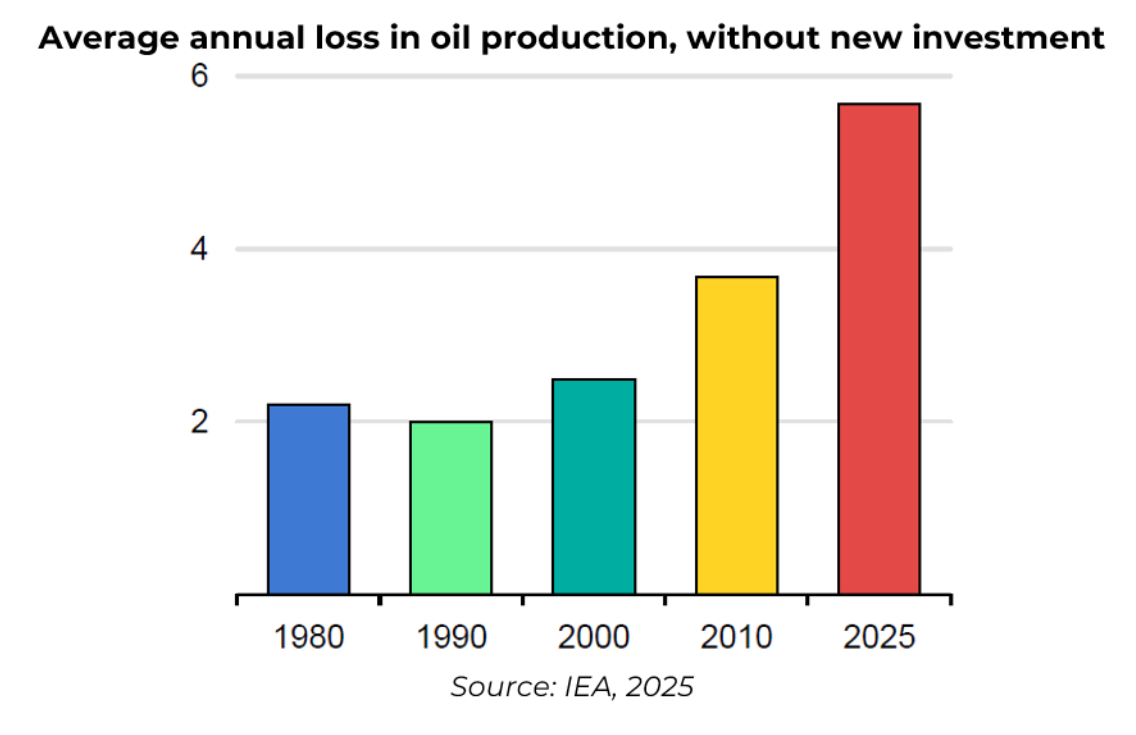

Decline rates are an inevitable factor in global oil production, and the rate of production decline continues to increase, with the oil industry needing to find over 5m b/day of new production every year just to keep production flat. Lower declines in OPEC+ means that OPEC+ market share would rise sharply in a zero-investment or ‘blow-down’ oil production scenario, bringing serious energy security issues. Non-OPEC+ needs to keep exploring and developing oil to maintain share.

Decline rates are inevitable and are a constant challenge to offset

Oil reservoirs are typically pressurised fluid bodies, and the pressure present in the reservoir provides the energy to produce the oil to the surface. Over time, as oil is produced, reservoir pressure falls, and so the rate of production starts to slow. This production decline, known as the decline rate, is a natural and unavoidable factor for most oil fields.

Decline rates are difficult to measure. A recent report by the International Energy Agency (IEA) estimated the decline rate to be around 8.5% per year for conventional oil fields and around 12% for unconventional oil fields, leading to a global average currently of around 9%, before any investment is made by oil companies to offset the decline.

Efforts to offset production decline include the drilling of in-fill wells or the flooding of reservoirs with water, gas, CO2 or solvents to maintain reservoir pressure. These enhanced recovery techniques are typically cheaper than drilling new wells in new oil fields and, over time, have been shown to reduce the natural decline by around 3 percentage points per year. Thus the natural decline of around 9% for global oil fields can be reduced to a ’managed’ decline rate of around 5.6%, according to the IEA.

This requires significant investment and the IEA estimates that around 90% of the $550bn that has been invested in oil production over the last six years has been to offset the natural decline, with only 10% (around $50bn) being responsible for delivering actual growth.

Decline rates have increased as the oil industry has evolved

Decline rates for the oil industry have been increasing over the last 50 years and, given development trends, they are likely to continue increasing.

Back in the 1970s and 1980s, global oil production was dominated by large, conventional onshore fields, especially in the Middle East, Russia, and North America. These fields typically had low managed decline rates, maybe 2–4% per year, due to their size, greater pressure support and relatively simple geology with multiple reservoir zones. They were typically developed in stages, justifying investment in improved reservoir management in order to recover their full potential and to maximise the sustained use of associated processing and transport infrastructure.

As these giant fields matured in the early 1990s, the industry started to develop new, smaller and more complex onshore or shallow water offshore discoveries, taking average managed decline rates up to around 4%.

In the mid 1990s and 2000s, the industry began exploring and developing offshore fields in the deepwater. Greater financial and technical risks meant that these deepwater fields were optimised for quick payback and, as a result, they suffered a faster decline than onshore fields, typically at rates of 8-10% a year. Due to their offshore setting, remedial production activities were also more expensive, meaning that production declines arrived earlier and were steeper once reservoir pressure began to fall.

As offshore production became more important, average global managed decline rates began to rise towards 5%.

In the late 2000s and early 2010s, a period of higher oil prices incentivised the industry to develop shale and tight oil, especially in the United States and Canada. Unconventional fields were developed using fracking technology, which applied external pressure to the reservoir, causing very high initial rates of production but also very steep subsequent declines, typically around 25-40% in the first year.

Rapid development over the last 15 years means that these unconventional sources now make up around 20% of global output, driving the global weighted average decline rate higher, after offsetting investment, to around 5.6%, according to the IEA.

Monthly imports of Russian fossil fuels, 2021-25 (tonnes)

Sources: CERA, The Times; September 2025

Steeper declines ahead mean that development activity must remain high

The oil industry is having to run faster every year just to stay still. The IEA estimates that if no new investment were made, oil production would drop an average of 5.5m b/day per year to 2035, much greater the 2m b/day decline that would have been expected in the 1980s, 1990s and 2000s.

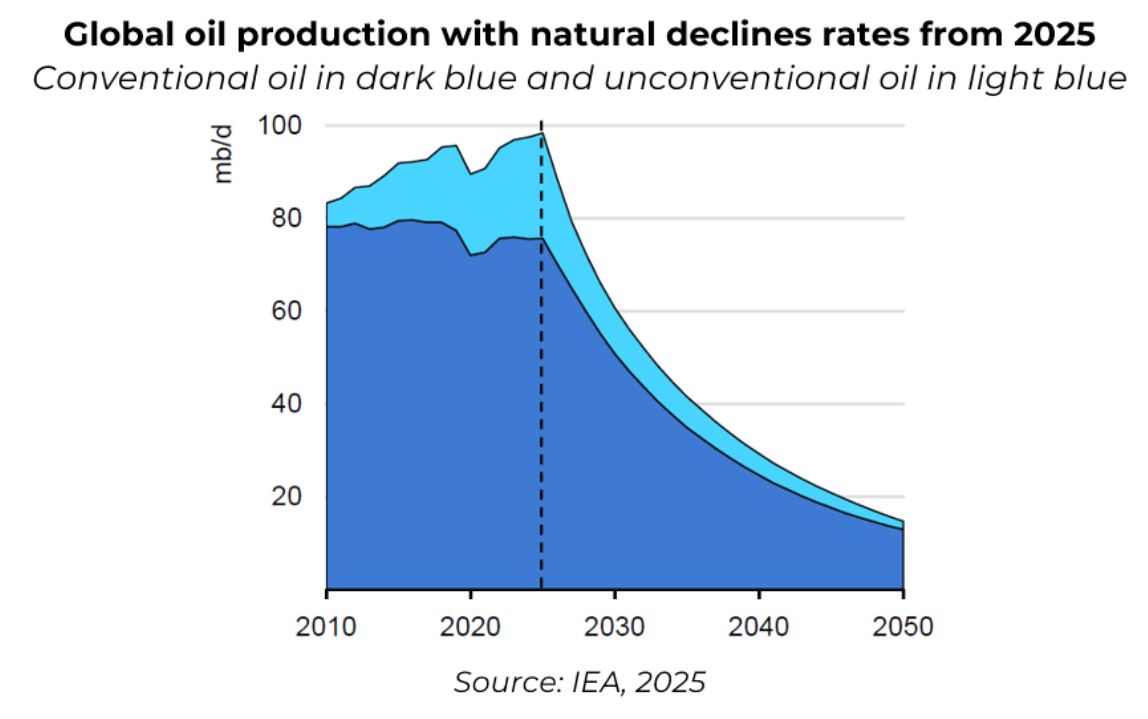

Other participants in this market are more hawkish on decline rates. For example, a recent energy outlook for Exxon showed that, with no new investment, global oil production would drop from roughly 100m b/day to around 85m b/day in one year, with production falling to around 30m b/day in around five years.

Energy security becomes an issue in any blowdown scenario

While global oil demand is likely to peak around 2030, there will be an ongoing need for non-OPEC+ countries to continue to develop their oil reserves because of differences in decline rates.

Oil fields in the Middle East, Russia and OPEC+ countries are typically larger, legacy oil fields with lower decline rates. In contrast, oil fields in non-OPEC+ countries such as Europe, West Africa, Brazil or Gulf of Mexico are typically smaller or offshore (with high decline rates) while those in the North American onshore are unconventional in nature and have exceptionally high decline rates. Non-OPEC+’s reliance on unconventional oil production in recent years means that it will face sharper declines in the years ahead.

The effect is that, in a zero-investment or ‘blow-down’ scenario, the share of production from OPEC+ countries would rise sharply from around 40% in 2025 to around 50% by 2030 and 60% by 2040 as their lower-decline fields perform better. Regarding energy security, this would not be a palatable outcome for the major oil-importing countries. As such, there is a greater need for non-OPEC+ countries and for international oil companies in general to continue to explore and develop oil fields so that production declines are managed to more acceptable levels. Allowing oil production to decline naturally, even in a weaker oil demand scenario, would quickly raise the salience of energy security as an economic and political issue.

To read the full report, click the link below.

The information provided on this page is for informational purposes only. While we believe it to be reliable, it may be inaccurate or incomplete. Any opinions stated are honestly held at the time of publication, but are not guaranteed and should therefore not be relied upon. This content should not be relied upon as financial advice or a recommendation to invest in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale. Full details on Ongoing Charges Figures (OCFs) for all share classes are available here.

The Guinness Global Energy Funds invest in listed equities of companies engaged in the exploration, production and distribution of oil, gas and other energy sources. We believe that over the next twenty years the combined effects of population growth, developing world industrialisation and diminishing fossil fuel supplies will force energy prices higher and generate growing profits for energy companies. The Funds are actively managed and use the MSCI World Energy Index as a comparator benchmark only.

For the avoidance of doubt, if you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Information Document (KID) / Key Investor Information Document (KIID) and the Application Form, is available from the website www.guinnessgi.com, or free of charge from:

- the Manager: Waystone Management Company (IE) Limited (Waystone IE), 2nd Floor 35 Shelbourne Road, Ballsbridge, Dublin DO4 A4E0; or,

- the Promoter and Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ.

Waystone IE is a company incorporated under the laws of Ireland having its registered office at 35 Shelbourne Rd, Ballsbridge, Dublin, D04 A4E0 Ireland, which is authorised by the Central Bank of Ireland, has appointed Guinness Asset Management Ltd as Investment Manager to this fund, and as Manager has the right to terminate the arrangements made for the marketing of funds in accordance with the UCITS Directive.

Investor Rights

A summary of investor rights in English, including collective redress mechanisms, is available here: https://www.waystone.com/waystone-policies/

Residency

In countries where the Funds are not registered for sale or in any other circumstances where their distribution is not authorised or is unlawful, the Funds should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & Regulation

The Fund is a sub-fund of Guinness Asset Management Funds PLC, an open-ended umbrella-type investment company, incorporated in Ireland and authorised and supervised by the Central Bank of Ireland, which operates under EU legislation. The Fund has been approved by the Financial Conduct Authority for sale in the UK. If you are in any doubt about the suitability of investing in the Fund, please consult your investment or other professional adviser.

WS Guinness Global Energy Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID) and the Application Form, is available in English from https://www.waystone.com/our-funds/waystone-fund-services-uk-limited/ or free of charge from:-

Waystone Management (UK) Limited, PO Box 389, Darlington DL1 9UF.

General enquiries: 0345 922 0044

E-Mail: iwtas-investorservices@waystone.com

Waystone Management (UK) Limited is authorised and regulated by the Financial Conduct Authority.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.

Structure & regulation

The Fund is an Authorised Unit Trust authorised by the Financial Conduct Authority.