Global Energy - February Commentary

This is a marketing communication. Please refer to the prospectus, supplement and KID/KIID for the Funds before making any final investment decisions. The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

Past performance does not predict future returns.

January saw the removal of Nicolás Maduro from power in Venezuela and the arrival of Trump’s armada in the Middle East. Both events raised the geopolitical risk level and caused oil prices to strengthen. At the time of writing, there has been no oil supply impact, but the threat of one remains. We assess the potential implications of both developments here.

Venezuela regime change: oil macro and company implications

The removal of Nicolás Maduro under the Trump administration’s direction represents a significant geopolitical intervention in a country with large proven oil reserves. The key question from an oil perspective is whether developments lead to a material increase in global oil supply, or whether the impact is more limited to trade flows, crude quality differentials, and company-specific outcomes. Our assessment is that while the political shift may eventually enable higher Venezuelan production, any meaningful supply response will take several years and require significant investment, with near-term effects concentrated more in refining markets than global oil prices.

Venezuela’s recent oil history

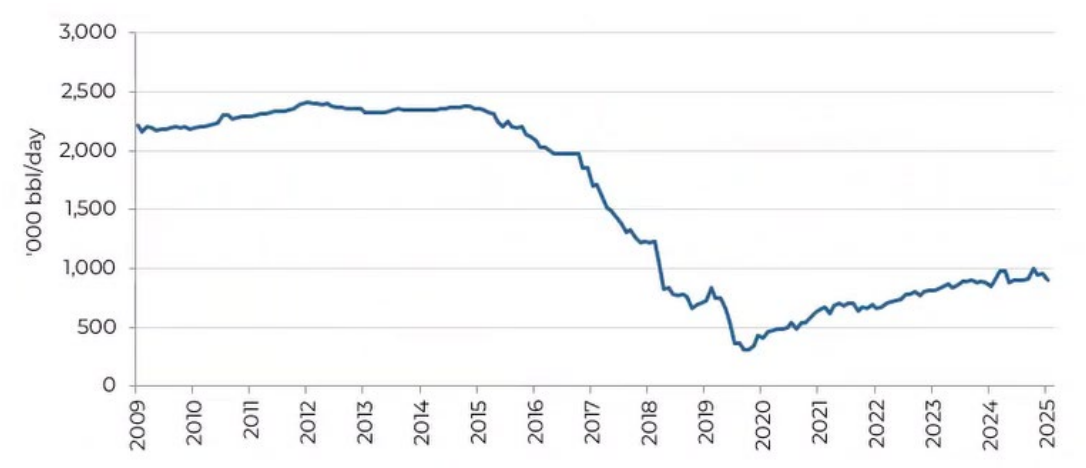

Venezuela’s oil production has fallen sharply over the past decade due to chronic under-investment, operational degradation, loss of technical capacity, and US sanctions. According to Bloomberg data, Venezuelan crude production averaged around 0.9m b/day in 2025, down from over 2.3m b/day in 2015, representing a decline of roughly 60%. Oil production troughed (ex-Covid) in 2022 at around 0.7m b/day, with the last three years bringing modest recovery, supported by partial sanctions relief and incremental operational improvements. The recovery has been fragile and heavily dependent on specific licences, diluent imports (which are imported from the US to allow Venezuela’s extra-heavy oil to flow), and export logistics. Currently, Venezuela accounts for approximately 1% of global oil supply.

Venezuela oil production (000s b/day)

Source: Bloomberg, January 2026

In the near term, the removal of Maduro is unlikely to drive a quick change in global oil balances. The more relevant near-term impacts are expected to occur through trade re-routing, crude quality differentials, and regional refining margins. Venezuelan crude is predominantly heavy and sour in quality. In recent years, much of this supply has flowed to China and other non-Western buyers, often at discounted prices. A reorientation of Venezuelan exports toward the US Gulf Coast, where refinery configurations are better suited to heavy crude, could alter North American crude differentials. Even a shift of 0.2-0.3m b/day (20-30% of Venezuela’s production) back toward US refiners would be meaningful for heavy crude pricing and refining margins.

While not affecting the oil price, we note that Venezuela has an outstanding debt to China (the amount unclear but estimated to be $10-15bn) which Venezuela has been servicing via discounted oil exports to China. US involvement in Venezuela, including the diversion of Venezuelan oil away from China and to US Gulf Coast refineries, creates friction for the Chinese.

Looking longer-term, any sustained increase in Venezuelan production depends on a stable regulatory environment that allows investment, access to services and equipment, imports of diluents, and reliable export channels. Despite Venezuela having significant global oil reserves, restoring production is a capital-intensive and operationally complex process, particularly after the deterioration of infrastructure over the past 10 years and loss of a skilled workforce locally. Heavy oil projects in the Orinoco Belt require continuous investment, blending agents, and reliable power and transport systems. Considering these factors, we estimate that an oil price of $80/bl or more would be required to incentive investment in new projects.

Oil companies and oil service companies that were active in Venezuela in the past (e.g. Conoco, Exxon, Schlumberger and Halliburton) have long memories and will be very cautious about committing again to the country without a strong fiscal regime and revenue guarantees. Darren Woods (CEO of Exxon) remarked in November 2025 when discussing a return: “We’ve been expropriated from Venezuela two different times. We have our history there”.

To summarise the Venezuela situation, if instability worsens further, we could expect around one-third of the country’s oil production (and over half of its oil exports) to be disrupted. If conditions improve, then consensus forecasts suggest that production could grow over the next 12 months by around 0.3m b/day to 1.2m b/day. The upside over the next decade is thought to be around a doubling of oil production (from c.1m b/day to 2m b/day), representing an increase in world oil production capacity of around 1%. To repeat, this would require sustained political stability, improved contract sanctity, easing of sanctions, and significant foreign investment – all big asks, in our opinion. Even if this were to occur, it will be up to fellow OPEC+ members to accommodate the increase as part of group quotas and it would be unlikely that Venezuela becomes a near-term swing producer comparable to major OPEC members with spare capacity.

Iran: further pressure to stop Iran’s nuclear ambitions

Turning to Iran, the Trump administration continued to put pressure on the Iranian regime during the month with a major US military build-up in the region together with aggressive economic sanctions. The catalyst was the Iranian regime’s response to an outbreak of nationwide demonstrations sparked by an economic collapse that saw inflation surge to 60% and the Iranian Rial lose half its value. Trump sent a “massive armada" to be positioned within effective striking range of Iran and followed up with imposing a 25% secondary tariff on any country trading with Iran, a move directly targeting major partners including China. Risk levels remained high in the second half of January as the US forces shot down an Iranian military drone and Iran carried out a military exercise in the Strait of Hormuz, but they receded somewhat at the end of the month as both sides agreed to resume nuclear negotiations in Oman to stave off a full-scale regional conflict.

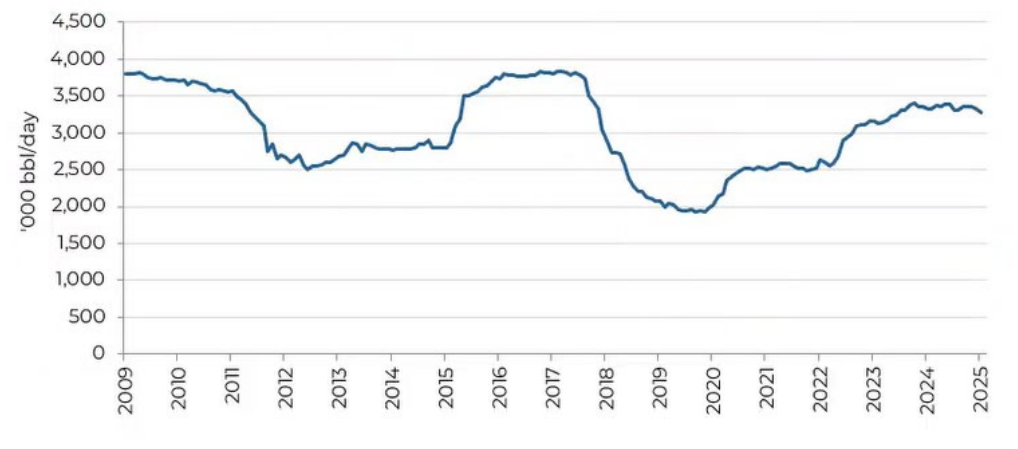

Iran oil production (000s b/day)

Source: Bloomberg, January 2026

Pressure from the United States on Iran has been building since the inauguration of Donald Trump. Even during the election campaign in late 2024, Trump made his hawkish stance towards Iran very clear, and his choice of national security advisor, Mike Waltz, promised “maximum pressure” on Iran. Consistent with his campaigning, early in February, Trump signed an executive order requiring the US treasury secretary to impose "maximum economic pressure" on Iran. Geopolitical risk reached a peak in June 2025 when Israel launched a bombing campaign on Iranian military sites and nuclear enrichment locations, and, a week later, the US joined the campaign by bombing the latter, in particular those out of reach of Israeli’s forces.

These events are important for the oil industry because Iran currently produces around 4.1m b/day of crude oil and condensate, with approximately 2.3m b/day exported – of which 1.7m b/day is exported as crude and 0.6m b/day as refined products. These exports represent roughly 2–2.5% of global demand and are primarily directed to China.

The loss of Iranian oil supply would be a significant near-term issue for the global oil industry, but we believe that the loss could be offset by the return of withheld OPEC+ capacity reasonably quickly. While it is difficult to be precise, we see OPEC+ spare capacity of around 3m b/day and believe that around 60% of this supply could enter the market within six months.

The Strait of Hormuz and the Bab al-Mandeb Strait

Beyond a potential production impact, Iran has control of the Strait of Hormuz, a 21-mile-wide stretch of water separating Iran from the United Arab Emirates and Oman. The strait is a vital corridor that represents a critical chokepoint in global energy logistics as it facilitates the transit of approximately 20m b/day of crude oil, condensate and oil products – equivalent to around 20% of global oil supply and 30% of seaborne oil trade. While much of the focus over the last few days has been on the Straits of Hormuz, we also highlight that the Bab al-Mandeb Strait in the Red Sea (through which nearly 10% of world oil is transported) could easily come under renewed threat from Iran-backed rebels, thereby forcing world shipping to avoid the area and travel all the way around the Cape of Good Hope in South Africa.

The risk of disruption to shipping through the Strait of Hormuz and the Bab al-Mandeb strait has clearly increased during January but we must remember that while Iran has threatened to close the Strait in previous years, it has never actually been achieved.

Potential impact on the oil price

The peace talks taking place in Oman over the weekend of February 7-8 will clearly dictate the near-term path for regional tensions and oil prices. Clearly, we cannot say what the outcome will be, but the following might help in thinking about the oil price implications of various events.

- If the situation is short-lived, if Iranian oil production is not affected and oil exports continue from the region, then oil prices likely decline to pre-conflict levels (in the order of $65/bl).

- If Iranian oil exports are reduced, or flows of oil through the Strait of Hormuz see minor disruption, we expect oil prices to rise to around the $80/bl level. In this scenario, Saudi gains better control of the global oil market and manages the oil price to a level that is closer to its own fiscal needs.

- Should this become a wider regional conflict with the threat of greater, or more sustained, supply shocks, then an oil price spike similar to 2008 or 2022, in excess of $100/bl, could easily be expected.

To read the full report, click the link below.

The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

The information provided on this page is for informational purposes only. While we believe it to be reliable, it may be inaccurate or incomplete. Any opinions stated are honestly held at the time of publication, but are not guaranteed and should therefore not be relied upon. This content should not be relied upon as financial advice or a recommendation to invest in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale. Full details on Ongoing Charges Figures (OCFs) for all share classes are available here.

The Guinness Global Energy Funds invest in listed equities of companies engaged in the exploration, production and distribution of oil, gas and other energy sources. We believe that over the next twenty years the combined effects of population growth, developing world industrialisation and diminishing fossil fuel supplies will force energy prices higher and generate growing profits for energy companies. The Funds are actively managed and use the MSCI World Energy Index as a comparator benchmark only.

For the avoidance of doubt, if you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Information Document (KID) / Key Investor Information Document (KIID) and the Application Form, is available from the website www.guinnessgi.com, or free of charge from:

- the Manager: Waystone Management Company (IE) Limited (Waystone IE), 2nd Floor 35 Shelbourne Road, Ballsbridge, Dublin DO4 A4E0; or,

- the Promoter and Investment Manager: Guinness Asset Management Ltd, 18 Smith Square, London SW1P 3HZ.

Waystone IE is a company incorporated under the laws of Ireland having its registered office at 35 Shelbourne Rd, Ballsbridge, Dublin, D04 A4E0 Ireland, which is authorised by the Central Bank of Ireland, has appointed Guinness Asset Management Ltd as Investment Manager to this fund, and as Manager has the right to terminate the arrangements made for the marketing of funds in accordance with the UCITS Directive.

Investor Rights

A summary of investor rights in English, including collective redress mechanisms, is available here: https://www.waystone.com/waystone-policies/

Residency

In countries where the Funds are not registered for sale or in any other circumstances where their distribution is not authorised or is unlawful, the Funds should not be distributed to resident Retail Clients. NOTE: THIS INVESTMENT IS NOT FOR SALE TO U.S. PERSONS.

Structure & Regulation

The Fund is a sub-fund of Guinness Asset Management Funds PLC, an open-ended umbrella-type investment company, incorporated in Ireland and authorised and supervised by the Central Bank of Ireland, which operates under EU legislation. The Fund has been approved by the Financial Conduct Authority for sale in the UK. If you are in any doubt about the suitability of investing in the Fund, please consult your investment or other professional adviser.

WS Guinness Global Energy Fund

Documentation

The documentation needed to make an investment, including the Prospectus, the Key Investor Information Document (KIID) and the Application Form, is available in English from https://www.waystone.com/our-funds/waystone-fund-services-uk-limited/ or free of charge from:-

Waystone Management (UK) Limited, PO Box 389, Darlington DL1 9UF.

General enquiries: 0345 922 0044

E-Mail: iwtas-investorservices@waystone.com

Waystone Management (UK) Limited is authorised and regulated by the Financial Conduct Authority.

Residency

In countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.

Structure & regulation

The Fund is an Authorised Unit Trust authorised by the Financial Conduct Authority.

This Fund is registered for distribution to the public in the UK but not in any other jurisdiction. In other countries or in circumstances where its distribution is not authorised or is unlawful, the Fund should not be distributed to resident Retail Clients.