Europe is not just a place for your summer holiday

Europe has not featured on the list of desirable destinations for investors for some time, and certainly not since the conflict in Ukraine started in early 2022. On top of this, the associated energy crisis and cost inflation that followed put Europe at a competitive disadvantage. The slowdown in the Chinese economy has not helped either given Europe’s export-led economy, with the German economy, in particular, struggling. So instead of sitting it out, playing scrabble and waiting for the clouds to clear, investors understandably flocked to the calmer waters of San Diego or Cape Cod.

However, there are signs that Europe could become a more desirable place to revisit and certainly should be moving up one’s bucket list. Investors have only tended to spend the equivalent of a weekend break investing in Europe over the years. But if things continue to improve, a Grand Tour may be needed to properly enjoy and experience the high-quality, undervalued, dividend-paying companies Europe has to offer.

The clouds are clearing

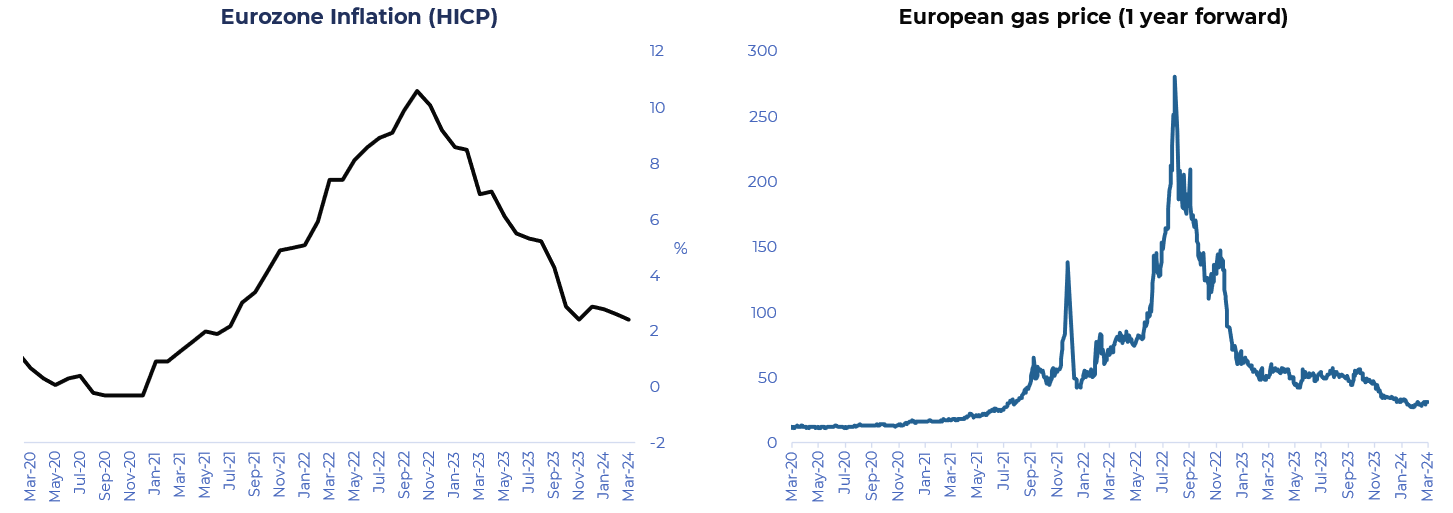

One of the themes in 2024 to date has been that the market has progressively revised its view on the trajectory of interest rates across developed markets largely because of ‘stickier’ than expected inflation in the US and a stronger than expected US economy. Having expected rates to fall to nearer 3.5% in the US by December at the start of 2023, the market now expects rates to fall just below 5%. The European markets have moved in sympathy, with rates now expected to be just above 3% by the end of the year versus around 2% in January. However, inflation is much less of a problem for Europe, it seems, and for now is still on its way to the ECB’s 2% target, due to ongoing energy price deflation and more muted economic growth than in the US.

Source: Bloomberg; 31.03.2024

As a result, the European Central Bank (ECB) has arguably more room to manoeuvre when it comes to rates and perhaps manage to guide the economy out of its recent tough patch. In addition, the associated weakness in the Euro could see a boost to Europe's competitiveness, with some commentators even speculating that it could go to parity with the US dollar should rates diverge.

Start packing your bags

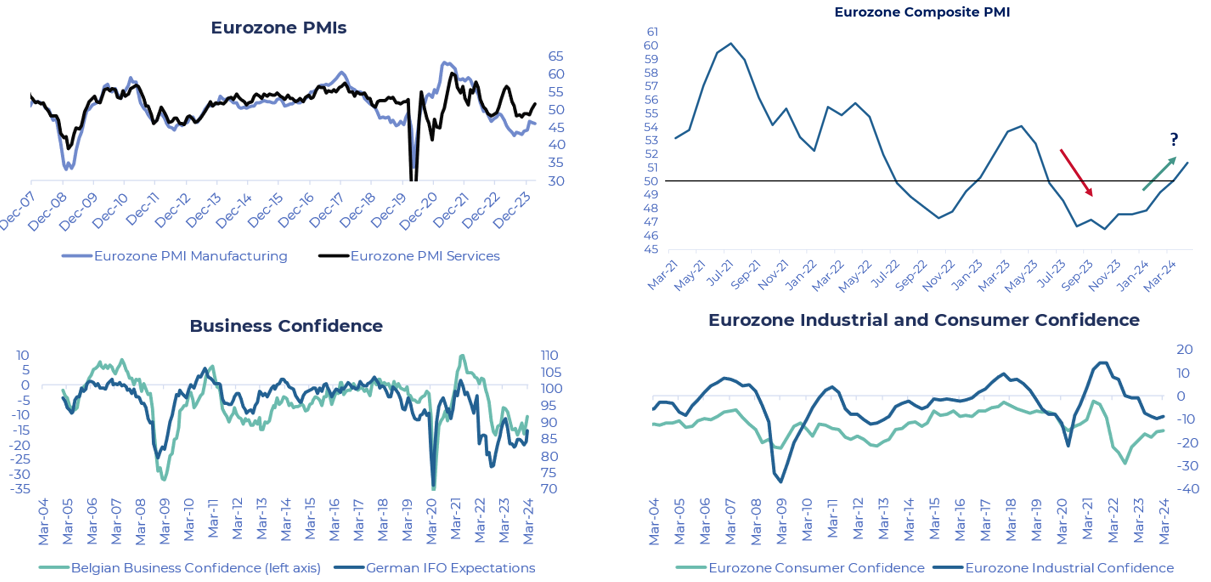

While economic growth has been far less impressive than in the US, the signs are growing that a recovery of sorts is underway.

Source: Bloomberg; 31.03.2024

Europe is starting to see economic activity pick up from a low base, while consumer and business confidence is returning. Against expectations that remain conservative, this could presage a period of stronger performance from European markets despite markets having recovered well from the September 2023 lows.

Book your cheap flights now

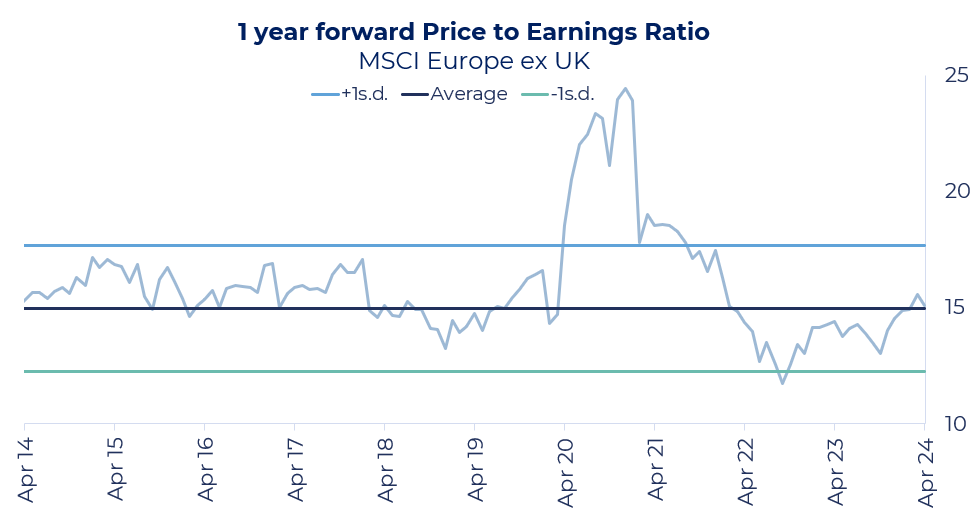

Source: Bloomberg; 30.04.2024

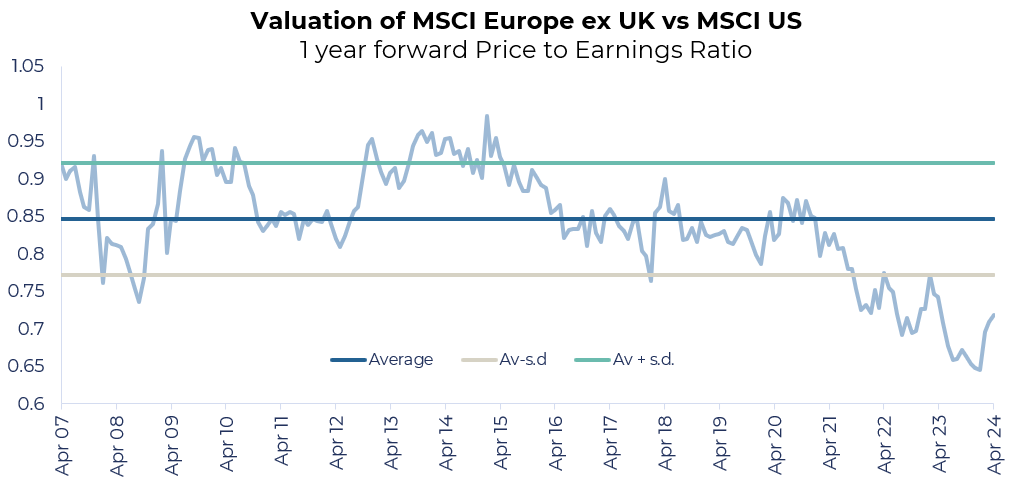

While we have witnessed a degree of multiple expansion from those market lows, the MSCI Europe ex UK index is trading in line with its long-run average as the improvement in data has not gone unnoticed. However, when considered against the US, the picture looks more interesting.

Source: Bloomberg; 30.04.2024

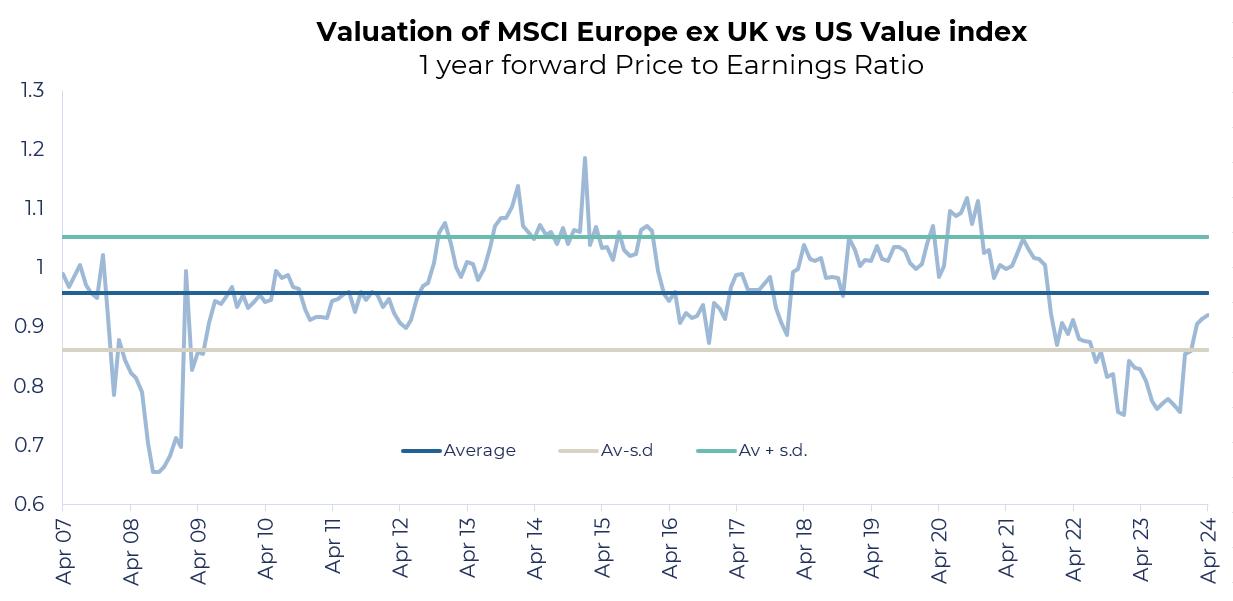

Now, some would argue that there are structural reasons that justify Europe trading at a discount, such as more Technology in the US market and a more established equity culture. However, comparing Europe (and accepting the ‘Value’ attributes of Europe) versus the MSCI US Value index highlights the opportunity on offer.

Source: Bloomberg; 30.04.2024

Europe tends to trade at a premium to US Value but due to geopolitical reasons, relative growth and the preference for all things American in the last two or three years, it remains at a discount!

Beat the crowds

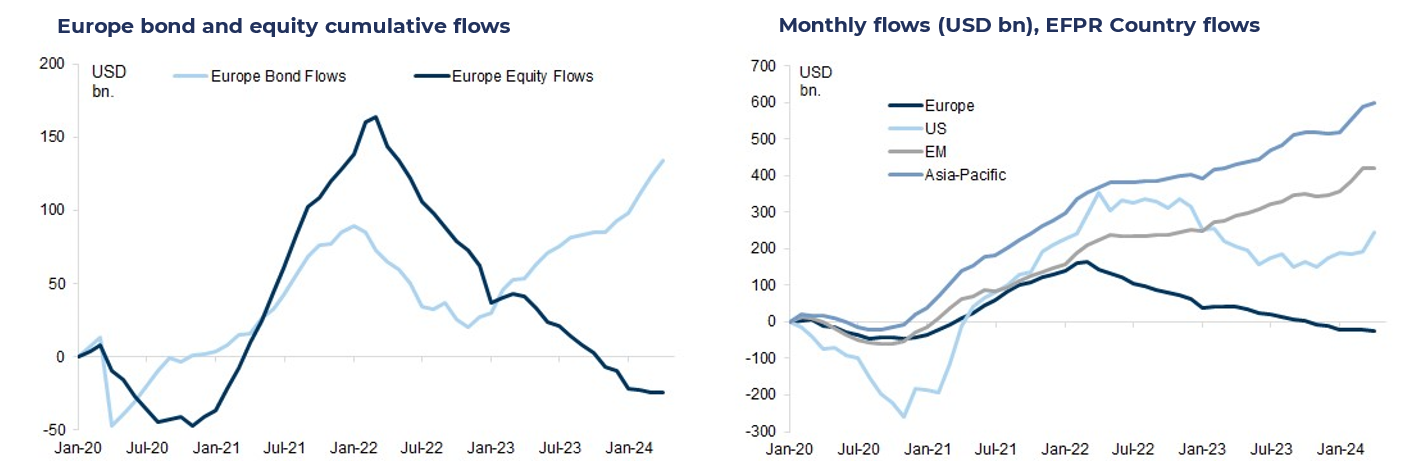

It may or may not come as a surprise, but investors have largely ignored the market moves of late and the potential improvement in the European economy.

Source: Goldman Sachs Global Research, 08.04.2024

European equity flows have continued to be weak since Russia’s invasion of Ukraine, and in fact European equity flows have been weaker than all other regions.

So, while the ‘safe haven’ lustre of the US has had its merits over the last few years, one could argue the risk profile is rising. The law of large numbers suggests that the US economy will have to slow at some point, while Europe is recovering. Inflation has stayed stickier than many predicted, but there is more room for manoeuvre in Europe. This should allow it to manage the nascent economic recovery with monetary policy, while it appears the Federal Reserve may have to wait for a proper slowdown. Yes, Europe has EU elections in the summer, but they are unlikely to change much for corporate Europe. In contrast, after the summer the focus will inevitably move to the US elections, which may justify a degree of reassessment of the relative risk profiles of the two regions. If one then overlays a bottom-up stock picking approach which identifies high-quality, undervalued, dividend-paying companies in Europe, the suggestion, in our opinion, becomes even more compelling. Remember to pack your bucket and spade!

Risk: The Guinness European Equity Income Fund and WS Guinness European Equity Income Fund are equity funds. Investors should be willing and able to assume the risks of equity investing. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement, and you may not get back the amount originally invested. Further details on the risk factors are included in the Funds’ documentation, available on our website (guinnessgi.com/literature).

The Funds are actively managed with the MSCI Europe ex UK Index used as a comparator benchmark only. The Funds will invest primarily in European Ex UK companies which pay dividends.

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.